Question: EXCEL Assignment - Chapter 6 : Accounting for Amortization of Discount / Premium on a Note Receivable Assume your company is loaning cash to another

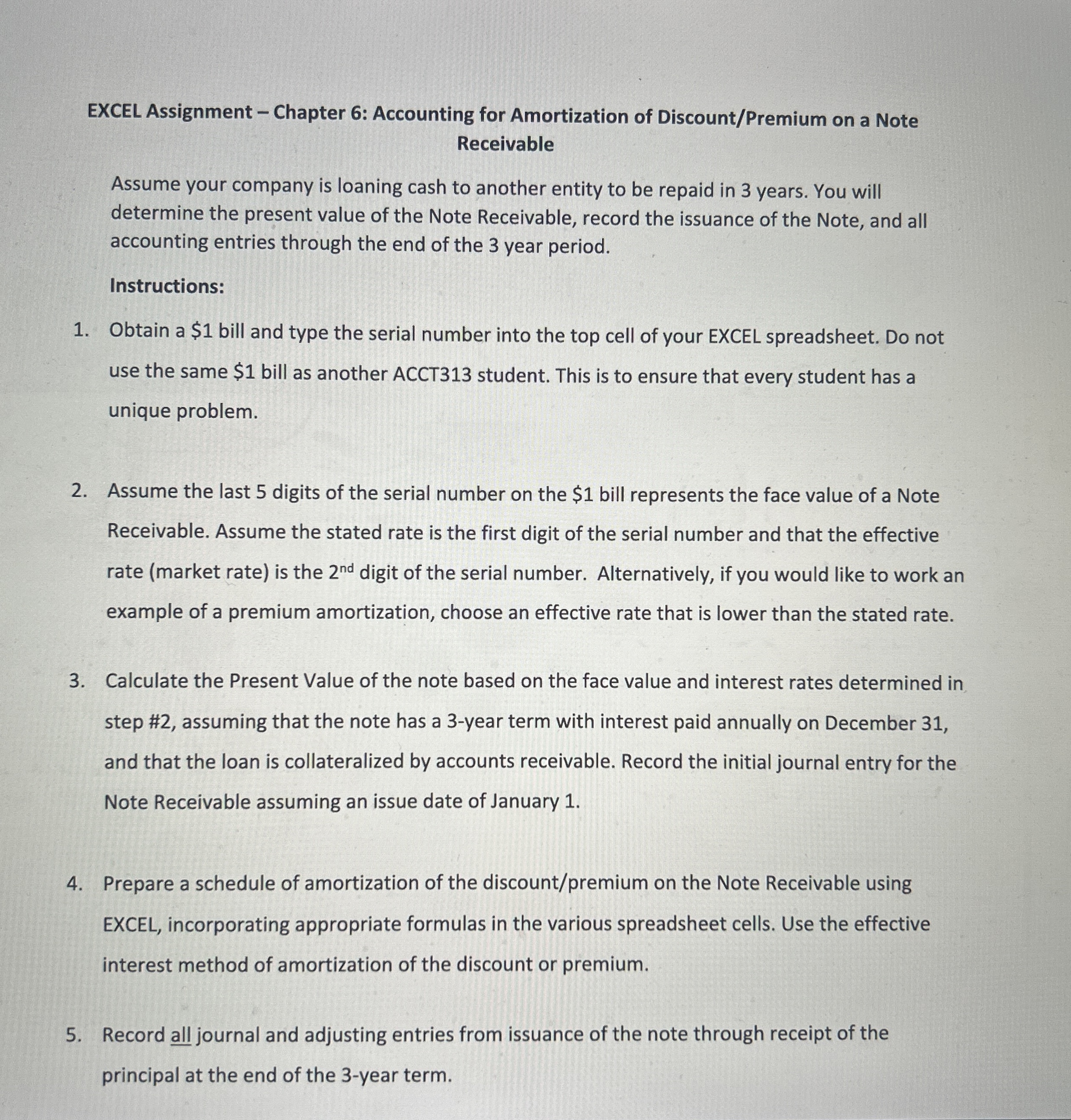

EXCEL Assignment Chapter : Accounting for Amortization of DiscountPremium on a Note Receivable

Assume your company is loaning cash to another entity to be repaid in years. You will determine the present value of the Note Receivable, record the issuance of the Note, and all accounting entries through the end of the year period.

Instructions:

Obtain a $ bill and type the serial number into the top cell of your EXCEL spreadsheet. Do not use the same $ bill as another ACCT student. This is to ensure that every student has a unique problem.

Assume the last digits of the serial number on the $ bill represents the face value of a Note Receivable. Assume the stated rate is the first digit of the serial number and that the effective rate market rate is the digit of the serial number. Alternatively, if you would like to work an example of a premium amortization, choose an effective rate that is lower than the stated rate.

Calculate the Present Value of the note based on the face value and interest rates determined in step # assuming that the note has a year term with interest paid annually on December and that the loan is collateralized by accounts receivable. Record the initial journal entry for the Note Receivable assuming an issue date of January

Prepare a schedule of amortization of the discountpremium on the Note Receivable using EXCEL, incorporating appropriate formulas in the various spreadsheet cells. Use the effective interest method of amortization of the discount or premium.

Record all journal and adjusting entries from issuance of the note through receipt of the principal at the end of the year term.EXCEL Assignment Chapter : Accounting for Amortization of DiscountPremium on a Note Receivable

Assume your company is loaning cash to another entity to be repaid in years. You will determine the present value of the Note Receivable, record the issuance of the Note, and all accounting entries through the end of the year period.

Instructions:

Obtain a $ bill and type the serial number into the top cell of your EXCEL spreadsheet. Do not use the same $ bill as another ACCT student. This is to ensure that every student has a unique problem.

Assume the last digits of the serial number on the $ bill represents the face value of a Note Receivable. Assume the stated rate is the first digit of the serial number and that the effective rate market rate is the digit of the serial number. Alternatively, if you would like to work an example of a premium amortization, choose an effective rate that is lower than the stated rate.

Calculate the Present Value of the note based on the face value and interest rates determined in step # assuming that the note has a year term with interest paid annually on December and that the loan is collateralized by accounts receivable. Record the initial journal entry for the Note Receivable assuming an issue date of January

Prepare a schedule of amortization of the discountpremium on the Note Receivable using EXCEL, incorporating appropriate formulas in the various spreadsheet cells. Use the effective interest method of amortization of the discount or premium.

Record all journal and adjusting entries from issuance of the note through receipt of the principal at the end of the year term.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock