Question: EXCEL ASSIGNMENT FOR CHAPTER 21 IEANS FOR ALL MAN KIND Due Date for Assignment May 1, 2017 (Jeans) is an international clothing manufacturer. Its El

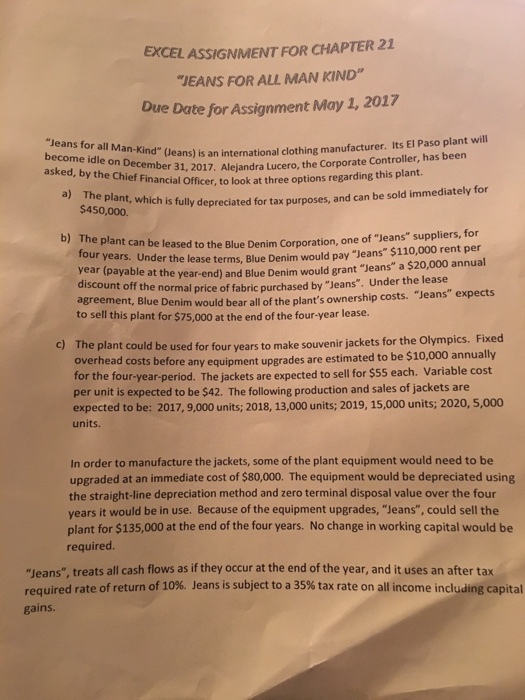

EXCEL ASSIGNMENT FOR CHAPTER 21 "IEANS FOR ALL MAN KIND" Due Date for Assignment May 1, 2017 (Jeans) is an international clothing manufacturer. Its El Paso plant will "Jeans for all Man-Kind" become idle on December Lucero, the corporate controller, has been asked, by 31, 2017. Alejandra three options regarding this plant. the Chief Financial officer, to look at a) The plant, purposes, and can be sold immediately for $450,000 which is fully depreciate for tax b) The plant be leased Denim Corporation, one of "Jeans" suppliers, for four can to the Blue $110,000 rent per ar years. Under the lease terms, Blue Denim would pay "Jeans" a s20,000 annual (payable at the and Denim would grant "ueans" year-e discount off the normal price of fabric purchased by "ueans". Under the lease expects agreement, Blue would bear all of the plant's own costs. "Jeans" Denim to sell this plant for s75,000 at end of the four-year lease. c) The plant make souvenir jackets for the Olympics. Fixed could be used for four years to overhead costs equipment upgrades are estimated to be $10,000 annually before any for the four-year-period. The jackets are expected to sell for $55 each. Variable cost per unit is expected to be s42. The following production and sales of jackets are expected to be 2017, 9,000 unit 2018, 13,000 units; 2019, 15,000 units; 2020, 5,000 units In order to manufacture the jackets, some of the plant equipment would need to be upgraded at an immediate cost of $80,000. The equipment would be depreciated using the straight-line depreciation method and zero terminal disposal value over the four years it would be in use. Because of the equipment upgrades, "Jeans", could sell the plant for $135,000 at the end of the four years No change in working capital would be required "Jeans", treats all cash flows as if they occur at the end of the year, and it uses an after tax required rate of return of 10%. Jeans is subject to a 35% tax rate on all income including capital gains

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts