Question: EXCEL Document. please show exact formulas used. screenshots perferred. SOA Candy Company is considering purchasing a machine that will allow them to expand operations. The

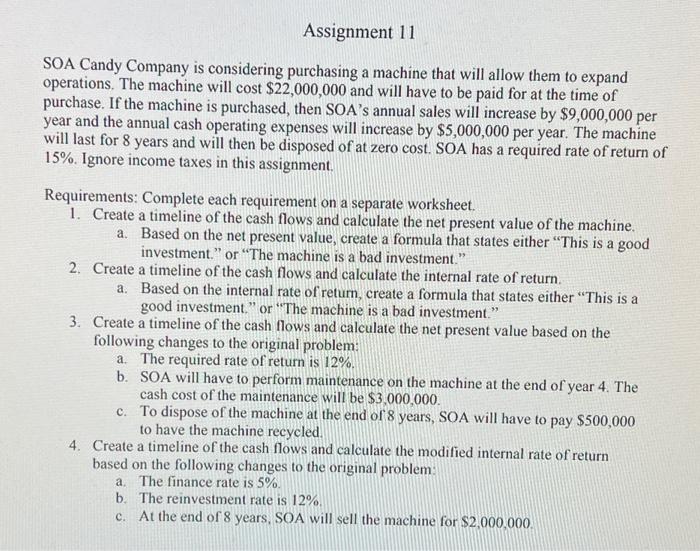

SOA Candy Company is considering purchasing a machine that will allow them to expand operations. The machine will cost $22,000,000 and will have to be paid for at the time of purchase. If the machine is purchased, then SOA's annual sales will increase by $9,000,000 per year and the annual cash operating expenses will increase by $5,000,000 per year. The machine will last for 8 years and will then be disposed of at zero cost. SOA has a required rate of return of 15%. Ignore income taxes in this assignment. Requirements: Complete each requirement on a separate worksheet. 1. Create a timeline of the cash flows and calculate the net present value of the machine. a. Based on the net present value, create a formula that states either "This is a good investment." or "The machine is a bad investment." 2. Create a timeline of the cash flows and calculate the internal rate of return. a. Based on the internal rate of retum, create a formula that states either "This is a good investment." or "The machine is a bad investment." 3. Create a timeline of the cash flows and calculate the net present value based on the following changes to the original problem: a. The required rate of return is 12%. b. SOA will have to perform maintenance on the machine at the end of year 4 . The cash cost of the maintenance will be $3,000,000. c. To dispose of the machine at the end of 8 years, SOA will have to pay $500,000 to have the machine recycled. 4. Create a timeline of the cash flows and calculate the modified internal rate of return based on the following changes to the original problem: a. The finance rate is 5%. b. The reinvestment rate is 12%. c. At the end of 8 years, SOA will sell the machine for $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts