Question: Excel File Edit View Insert Format Tools Data Window Help S20Chapter 07 Homework.pdf (1 page) SPRING 2020 BUS2101 Chapter 7 Homework SHOW ALL WORK, colors

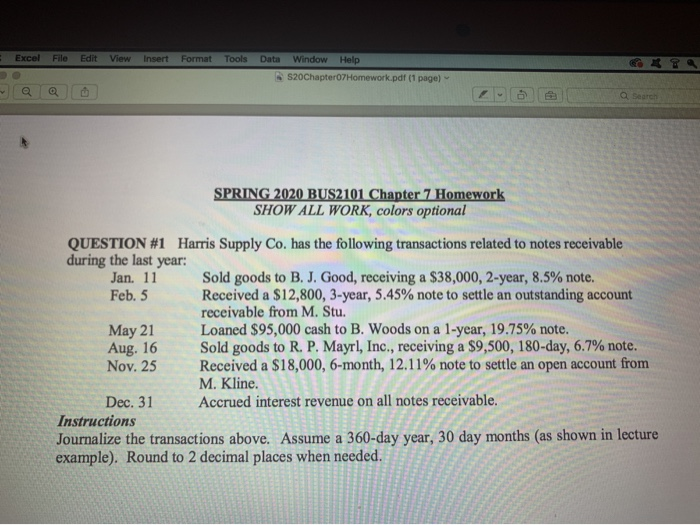

Excel File Edit View Insert Format Tools Data Window Help S20Chapter 07 Homework.pdf (1 page) SPRING 2020 BUS2101 Chapter 7 Homework SHOW ALL WORK, colors optional QUESTION #1 Harris Supply Co. has the following transactions related to notes receivable during the last year: Jan. 11 Sold goods to B.J. Good, receiving a $38,000, 2-year, 8.5% note. Feb. 5 Received a $12,800, 3-year, 5.45% note to settle an outstanding account receivable from M. Stu. May 21 Leaned SOS Loaned $95,000 cash to B. Woods on a 1-year, 19.75% note. Aug. 16 Sold goods to R. P. Mayrl, Inc., receiving a $9,500, 180-day, 6.7% note. Nov. 25 Received a $18,000, 6-month, 12.11% note to settle an open account from M. Kline. Dec. 31 Accrued interest revenue on all notes receivable. Instructions Journalize the transactions above. Assume a 360-day year, 30 day months (as shown in lecture example). Round to 2 decimal places when needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts