Question: Excel File Edit View Insert Format Tools Data Window Help 10% (4) Wed 6:21 PM AutoSave OFF HES 5 = HUN-group-hw2.xls - Compatibility Mode Q

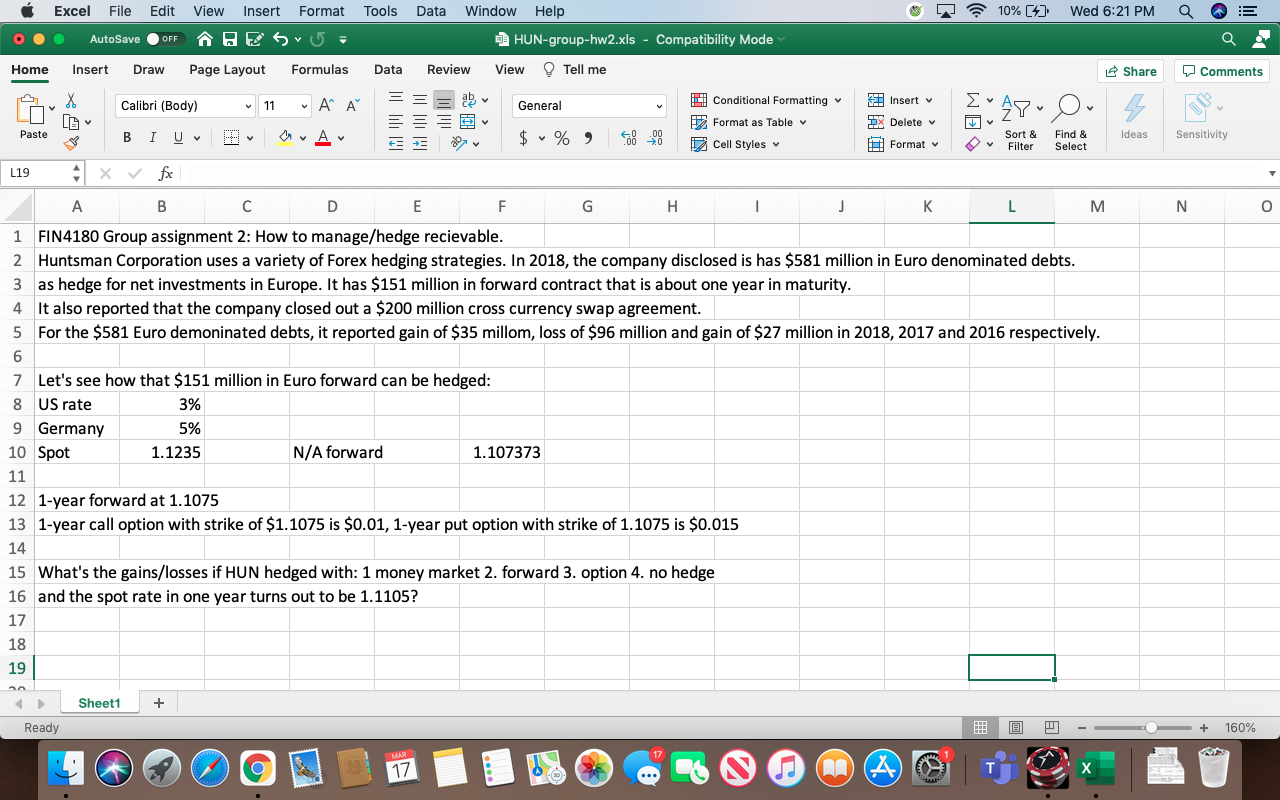

Excel File Edit View Insert Format Tools Data Window Help 10% (4) Wed 6:21 PM AutoSave OFF HES 5 = HUN-group-hw2.xls - Compatibility Mode Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share o Comments Calibri (Body) Insert X LE 11 Conditional Formatting . General WE Ayu O Format as Table Paste 1 B U ov Av E- $ % ) DX Delete Format Ideas Sort & Filter Cell Styles Find & Select Sensitivity L19 x fx A B D E F G H 1 J K L M N 0 3 1 FIN4180 Group assignment 2: How to manage/hedge recievable. 2 Huntsman Corporation uses a variety of Forex hedging strategies. In 2018, the company disclosed is has $581 million in Euro denominated debts. as hedge for net investments in Europe. It has $151 million in forward contract that is about one year in maturity. 4 It also reported that the company closed out a $200 million cross currency swap agreement. 5 For the $581 Euro demoninated debts, it reported gain of $35 millom, loss of $96 million and gain of $27 million in 2018, 2017 and 2016 respectively. 6 7 Let's see how that $151 million in Euro forward can be hedged: 8 US rate 3% 9 Germany 5% 10 Spot 1.1235 N/A forward 1.107373 11 12 1-year forward at 1.1075 13 1-year call option with strike of $1.1075 is $0.01, 1-year put option with strike of 1.1075 is $0.015 14 15 What's the gains/losses if HUN hedged with: 1 money market 2. forward 3. option 4. no hedge 16 and the spot rate in one year turns out to be 1.1105? 17 18 19 Sheet1 + Ready H! 160% 17 T Excel File Edit View Insert Format Tools Data Window Help 10% (4) Wed 6:21 PM AutoSave OFF HES 5 = HUN-group-hw2.xls - Compatibility Mode Q Home Insert Draw Page Layout Formulas Data Review View Tell me Share o Comments Calibri (Body) Insert X LE 11 Conditional Formatting . General WE Ayu O Format as Table Paste 1 B U ov Av E- $ % ) DX Delete Format Ideas Sort & Filter Cell Styles Find & Select Sensitivity L19 x fx A B D E F G H 1 J K L M N 0 3 1 FIN4180 Group assignment 2: How to manage/hedge recievable. 2 Huntsman Corporation uses a variety of Forex hedging strategies. In 2018, the company disclosed is has $581 million in Euro denominated debts. as hedge for net investments in Europe. It has $151 million in forward contract that is about one year in maturity. 4 It also reported that the company closed out a $200 million cross currency swap agreement. 5 For the $581 Euro demoninated debts, it reported gain of $35 millom, loss of $96 million and gain of $27 million in 2018, 2017 and 2016 respectively. 6 7 Let's see how that $151 million in Euro forward can be hedged: 8 US rate 3% 9 Germany 5% 10 Spot 1.1235 N/A forward 1.107373 11 12 1-year forward at 1.1075 13 1-year call option with strike of $1.1075 is $0.01, 1-year put option with strike of 1.1075 is $0.015 14 15 What's the gains/losses if HUN hedged with: 1 money market 2. forward 3. option 4. no hedge 16 and the spot rate in one year turns out to be 1.1105? 17 18 19 Sheet1 + Ready H! 160% 17 T

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts