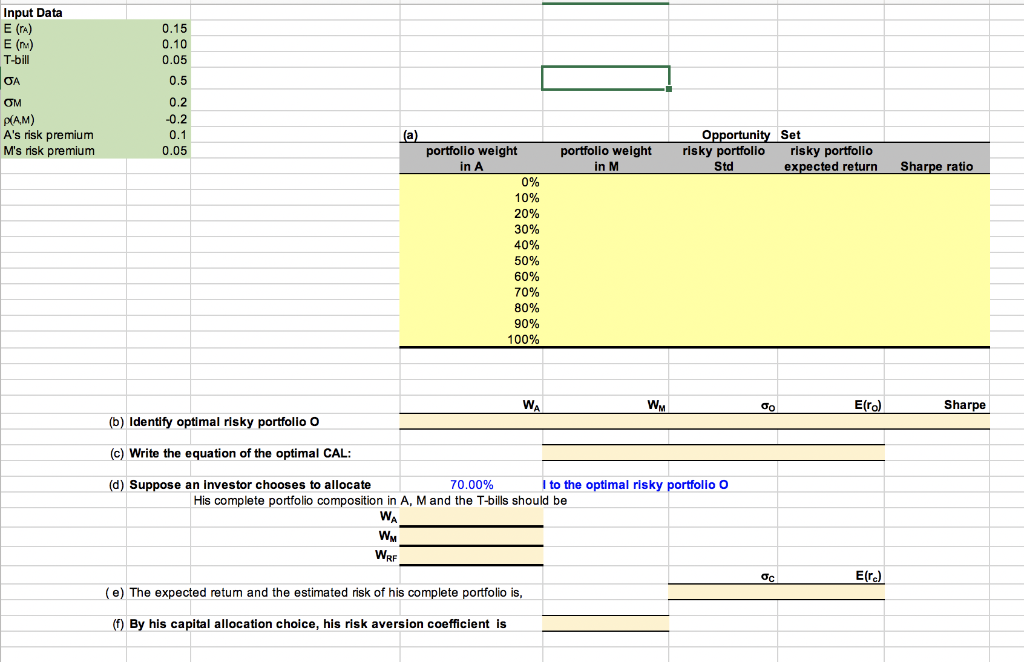

Question: excel for reference Question 1 Not yet You are required to generate the investment opportunity set by varying asset allocations between two risky assets: A

excel for reference

excel for reference

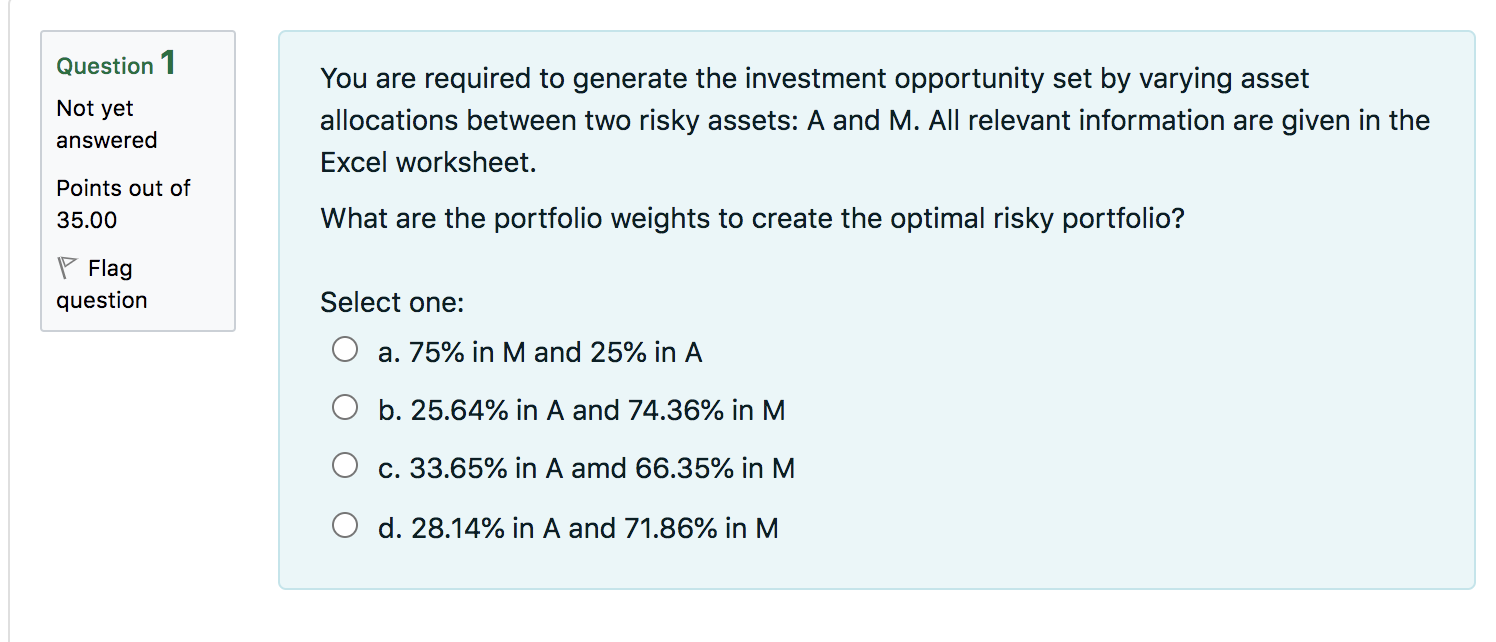

Question 1 Not yet You are required to generate the investment opportunity set by varying asset allocations between two risky assets: A and M. All relevant information are given in the Excel worksheet. answered Points out of 35.00 What are the portfolio weights to create the optimal risky portfolio? P Flag question Select one: a. 75% in M and 25% in A b. 25.64% in A and 74.36% in M c. 33.65% in A amd 66.35% in M d. 28.14% in A and 71.86% in M What is the Sharpe ratio of the optimal risky portfolio? Select one: a. 0.357 b. 0.362 c. 0.342 d. 0.328 Question 1 Not yet You are required to generate the investment opportunity set by varying asset allocations between two risky assets: A and M. All relevant information are given in the Excel worksheet. answered Points out of 35.00 What are the portfolio weights to create the optimal risky portfolio? P Flag question Select one: a. 75% in M and 25% in A b. 25.64% in A and 74.36% in M c. 33.65% in A amd 66.35% in M d. 28.14% in A and 71.86% in M What is the Sharpe ratio of the optimal risky portfolio? Select one: a. 0.357 b. 0.362 c. 0.342 d. 0.328

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts