Question: Excel format for answer, please Brief Exercise 3-14 Here are some qualitative characteristics of useful accounting information: 1. Predictive value. 2. Neutral. 3. Verifiable. 4.

Excel format for answer, please

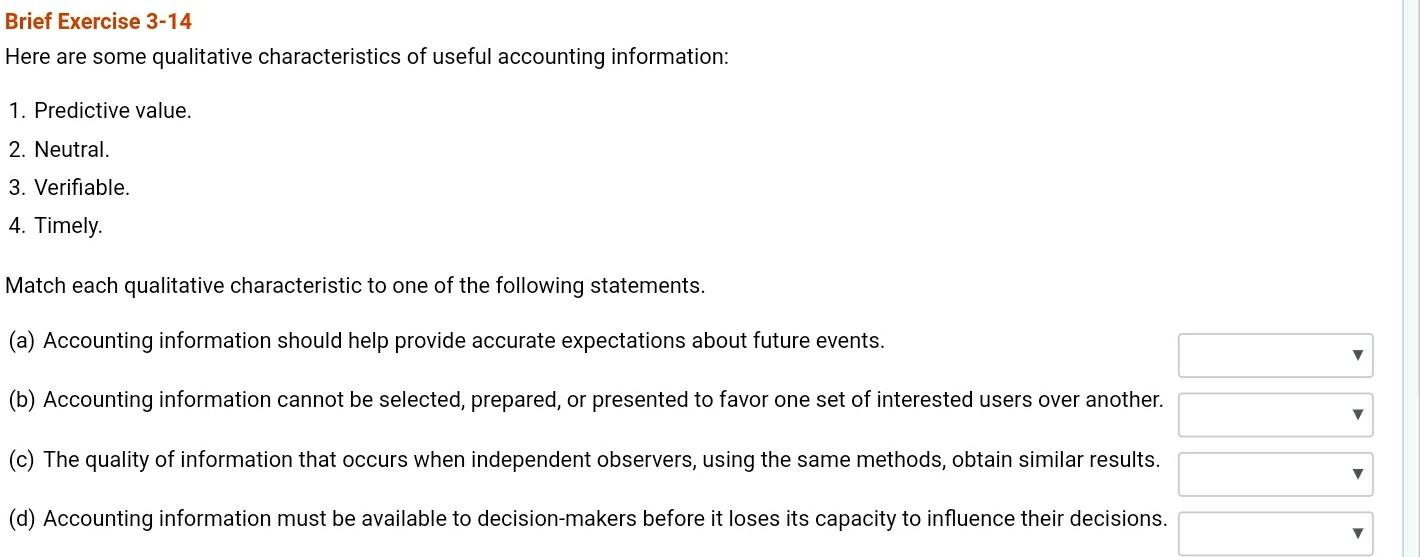

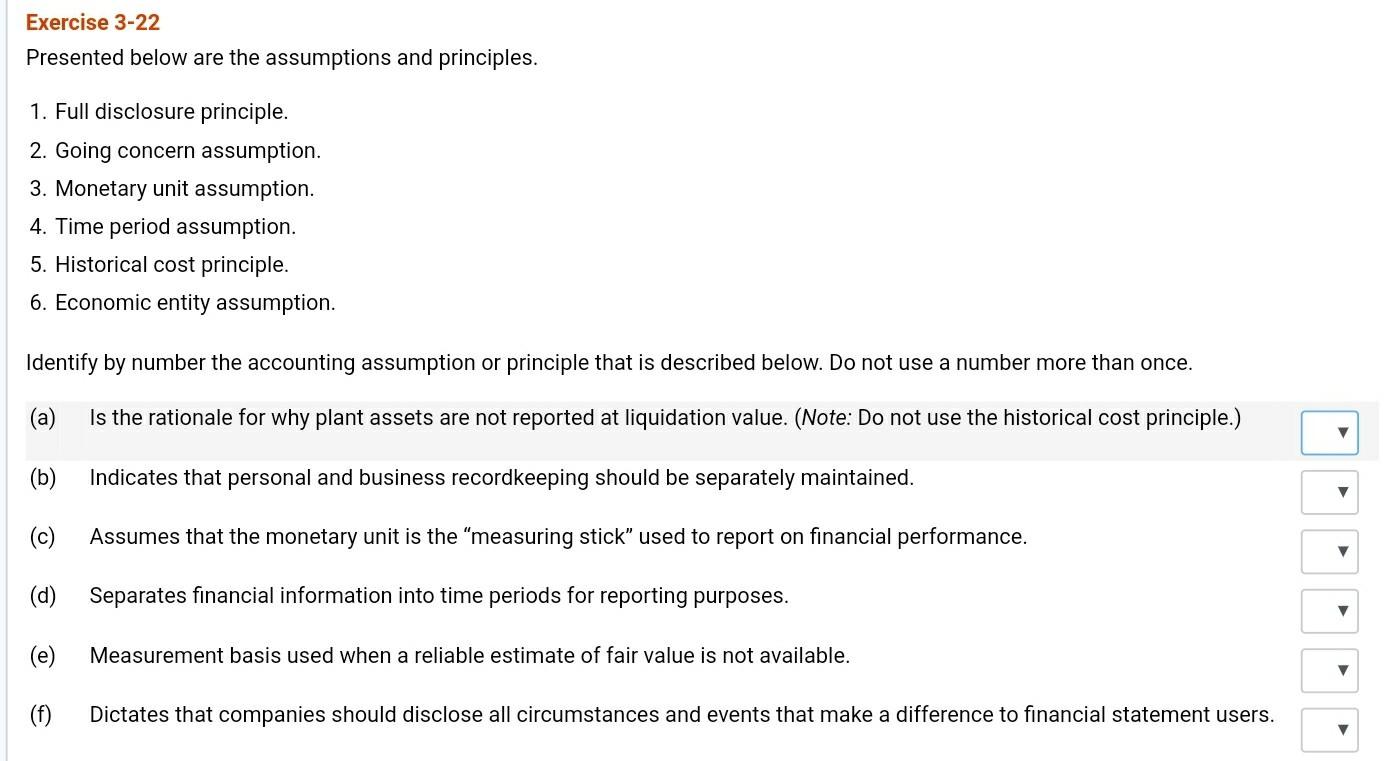

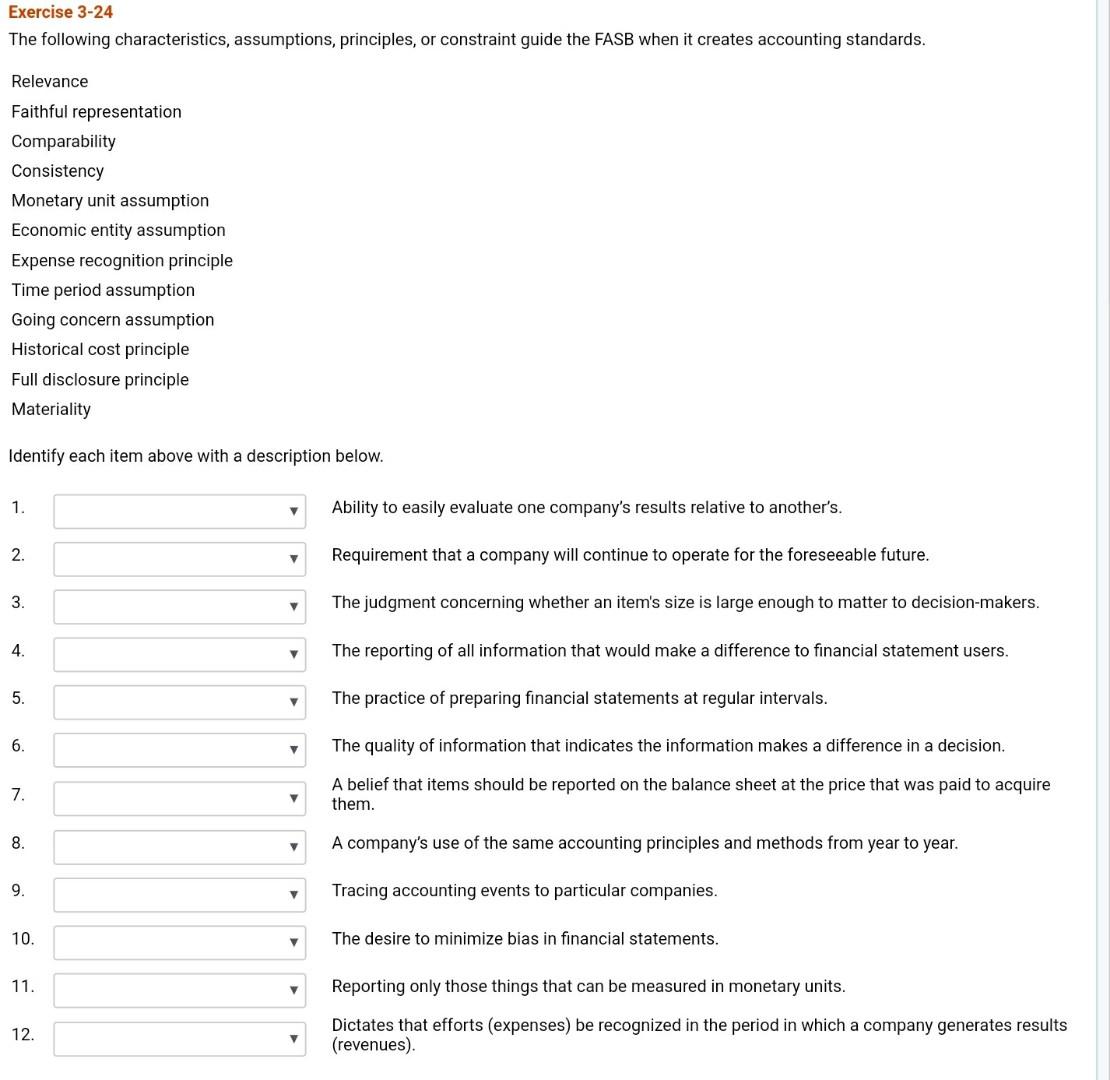

Brief Exercise 3-14 Here are some qualitative characteristics of useful accounting information: 1. Predictive value. 2. Neutral. 3. Verifiable. 4. Timely. Match each qualitative characteristic to one of the following statements. (a) Accounting information should help provide accurate expectations about future events. (b) Accounting information cannot be selected, prepared, or presented to favor one set of interested users over another. v (c) The quality of information that occurs when independent observers, using the same methods, obtain similar results. (d) Accounting information must be available to decision-makers before it loses its capacity to influence their decisions. Exercise 3-22 Presented below are the assumptions and principles. 1. Full disclosure principle. 2. Going concern assumption. 3. Monetary unit assumption. 4. Time period assumption. 5. Historical cost principle. 6. Economic entity assumption. Identify by number the accounting assumption or principle that is described below. Do not use a number more than once. (a) Is the rationale for why plant assets are not reported at liquidation value. (Note: Do not use the historical cost principle.) (b) Indicates that personal and business recordkeeping should be separately maintained. (c) Assumes that the monetary unit is the measuring stick used to report on financial performance. (d) Separates financial information into time periods for reporting purposes. (e) Measurement basis used when a reliable estimate of fair value is not available. (f) Dictates that companies should disclose all circumstances and events that make a difference to financial statement users. Exercise 3-24 The following characteristics, assumptions, principles, or constraint guide the FASB when it creates accounting standards. Relevance Faithful representation Comparability Consistency Monetary unit assumption Economic entity assumption Expense recognition principle Time period assumption Going concern assumption Historical cost principle Full disclosure principle Materiality Identify each item above with a description below. 1. V Ability to easily evaluate one company's results relative to another's. 2. Requirement that a company will continue to operate for the foreseeable future. 3. The judgment concerning whether an item's size is large enough to matter to decision-makers. 4. V The reporting of all information that would make a difference to financial statement users. 5. The practice of preparing financial statements at regular intervals. 6. The quality of information that indicates the information makes a difference in a decision. 7. A belief that items should be reported on the balance sheet at the price that was paid to acquire them. V 8. v A company's use of the same accounting principles and methods from year to year. 9. v Tracing accounting events to particular companies. 10. The desire to minimize bias in financial statements. 11. v Reporting only those things that can be measured in monetary units. 12. Dictates that efforts (expenses) be recognized in the period in which a company generates results (revenues)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts