Question: Excel format please show the step-by-step calculation. Pa EXERCISE 14C-2 Income Taxes and Net Present Value Analysis 20148 Winthrop Company has an opportunity to manufacture

Excel format please show the step-by-step calculation.

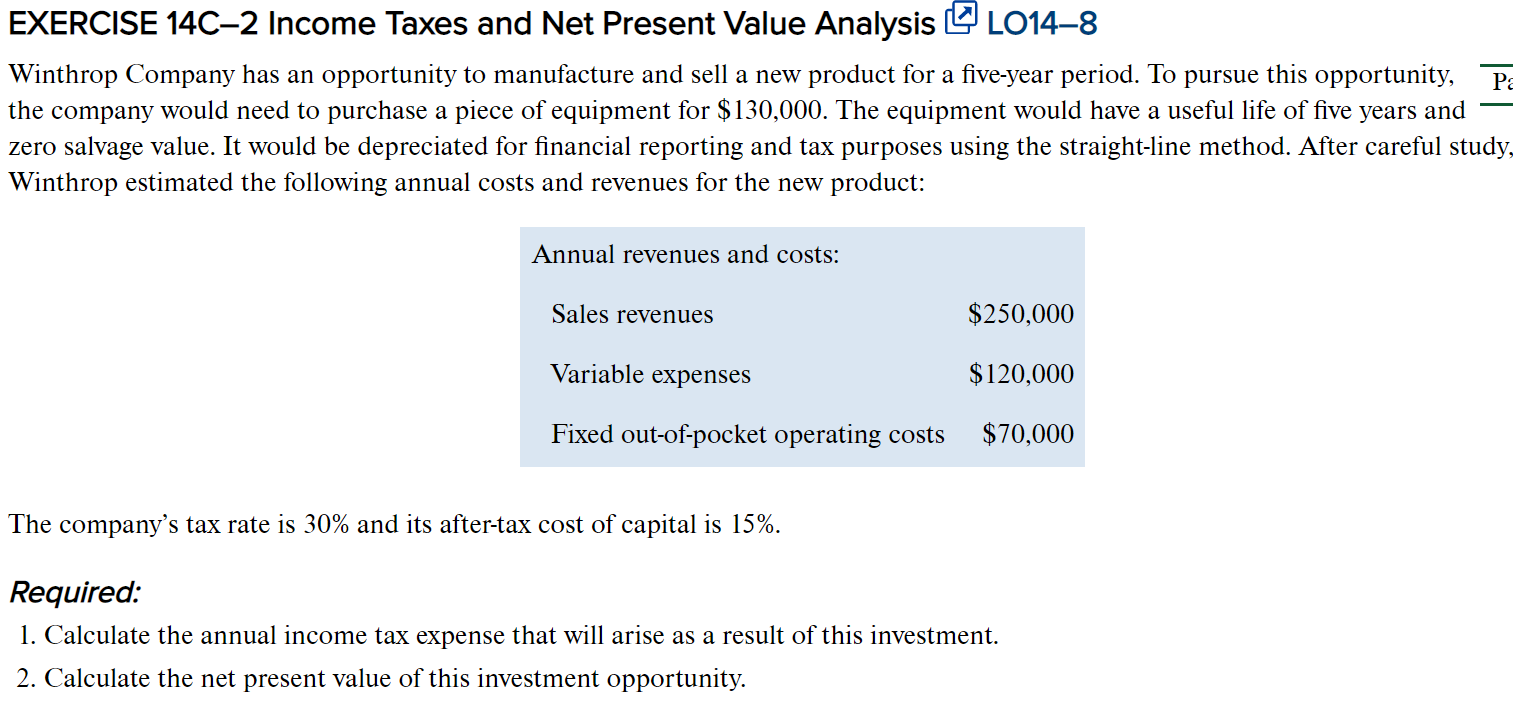

Pa EXERCISE 14C-2 Income Taxes and Net Present Value Analysis 20148 Winthrop Company has an opportunity to manufacture and sell a new product for a five-year period. To pursue this opportunity, the company would need to purchase a piece of equipment for $130,000. The equipment would have a useful life of five years and zero salvage value. It would be depreciated for financial reporting and tax purposes using the straight-line method. After careful study, Winthrop estimated the following annual costs and revenues for the new product: Annual revenues and costs: Sales revenues $250,000 Variable expenses $120,000 Fixed out-of-pocket operating costs $70,000 The company's tax rate is 30% and its after-tax cost of capital is 15%. Required: 1. Calculate the annual income tax expense that will arise as a result of this investment. 2. Calculate the net present value of this investment opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts