Question: excel formula needed to get highlighted answer 5. Which is the better deal, a $165,000 loan quoted @ 6.25% APR over 15 years with $3,375

excel formula needed to get highlighted answer

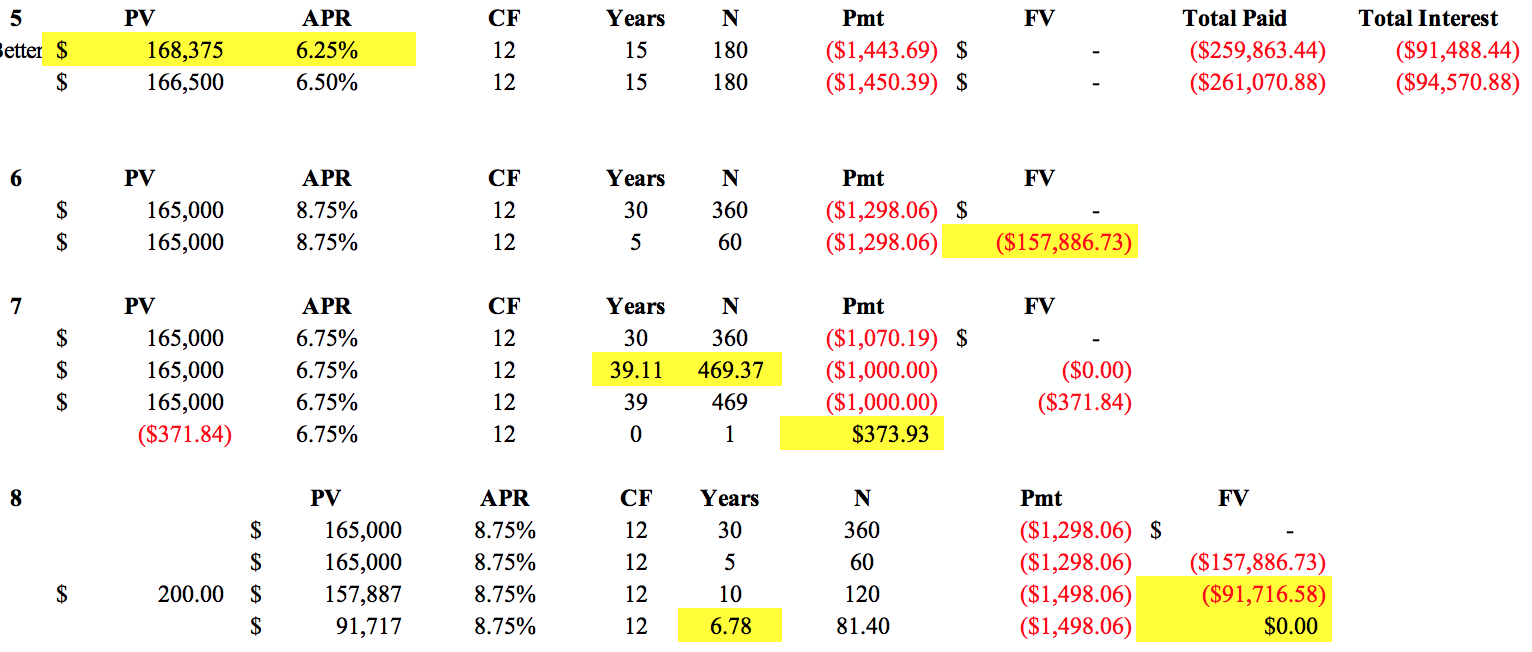

5. Which is the better deal, a $165,000 loan quoted @ 6.25% APR over 15 years with $3,375 in fees or quoted @ 6.5% APR $1,500 flat fee (monthly payments)?

6. Suppose you obtain a mortgage for $165,000 loan @ 8.75% APR over 30 years (monthly payments). You make these payments on time for 5 years. What is the payoff balance (balloon payment) then?

7. On a $165,000 loan @ 6.75% APR over 30 years you make regular $1,000 monthly payments. How long (# of payments) until the loan is paid in full? What is the last payment amount?

8. Suppose you obtain a mortgage for $165,000 loan @ 8.75% APR over 30 years (monthly payments). You make these payments on time for 5 years. At that time you decide to make an additional $200 payment with each regular mortgage payment. What is the balance in year 15? When will the loan be paid in full?

Years FV 5 Better $ PV 168,375 166,500 APR 6.25% 6.50% 15 N 180 180 Pmt ($1,443.69) $ ($1,450.39) $ Total Paid ($259,863.44) ($261,070.88) 863.44) Total Interest ($91,488.44) ($94,570.88) 15 FV PV 165,000 165,000 APR 8.75% 8.75% Years 30 5 N 360 Pmt ($1,298.06) $ ($1,298.06) 60 ($157,886.73) Years FV 30 PV 165,000 165,000 165,000 ($371.84) APR 6.75% 6.75% 6.75% 6.75% 39.11 N 360 469.37 469 1 Pmt ($1,070.19) $ ($1,000.00 ($1,000.00 $373.93 ($0.00) ($371.84) 39 0 CF N FV Years 30 360 PV 165,000 165,000 157,887 91,717 APR 8.75% 8.75% 8.75% 8.75% Pmt ($1,298.06) $ ($1,298.06) ($1,498.06) ($1,498.06) $ 200.00 $ 60 120 81.40 10 ($157,886.73) ($91,716.58) $0.00 12 6.78 Years FV 5 Better $ PV 168,375 166,500 APR 6.25% 6.50% 15 N 180 180 Pmt ($1,443.69) $ ($1,450.39) $ Total Paid ($259,863.44) ($261,070.88) 863.44) Total Interest ($91,488.44) ($94,570.88) 15 FV PV 165,000 165,000 APR 8.75% 8.75% Years 30 5 N 360 Pmt ($1,298.06) $ ($1,298.06) 60 ($157,886.73) Years FV 30 PV 165,000 165,000 165,000 ($371.84) APR 6.75% 6.75% 6.75% 6.75% 39.11 N 360 469.37 469 1 Pmt ($1,070.19) $ ($1,000.00 ($1,000.00 $373.93 ($0.00) ($371.84) 39 0 CF N FV Years 30 360 PV 165,000 165,000 157,887 91,717 APR 8.75% 8.75% 8.75% 8.75% Pmt ($1,298.06) $ ($1,298.06) ($1,498.06) ($1,498.06) $ 200.00 $ 60 120 81.40 10 ($157,886.73) ($91,716.58) $0.00 12 6.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts