Question: Excel Formula only! - X Calculating investment returns - Excel FORMULAS DATA REVIEW ALE HOME INSERT PAGE LAYOUT VIEW Sign In Arial 12 AA Paste

Excel Formula only!

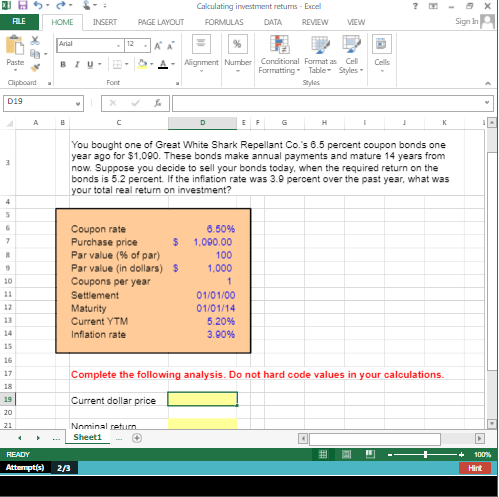

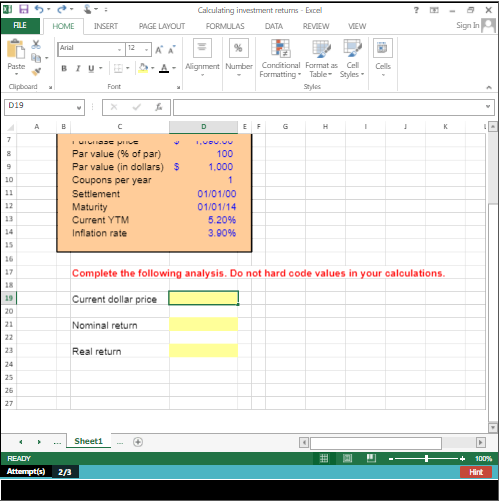

- X Calculating investment returns - Excel FORMULAS DATA REVIEW ALE HOME INSERT PAGE LAYOUT VIEW Sign In Arial 12 AA Paste BIU A Cells Alignment Number Conditional Formatas Cell Formatting Table- Styles Styles Clipboard Font D19 A B H 1 K 3 You bought one of Great White Shark Repellant Co.'s 6.5 percent coupon bonds one year ago for $1.090. These bonds make annual payments and mature 14 years from now. Suppose you decide to sell your bonds today, when the required return on the bonds is 5.2 percent. If the inflation rate was 3.9 percent over the past year, what was your total real return on investment? 4 5 7 10 Coupon rate Purchase price $ Par value (% of par) Par value (in dollars) $ Coupons per year Settlement Maturity Current YTM Inflation rate 6.50% 1.000.00 100 1,000 1 01/01/00 01/01/14 5.20% 3.90% 11 12 13 14 15 16 17 18 Complete the following analysis. Do not hard code values in your calculations. 19 Current dollar price 20 21 Nominal return Sheet1 100% READY Attempt(s) 2/3 Hint S. HOME Calculating investment returns - Excel FORMULAS DATA REVIEW ALE INSERT PAGE LAYOUT VIEW Sign In In Arial 12 AA % Paste BIU Cells Alignment Number Conditional Formatas Cell Formatting Table Styles Styles Clipboard Font D19 B D H 1 K 7 8 9 10 11 I UILISE WIVE Par value % of par) Par value in dollars) $ Coupons per year Settlement Maturity Current YTM Inflation rate 1.VOU. 100 1.000 1 01/01/00 01/01/14 5.20% 3.90% 12 13 14 15 16 17 Complete the following analysis. Do not hard code values in your calculations. Current dollar price 20 Nominal return 21 22 23 Real return 24 25 26 27 Sheet1 READY Attempt(s) 100% Hint 2/3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts