Question: Excel Formulas G6 fi A B D E F H I J 4 A 6.50 percent coupon bond with ten years left to maturity is

Excel Formulas

Excel Formulas

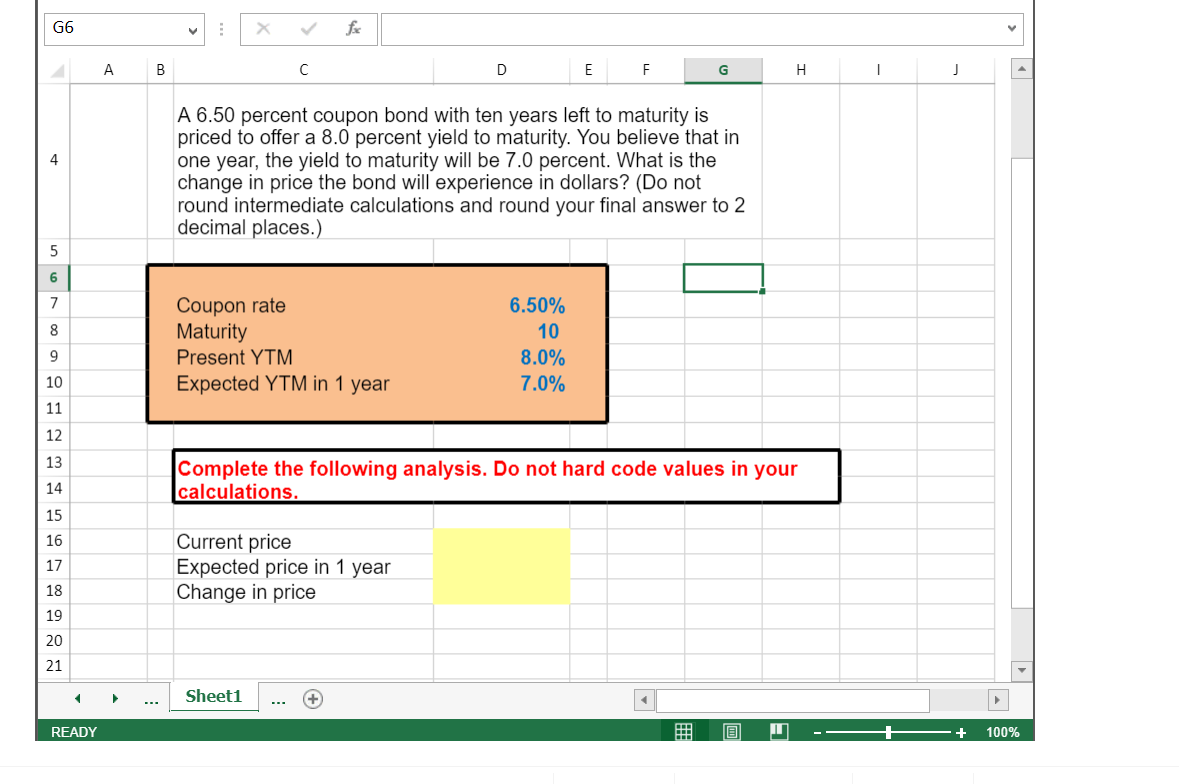

G6 fi A B D E F H I J 4 A 6.50 percent coupon bond with ten years left to maturity is priced to offer a 8.0 percent yield to maturity. You believe that in one year, the yield to maturity will be 7.0 percent. What is the change in price the bond will experience in dollars ? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 5 6 7 8 Coupon rate Maturity Present YTM Expected YTM in 1 year 6.50% 10 8.0% 7.0% 9 10 11 12 Complete the following analysis. Do not hard code values in your calculations. 14 15 16 17 Current price Expected price in 1 year Change in price 18 19 20 21 Sheet1 READY D + 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts