Question: EXCEL FUNCTIONS PLEASE You consider purchasing a $250,000 home for which you will be making a 20% down payment and obtaining a mortgage to finance

EXCEL FUNCTIONS PLEASE

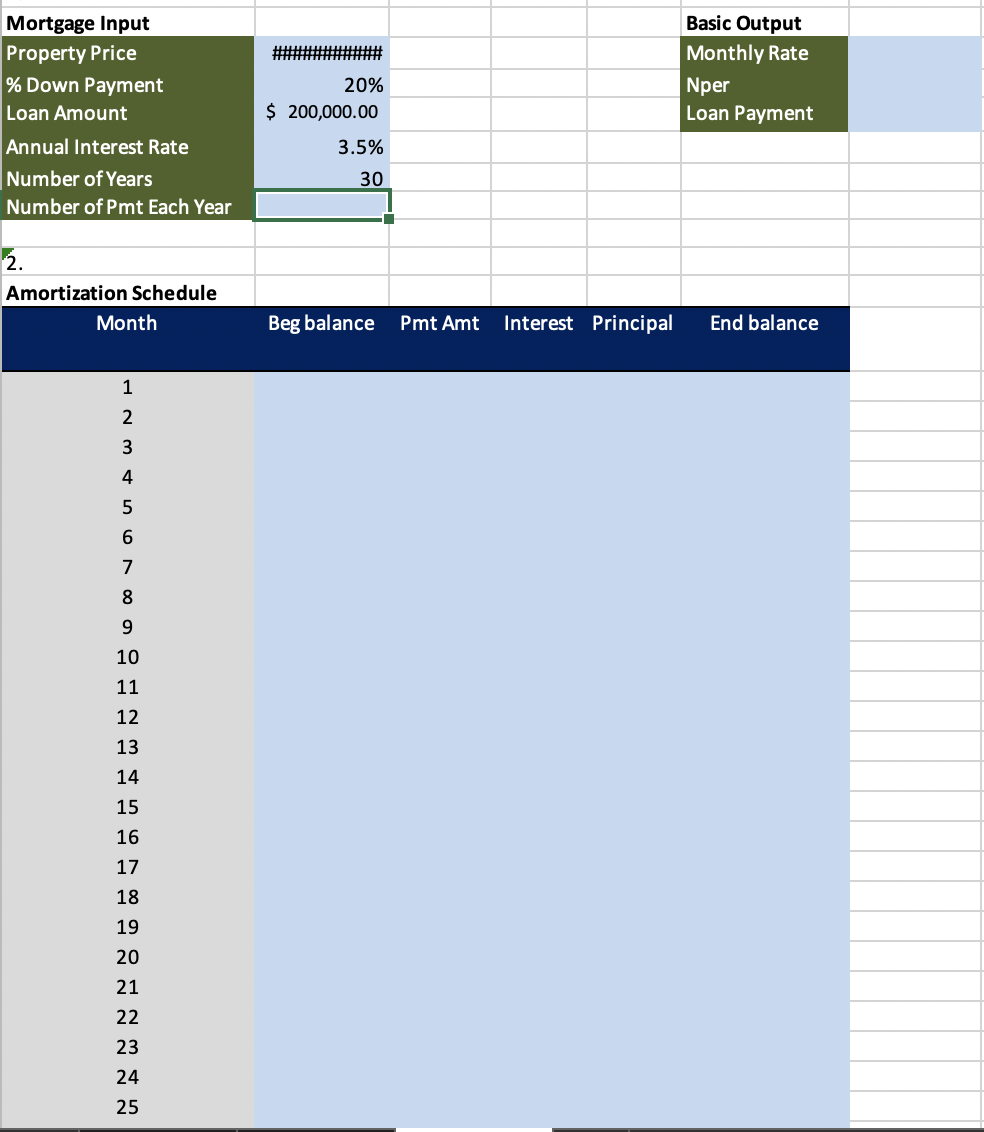

You consider purchasing a $250,000 home for which you will be making a 20% down payment and obtaining a mortgage to finance the remaining amount. The mortgage is for 30 years (360 months) and has a fixed nominal annual rate of 3.5 percent, with monthly payments made at the end of months. 1. Fill out the blank blue cells in the Mortgage Input and Basic Output sections. 2. Complete the mortgage amortization schedule. 3. Insert the graphs for: Interest & Principal payments b. Ending balance a. Mortgage Input Property Price % Down Payment Loan Amount Annual Interest Rate Number of Years Number of Pmt Each Year Basic Output Monthly Rate Nper Loan Payment 20% $ 200,000.00 3.5% 30 3. Amortization Schedule Month Beg balance Pmt Amt Interest Principal End balance No 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts