Question: Excel is not allowed. Please use financial calculator or normal calculator Thank you 4. Consider a project with the following data: Initial investment to purchase

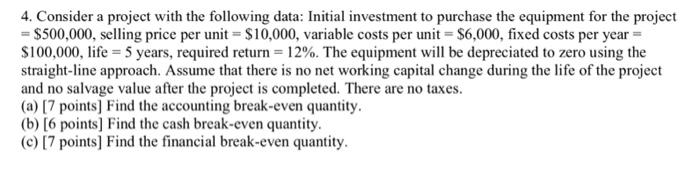

4. Consider a project with the following data: Initial investment to purchase the equipment for the project = $500,000, selling price per unit = $10,000, variable costs per unit = $6,000, fixed costs per year = $100,000, life = 5 years, required return = 12%. The equipment will be depreciated to zero using the straight-line approach. Assume that there is no net working capital change during the life of the project and no salvage value after the project is completed. There are no taxes. (a) [7 points] Find the accounting break-even quantity. (b) [6 points] Find the cash break-even quantity. (c) [7 points] Find the financial break-even quantity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts