Question: excel it is $70,000 Chapter 11 Problems (100 points) Problem 1: Capital Budgeting Cash Flows (80 points) You are a financial analyst at the Humongous

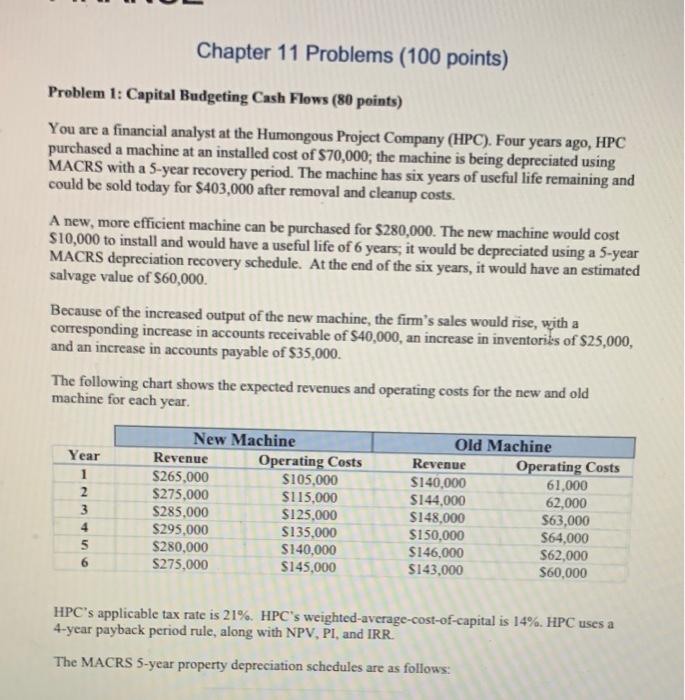

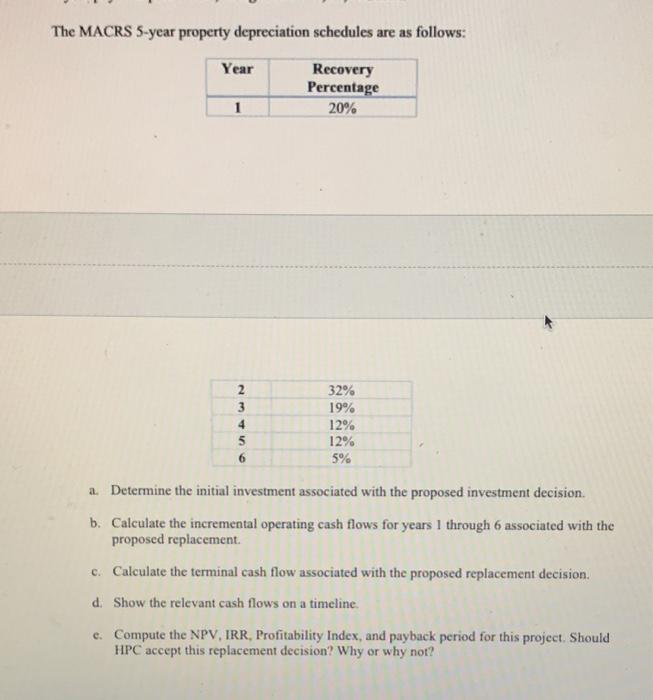

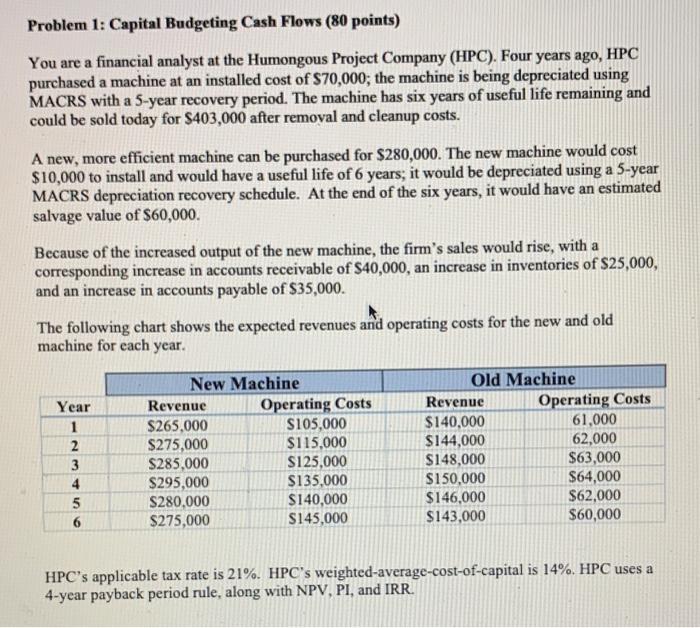

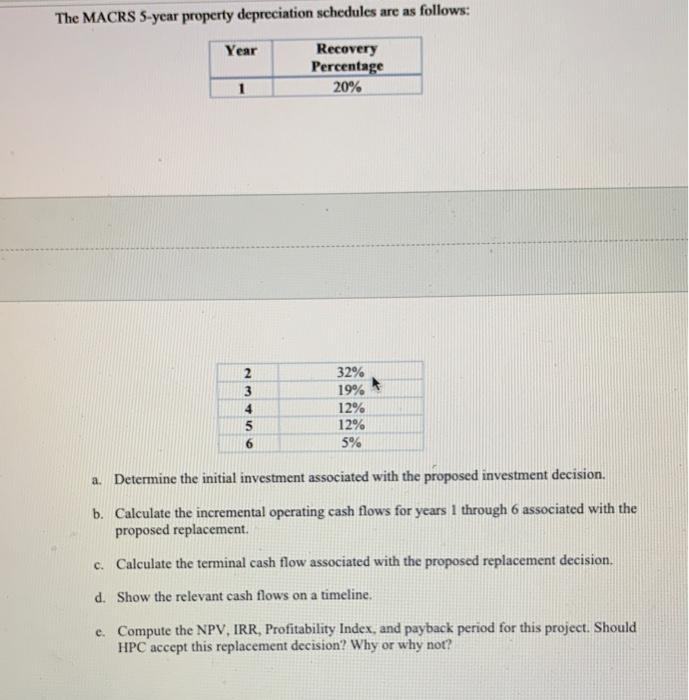

Chapter 11 Problems (100 points) Problem 1: Capital Budgeting Cash Flows (80 points) You are a financial analyst at the Humongous Project Company (HPC). Four years ago, HPC purchased a machine at an installed cost of $70,000, the machine is being depreciated using MACRS with a 5-year recovery period. The machine has six years of useful life remaining and could be sold today for $403,000 after removal and cleanup costs. A new, more efficient machine can be purchased for $280,000. The new machine would cost $10,000 to install and would have a useful life of 6 years, it would be depreciated using a 5-year MACRS depreciation recovery schedule. At the end of the six years, it would have an estimated salvage value of $60,000. Because of the increased output of the new machine, the firm's sales would rise, with a corresponding increase in accounts receivable of $40,000, an increase in inventoriks of $25,000, and an increase in accounts payable of $35,000. The following chart shows the expected revenues and operating costs for the new and old machine for each year. Year 1 2 3 4 5 6 NMT New Machine Revenue Operating Costs S265,000 $105,000 $275,000 S115,000 $285,000 $125,000 $295.000 $135,000 $280,000 $140,000 $275,000 $145,000 Old Machine Revenue Operating Costs $140,000 61,000 $144,000 62,000 $148,000 $63,000 $150,000 S64,000 S146,000 362,000 $143.000 $60,000 HPC's applicable tax rate is 21%. HPC's weighted-average-cost-of-capital is 14%. HPC uses a 4-year payback period rule, along with NPV, PI, and IRR. The MACRS 5-year property depreciation schedules are as follows: The MACRS 5-year property depreciation schedules are as follows: Year Recovery Percentage 20% 1 NMT 2 3 4 5 6 32% 19% 12% 12% 5% a. Determine the initial investment associated with the proposed investment decision b. Calculate the incremental operating cash flows for years I through 6 associated with the proposed replacement c. Calculate the terminal cash flow associated with the proposed replacement decision. d. Show the relevant cash flows on a timeline. e. Compute the NPV, IRR, Profitability Index, and payback period for this project. Should HPC accept this replacement decision? Why or why not? Problem 1: Capital Budgeting Cash Flows (80 points) You are a financial analyst at the Humongous Project Company (HPC). Four years ago, HPC purchased a machine at an installed cost of $70,000; the machine is being depreciated using MACRS with a 5-year recovery period. The machine has six years of useful life remaining and could be sold today for $403,000 after removal and cleanup costs. A new, more efficient machine can be purchased for $280,000. The new machine would cost $10,000 to install and would have a useful life of 6 years, it would be depreciated using a 5-year MACRS depreciation recovery schedule. At the end of the six years, it would have an estimated salvage value of $60,000. Because of the increased output of the new machine, the firm's sales would rise, with a corresponding increase in accounts receivable of $40,000, an increase in inventories of $25,000, and an increase in accounts payable of $35,000. The following chart shows the expected revenues and operating costs for the new and old machine for each year. Year 1 2 3 4 5 6 New Machine Revenue Operating Costs $265,000 S105,000 $275,000 $115,000 S285,000 S125.000 $295,000 $135,000 S280,000 $140,000 $275,000 S145,000 Old Machine Revenue Operating Costs $140,000 61,000 $144,000 62,000 $148,000 $63,000 $150,000 $64,000 $146,000 $62,000 $143,000 $60,000 HPC's applicable tax rate is 21%. HPC's weighted average-cost-of-capital is 14%. HPC uses a 4-year payback period rule, along with NPV, PI, and IRR. The MACRS 5-year property depreciation schedules are as follows: Year Recovery Percentage 20% 2 3 4 5 6 32% 19% 12% 12% 5% a. Determine the initial investment associated with the proposed investment decision. b. Calculate the incremental operating cash flows for years 1 through 6 associated with the proposed replacement. c. Calculate the terminal cash flow associated with the proposed replacement decision. d. Show the relevant cash flows on a timeline. e. Compute the NPV, IRR, Profitability Index, and payback period for this project. Should HPC accept this replacement decision? Why or why not? Chapter 11 Problems (100 points) Problem 1: Capital Budgeting Cash Flows (80 points) You are a financial analyst at the Humongous Project Company (HPC). Four years ago, HPC purchased a machine at an installed cost of $70,000, the machine is being depreciated using MACRS with a 5-year recovery period. The machine has six years of useful life remaining and could be sold today for $403,000 after removal and cleanup costs. A new, more efficient machine can be purchased for $280,000. The new machine would cost $10,000 to install and would have a useful life of 6 years, it would be depreciated using a 5-year MACRS depreciation recovery schedule. At the end of the six years, it would have an estimated salvage value of $60,000. Because of the increased output of the new machine, the firm's sales would rise, with a corresponding increase in accounts receivable of $40,000, an increase in inventoriks of $25,000, and an increase in accounts payable of $35,000. The following chart shows the expected revenues and operating costs for the new and old machine for each year. Year 1 2 3 4 5 6 NMT New Machine Revenue Operating Costs S265,000 $105,000 $275,000 S115,000 $285,000 $125,000 $295.000 $135,000 $280,000 $140,000 $275,000 $145,000 Old Machine Revenue Operating Costs $140,000 61,000 $144,000 62,000 $148,000 $63,000 $150,000 S64,000 S146,000 362,000 $143.000 $60,000 HPC's applicable tax rate is 21%. HPC's weighted-average-cost-of-capital is 14%. HPC uses a 4-year payback period rule, along with NPV, PI, and IRR. The MACRS 5-year property depreciation schedules are as follows: The MACRS 5-year property depreciation schedules are as follows: Year Recovery Percentage 20% 1 NMT 2 3 4 5 6 32% 19% 12% 12% 5% a. Determine the initial investment associated with the proposed investment decision b. Calculate the incremental operating cash flows for years I through 6 associated with the proposed replacement c. Calculate the terminal cash flow associated with the proposed replacement decision. d. Show the relevant cash flows on a timeline. e. Compute the NPV, IRR, Profitability Index, and payback period for this project. Should HPC accept this replacement decision? Why or why not? Problem 1: Capital Budgeting Cash Flows (80 points) You are a financial analyst at the Humongous Project Company (HPC). Four years ago, HPC purchased a machine at an installed cost of $70,000; the machine is being depreciated using MACRS with a 5-year recovery period. The machine has six years of useful life remaining and could be sold today for $403,000 after removal and cleanup costs. A new, more efficient machine can be purchased for $280,000. The new machine would cost $10,000 to install and would have a useful life of 6 years, it would be depreciated using a 5-year MACRS depreciation recovery schedule. At the end of the six years, it would have an estimated salvage value of $60,000. Because of the increased output of the new machine, the firm's sales would rise, with a corresponding increase in accounts receivable of $40,000, an increase in inventories of $25,000, and an increase in accounts payable of $35,000. The following chart shows the expected revenues and operating costs for the new and old machine for each year. Year 1 2 3 4 5 6 New Machine Revenue Operating Costs $265,000 S105,000 $275,000 $115,000 S285,000 S125.000 $295,000 $135,000 S280,000 $140,000 $275,000 S145,000 Old Machine Revenue Operating Costs $140,000 61,000 $144,000 62,000 $148,000 $63,000 $150,000 $64,000 $146,000 $62,000 $143,000 $60,000 HPC's applicable tax rate is 21%. HPC's weighted average-cost-of-capital is 14%. HPC uses a 4-year payback period rule, along with NPV, PI, and IRR. The MACRS 5-year property depreciation schedules are as follows: Year Recovery Percentage 20% 2 3 4 5 6 32% 19% 12% 12% 5% a. Determine the initial investment associated with the proposed investment decision. b. Calculate the incremental operating cash flows for years 1 through 6 associated with the proposed replacement. c. Calculate the terminal cash flow associated with the proposed replacement decision. d. Show the relevant cash flows on a timeline. e. Compute the NPV, IRR, Profitability Index, and payback period for this project. Should HPC accept this replacement decision? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts