Question: Excel McGraw Hill Excel Question - Saved v Search (Option + Q) File Home Insert Draw Formulas Data Review View Help Editing Comments Calibri 11

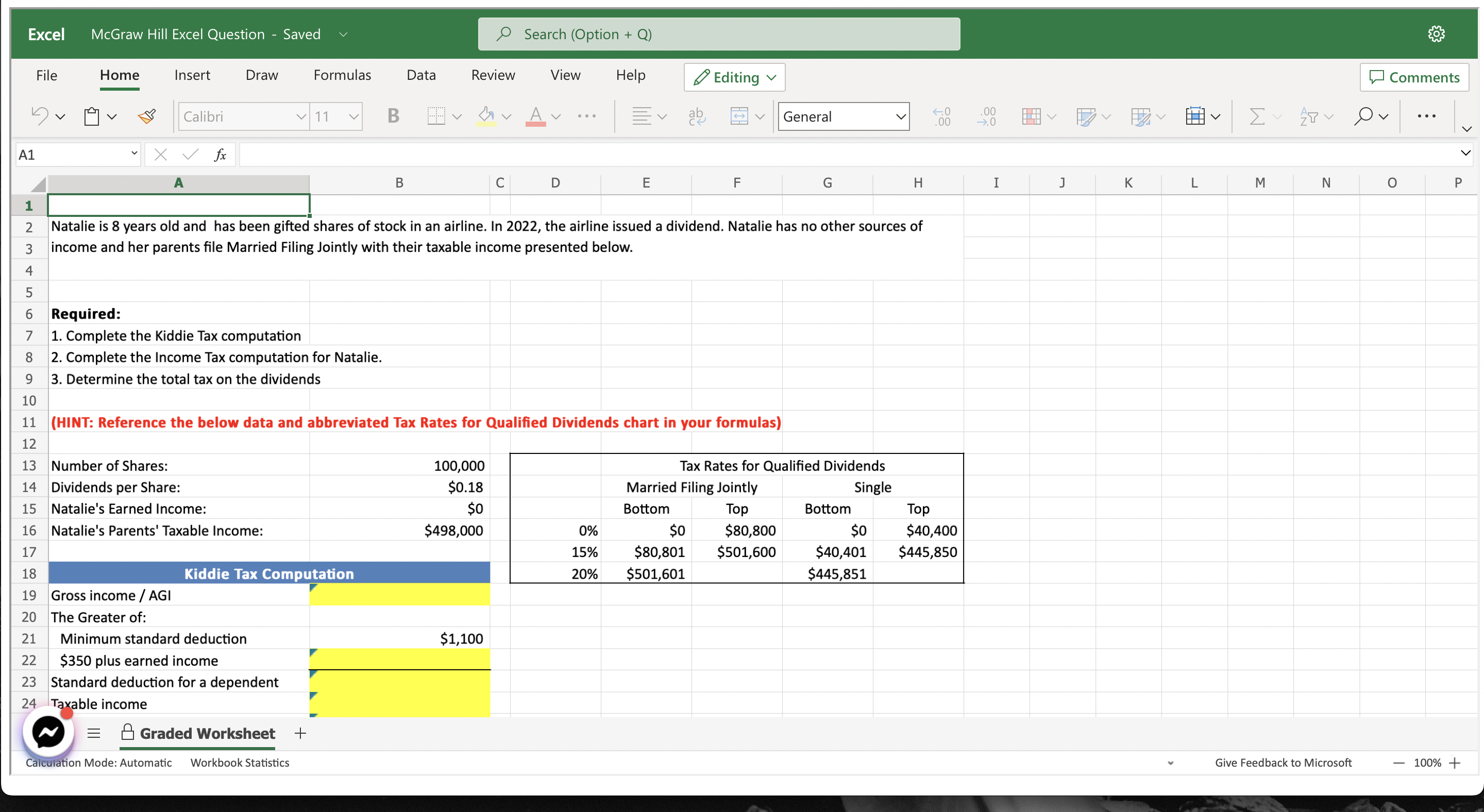

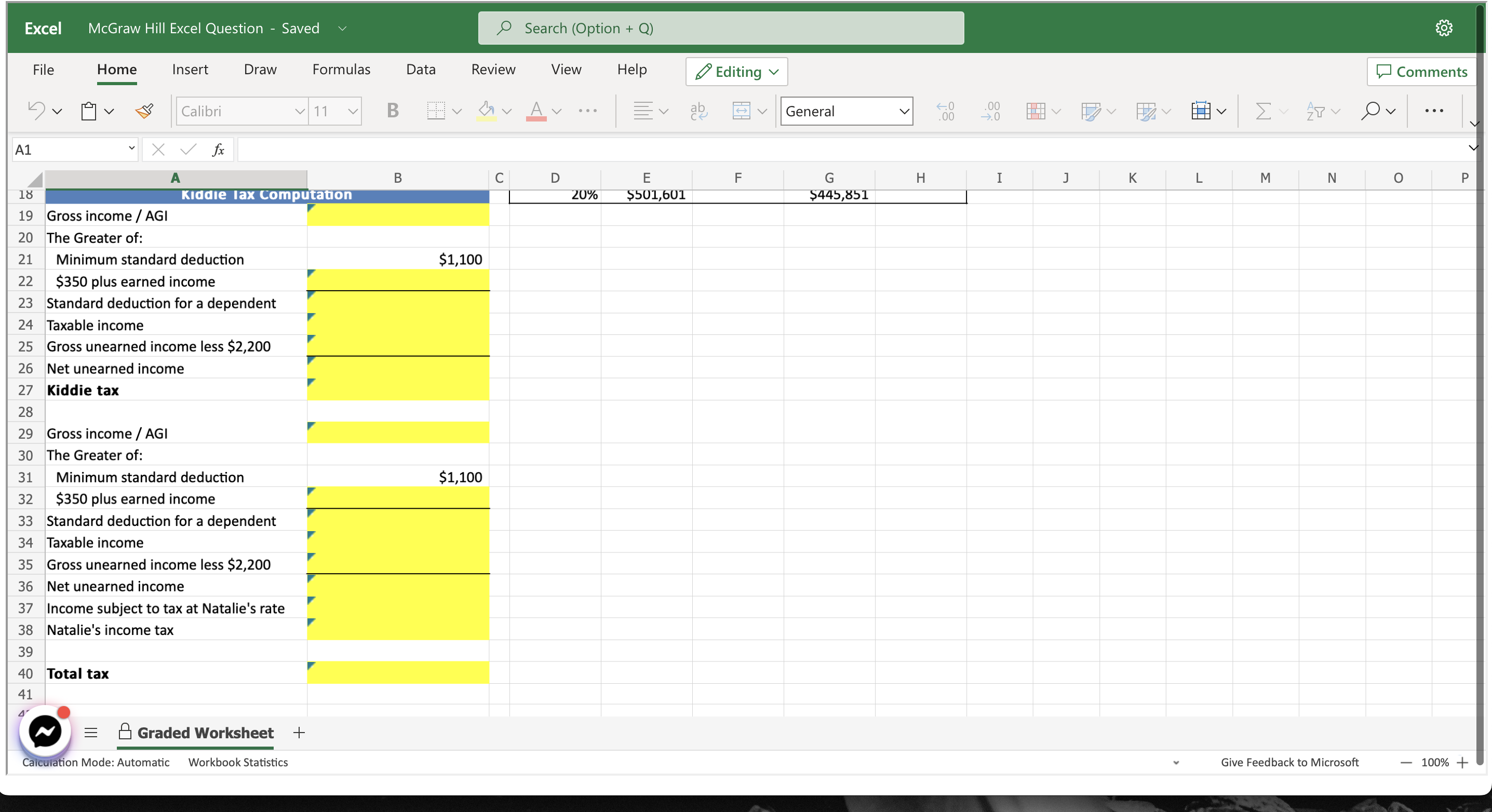

Excel McGraw Hill Excel Question - Saved v Search (Option + Q) File Home Insert Draw Formulas Data Review View Help Editing Comments Calibri 11 v B vvAv ... Ev ab General .00 00 Ov . . . A1 " X V fx A B CI D E F G H I J K L M N O P 1 N Natalie is 8 years old and has been gifted shares of stock in an airline. In 2022, the airline issued a dividend. Natalie has no other sources of income and her parents file Married Filing Jointly with their taxable income presented below. Va UI A W Required: 1. Complete the Kiddie Tax computation 8 2. Complete the Income Tax computation for Natalie. 9 3. Determine the total tax on the dividends 10 11 (HINT: Reference the below data and abbreviated Tax Rates for Qualified Dividends chart in your formulas) 12 3 Number of Shares: 100,000 Tax Rates for Qualified Dividends 14 Dividends per Share: $0.18 Married Filing Jointly Single 15 Natalie's Earned Income: So Bottom Top Bottom Top 16 Natalie's Parents' Taxable Income: $498,000 0% SO $80,800 SO $40,400 17 15% $80,801 $501,600 $40,401 $445,850 18 Kiddie Tax Computation 20% $501,601 $445,851 19 Gross income / AGI 20 The Greater of: 21 Minimum standard deduction $1,100 22 $350 plus earned income 23 Standard deduction for a dependent 24 Taxable income E Graded Worksheet + Calculation Mode: Automatic Workbook Statistics Give Feedback to Microsoft - 100% +Excel McGraw Hill Excel Question - Saved ,0 Search (Option + Q) File Home Insert Draw Formulas Data Review View Help / Editing V I; Comments V}V Ev (alien v H V B 7V 0 V A V EV 9'\" :V General V '1': [: l7 H V 7? ,OV "' A1 V [3: A B C D E F G H I J K L M N O P w | 20% swim $445,851 | 19 Gross income / AGI r 20 The Greater of: 21 Minimum standard deduction $1,100 22 $350 plus earned income 7 23 Standard deduction for a dependent 24 Taxable income 7 25 Gross unearned income less $2,200 7 26 Net unearned income 27 Kiddie tax 7 28 29 Gross income / AGI r 30 The Greater of: 31 Minimum standard deduction $1,100 32 $350 plus earned income 7 33 Standard deduction for a dependent 34 Taxable income 7 35 Gross unearned income less $2,200 ' 36 Net unearned income 37 Income subject to tax at Natalie's rate 38 Natalie's income tax 7 39 40 Total tax 7 41 4' O E El Graded Worksheet + Wt. Mode: Automatic Workbook Statistics . Give Feedback to Microsoft 100% +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts