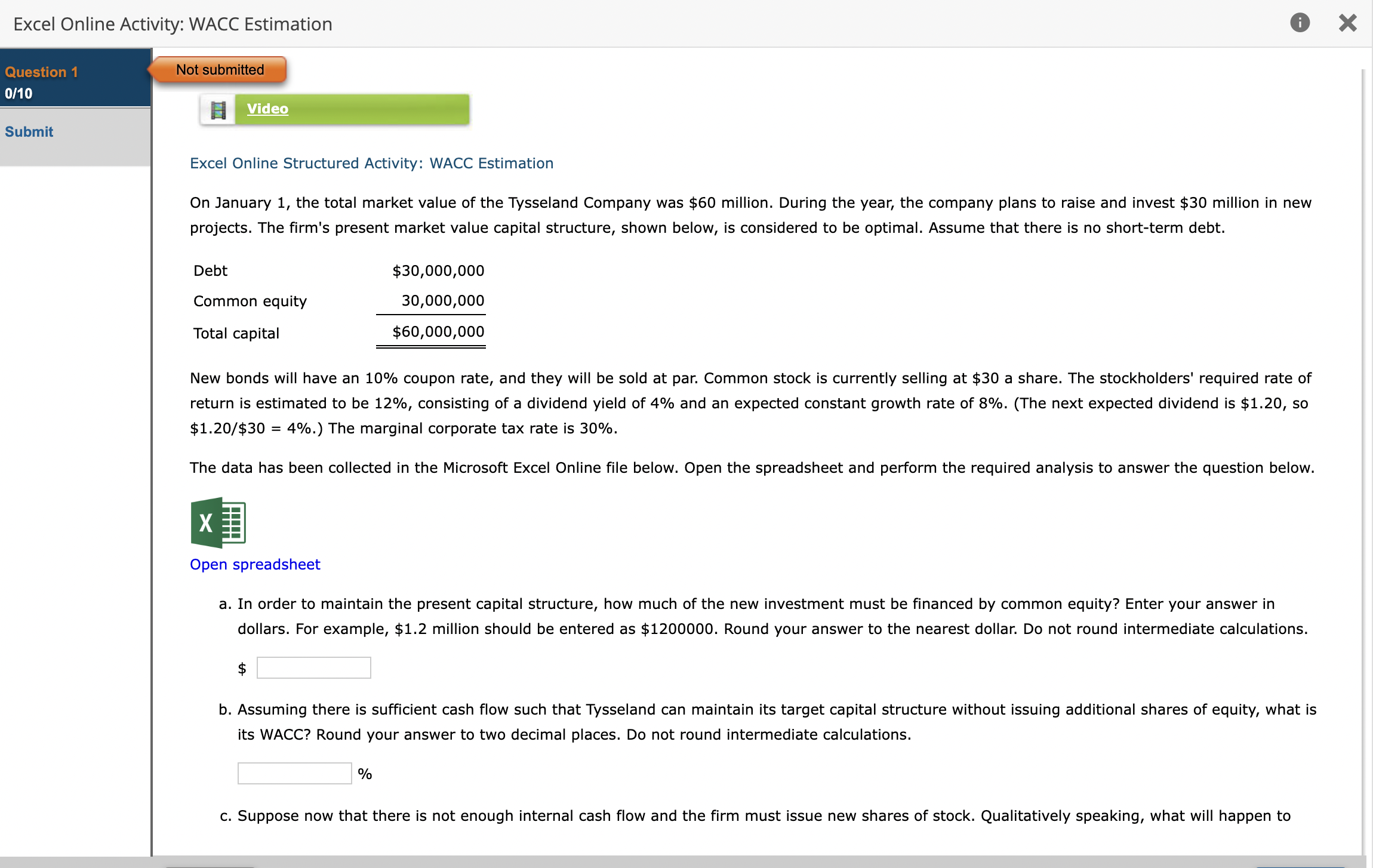

Question: Excel Online Activity: WACC Estimation Question 1 0/10 Submit Excel Online Structured Activity: WACC Estimation projects. The firm's present market value capital structure, shown below,

Excel Online Activity: WACC Estimation Question 1 0/10 Submit Excel Online Structured Activity: WACC Estimation projects. The firm's present market value capital structure, shown below, is considered to be optimal. Assume that there is no short-term debt. $1.20/$30=4%.) The marginal corporate tax rate is 30%. Open spreadsheet a. In order to maintain the present capital structure, how much of the new investment must be financed by common equity? Enter your answer in dollars. For example, $1.2 million should be entered as $1200000. Round your answer to the nearest dollar. Do not round intermediate calculations. \$ b. Assuming there is sufficient cash flow such that Tysseland can maintain its target capital structure without issuing additional shares of equity, what is its WACC? Round your answer to two decimal places. Do not round intermediate calculations. % c. Suppose now that there is not enough internal cash flow and the firm must issue new shares of stock. Qualitatively speaking, what will happen to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts