Question: Excel Online Structured Activity: Balance Sheet Analysis Consider the following financial data for). White Industries: Total assets turnover: 1.3 Gross profit margin on sales: (Sales

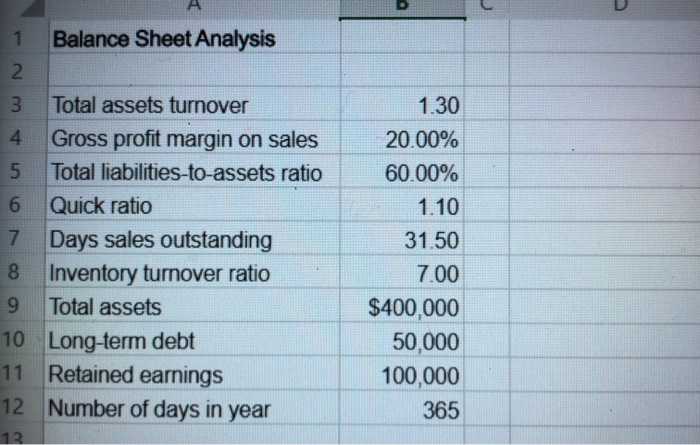

Excel Online Structured Activity: Balance Sheet Analysis Consider the following financial data for). White Industries: Total assets turnover: 1.3 Gross profit margin on sales: (Sales - Cost of goods sold)/Sales - 20% Total Habilities-to-assets ratio: 60% Quick ratio: 1.10 Days sales outstanding (based on 365-day year): 31.5 days Inventory turnover ratio: 7.0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Complete the balance sheet and sales information in the table that follows for). White Industries. Do not round intermediate calculations. Round your answers to the nearest whole dollar, Partial Income Statement Information $ Sales Cost of goods sold $ Balance Sheet $ $ Cash Accounts receivable Inventories $ $50,000 $ Accounts payable Long-term debt Common stock Retained earnings Total liabilities and equity $ $ 100,000 Fixed assets $ Total assets $ 400,000 $ D 1 Balance Sheet Analysis 2. 3 Total assets turnover 4 Gross profit margin on sales 5 Total liabilities-to-assets ratio 6 Quick ratio 7 Days sales outstanding 8 Inventory turnover ratio 9 Total assets 10 Long-term debt 11 Retained earnings 12 Number of days in year 13 1.30 20.00% 60.00% 1.10 31.50 7.00 $400,000 50,000 100,000 365

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts