Question: Excel Online Structured Activity: Bond valuation You are considering a 15-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid semiannually.

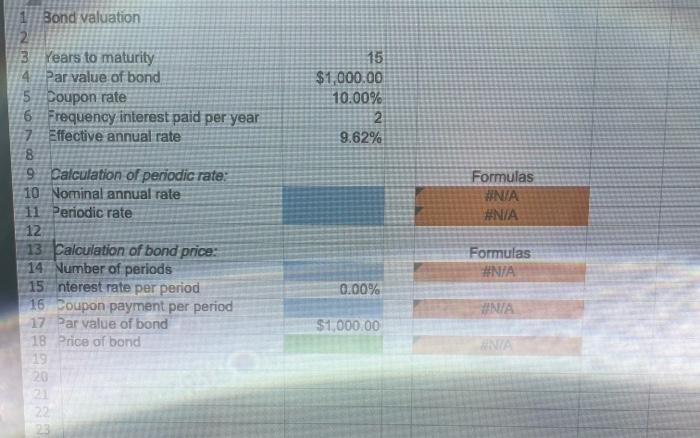

Excel Online Structured Activity: Bond valuation You are considering a 15-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid semiannually. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet If you require an "effective" annual interest rate (not a nominal rate) of 9.62%, how much should you be willing to pay for the bond? Do not round Intermediate steps. Round your answer to the nearest cent. Bond valuation 15 $1,000.00 10.00% 2 9.62% Years to maturity Par value of bond 5 Coupon rate 6 Frequency interest paid per year 7 Effective annual rate 8 9 Calculation of periodic rate: 10 Nominal annual rate 11 Periodic rate 12 13 Calculation of bond price: 14 Number of periods 15 nterest rate per period 16 Coupon payment per period 17 Par value of bond 18 Price of bond 19 20 Formulas #N/A #N/A Formulas #N/A 0.00% WNIA $1,000.00 NA

Step by Step Solution

There are 3 Steps involved in it

To calculate the price of the bond follow these steps Step 1 Determine the Periodic Rate Given Effec... View full answer

Get step-by-step solutions from verified subject matter experts