Question: Excel Online Structured Activity: Evaluating risk and return Stock x has a 9.5% expected return, a beta coefficient of 0.8, and a 30 standard deviation

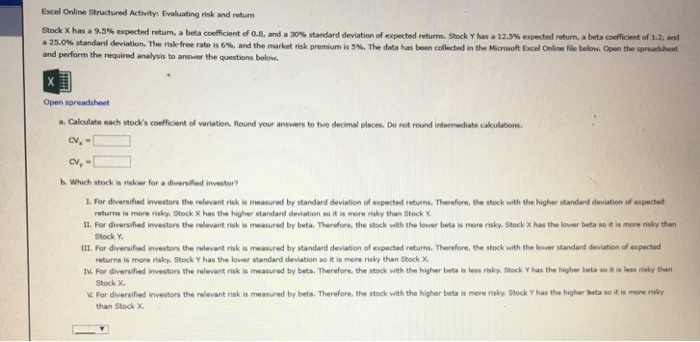

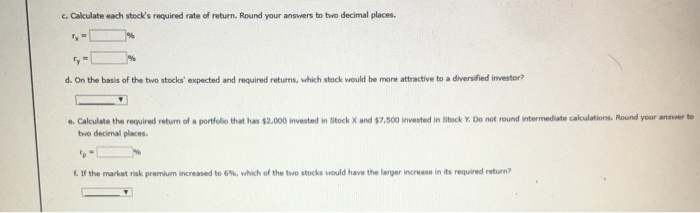

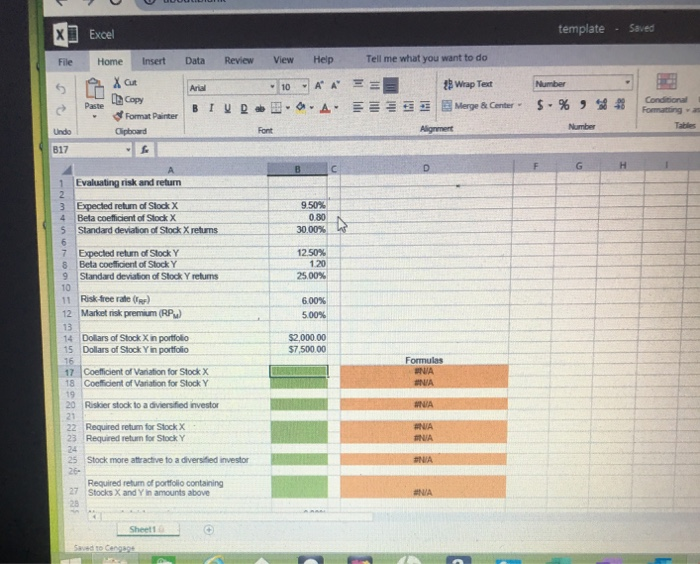

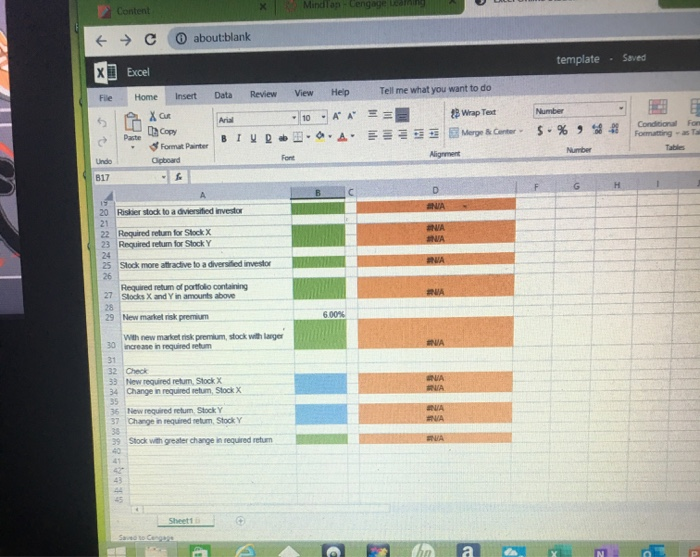

Excel Online Structured Activity: Evaluating risk and return Stock x has a 9.5% expected return, a beta coefficient of 0.8, and a 30 standard deviation of expected returns Shock Y has a 12.5% expected return, abeta c icient of 1.2, and a 25.0% standard deviation. The risk-free rate is and the market risk premium is 5. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below X Open spreadsheet Calculate each stock's coeficient of variation. Round your answers to the decimal places. Do not round intermediate calcio CV- CV, Which stocks for a divendintor 1. For diversified investors the relevant risk measured by standard deviation of expected returns. Therefore the stock with the higher standard deviation of expected pourrais merry Stock X has the higher standard deviation is more than stock 11. For diversified investors the relevant risk is measured by bota. Therefore the stock with the lower but is more risky Stock X has the lower beta so is more risky than Stock Y. III. For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more risky Stock Y has the lower standard deviation it is more risky than Stock X For diversified investors the relevant risk measured by beta. Therefore the stock with the higher t r iky Stock has the higher than Stock X. For diversified into the relevant risk measured by beta. Therefore the stock with the higher bete is more risky Stock has the higher but it is more risky than Stock X c. Calculate each stock's required rate of return. Round your answers to be decimal places. - d. On the basis of the two stock expected and required returns, which stock would be more attractive to a diversified investor? e. Calculate the required return of a portfolio that has $2.000 invested in Stock X and $2,500 invested in Stock y Do not round intermediate calculations. Round your answer to two decimal places. c. If the market risk premium increased to 6%, which of the two stocks would have the larger increase in its required return? template - Saved x] Excel Home Insert A Xu File Data Review View Help Tell me what you want to do Numbe LU Copy Copy Aria 10 AA BIURO A Wrap Test Merge & Center Paste s S. % * Format Painter Clipboard - Number 817 1 Evaluating risk and return 3 Expected return of Stock X Beta coefficient of Stock X Standard deviation of Stock X retums 950 0.00 30 0 5 1250 7 8 9 Expected retum of Stock Y Beta coefficient of Stock Y Standard deviation of Stock y retums 120 25 OON 11 Risk free rate ) 12 Marisk premium RP 6.00% 5.00% 14 15 Dollars of Stock X in portfolio Dollars of Stock Yin portfolio $2,000.00 $7.500.00 17 Coefficient of Variation for Stock X 18 Coefficient of Variation for Stock Y Formulas ENJA INA 20Rosar stock to a dvered investor 22 Required retum for Stock X 23 Required return for Stock Y RA NA Stock more attractive to a diversified investor Required reum of portfolio containing Stocks X and Yin amounts above Content X M indian tenga + C about:blank x Excel template - Saved File Home Insert Data Review View Help Tell me what you want to do X GR 23 Wrap Test - 10 -A BIURO Merge Gants Format Painter ona Formatting Fc as 20 Risker stock to a diversified investor Required reum for Stock X Required return for StockY DANN NA Stock more attractive to a diversified investor Required eum of portfolio Containing Stocks X and Yiamounts above 29 New market is premium 30 with new market premium stock with larger increase in required retum 32 33 Creok New required retum Stock X Change in requiredum Stock X 35 37 w required retum Stock Y Change in required retum Stock Y Stock with greater change in required retum AAA a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts