Question: Excel Online Structured Activity: Evalubting risk and return Stock X has a 9.5% expected return, a beta coefficlent of 0.8 , and a 3056 standard

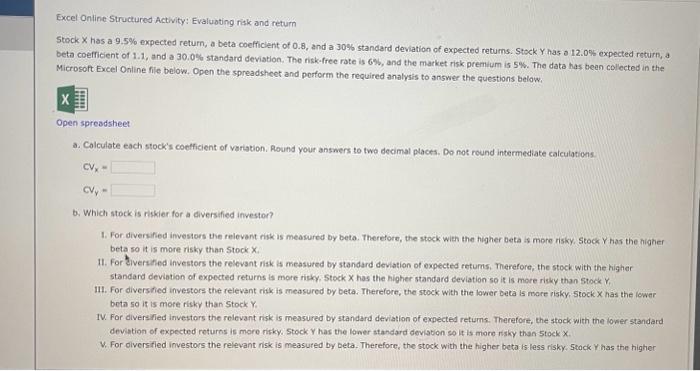

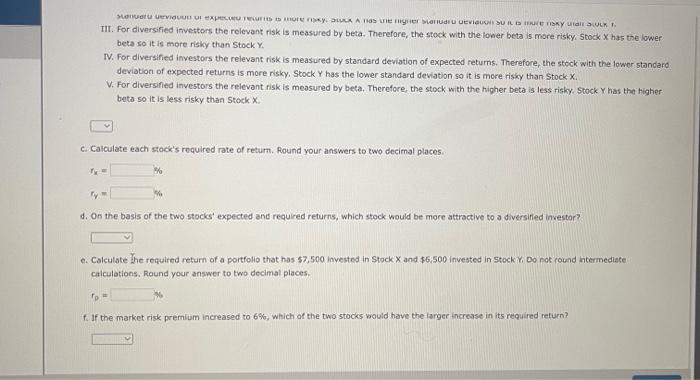

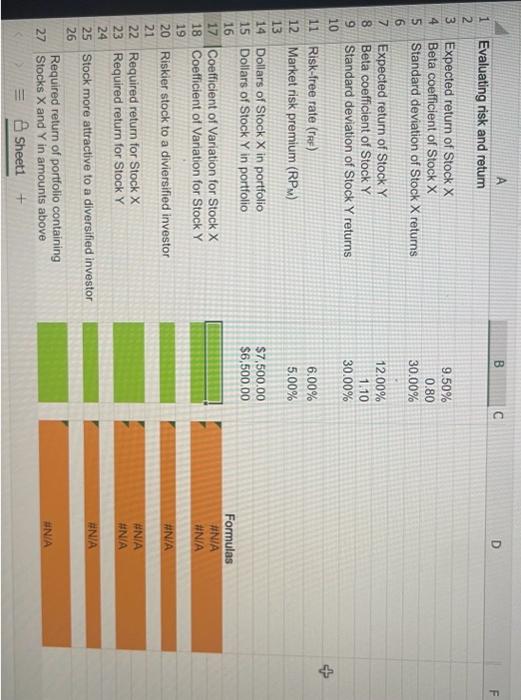

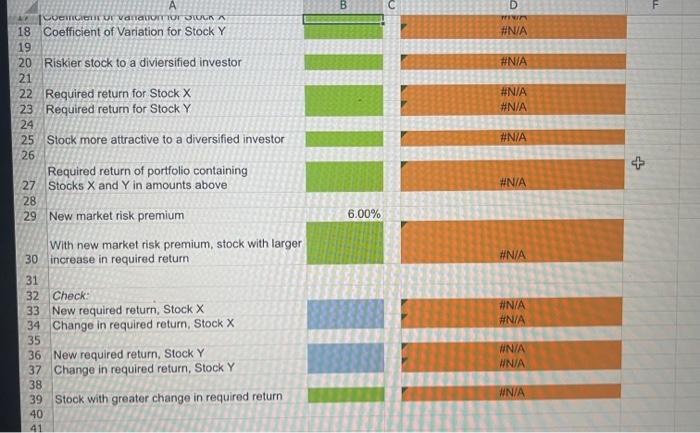

Excel Online Structured Activity: Evalubting risk and return Stock X has a 9.5% expected return, a beta coefficlent of 0.8 , and a 3056 standard devlation of expected retums. Stock Y has o 12.0% expected return, a beta coefficient of 1.1, and a 30.0\% standard deviation. The risk-free rate is 6%, and the market risk premium is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadshcet and porform the required analysis to answer the questions belowi. Open spresdsheet a. Colculate each stock's coefficient of variation. Round your answers to two decimal places. Do not round intermediate calculations. CV=CVy= b. Which stock is riskier for a diversified investor? 1. For diversified imvesters the relevant rikk is measured by beto. Therefore, the stock with the higher beta is more risky, Stock Y has the higher beta so it is more risky than Stock X. 11. For Biversified investors the relovant risk is measured by standard deviation of expected retums, Therefore, the stock with the higher standard deviation of expected returns is more risky, Stock X has the higher standard deviation so it is more risky than 5tock. 111. For diversfied investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more isky, Stock X has the lewer beta so it is more risky than stock Y. IV. For diversified investers the relevant risk is measured by standard deviation of expected retums. Therefore, the stock with the ioner standard deviation of expected retures is more rikky. Stock Y has the lower standard deviation so it is more risky than 5 tock X. . For olversifled investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky. 5 tack Y has the higher III. For diversified investors the relevant risk is measured by beta. Therefore, the stock with the lower beta is more risky, Stock x has the lower. beta so it is more risky than Stock Y. IV. For diversified investors the relevant risk is measured by standard deviation of expected returns. Therefore, the stock with the lower standard deviation of expected returns is more risky. Stock Y has the lower standard deviation so it is more risky than Stock X. V. For diversined investors the relevant risk is measured by beta. Therefore, the stock with the higher beta is less risky. Stock Y has the higher beta so it is less risky than Stock X. C. Calculate each stock's required rate of return. Round your answers to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts