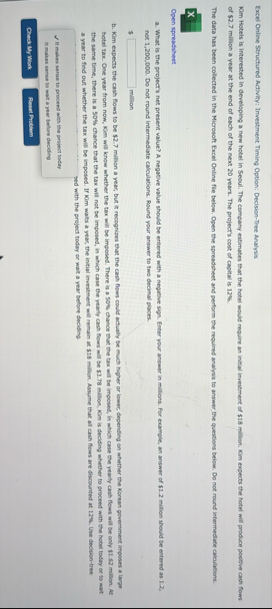

Question: Excel Online Structured Activity; Investment Timing Option; Decision - Tree Analyis Kim Hotets is interested in developing a new hobel in Seoul. The compacy eatimabes

Excel Online Structured Activity; Investment Timing Option; DecisionTree Analyis

Kim Hotets is interested in developing a new hobel in Seoul. The compacy eatimabes that the hotel mould require an intal investment of $ million. Kim expects the hotel mill produce postive cauh fows of $ milion a year at the end of each of the next years. The project's cost of capital is

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and pertorm the required analvis to answer, the questions below, Do not round intermedate catalabons.

Open spreadibeet

a What is the project's net present value? A negative value should be entered with a negubive sigh. Froer your ansmer in milions. For example, an answer of $ million inould be entered as not Do not round intermediate calculations. Round your anower to tmo decimal places.

$ million the same time, there is a chance that the tax will not be imposed, in which case the yebly cash fows wall be s mallion. Kim is deciding whether to proceed with the hotel today or to mat a year to find out whether the tax will be imposed. If Kim watis a yeac, the initigl inventeest mill remain at sis million. Aovume that al canh flows are discounted at th Use decisiontree ped with the project today or wat a year before deoding.

ll makes sernes to proceed whe the proiect todey

an maken serse to mat a year teflone deciding Irvestment Tiring Option: DecisionTree Analysis

No Timing Option:

Inital investment at in milions

Annual expected cash flow in millions

Number of years cash flow expecled

Project cost of capital

Tining Option:

Initial investment at in millions

Number of years cash flow expected

Probability that tax will be imposed

Anhual CF in milions if tax imposed, Years to

Probability that tax will not be imposed

Annual CF in mitions if tax not imposed. Years is

Propect cost of capital

No Timing Opbion:

Formulas

#NA

Triming Option:

NPV in mitions at tax imposed

NPV if tax imposed, reduced to rero if NPV negative

NPV in mitions at if tax not imposed

Expected NPV of project in milions at with timing option

Should firm proceed now or wat to do the propect?

tableaNAINAINAANA

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock