Question: Excel Online Structured Activity: NPV profiles A company is considering two mutually exclusive expansion plans, Plan A requires a $39 million expenditure on a large-scale

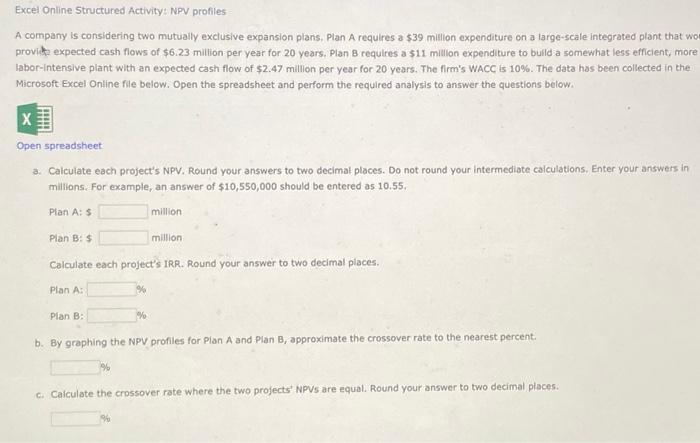

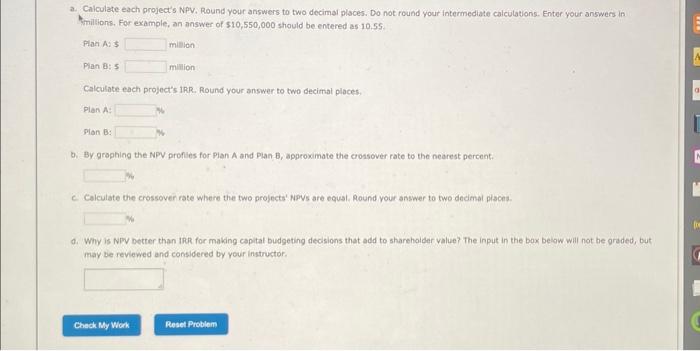

Excel Online Structured Activity: NPV profiles A company is considering two mutually exclusive expansion plans, Plan A requires a $39 million expenditure on a large-scale integrated plant that wo provid expected cash flows of $6.23 million per year for 20 years. Plan B requires a $11 million expenditure to bulld a somewhat less efficient, more labor-intensive plant with an expected cash flow of $2.47 million per year for 20 years. The firm's WACC is 10%. The data has been collected in the Microsoft Excel Online fle below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. Catculate each project's NPV. Round your answers to two decimal places. Do not round your intermediate calculations, Enter your answers in milions. For example, an answer of $10,550,000 should be entered as 10.55 . PlanA:5PlanB:5millionmillion Calculate each profect's IRR. Round your answer to two decimal places. Ptan A: Ptan B: % b. By graphing the NPV profles for Plan A and Plan B, approximate the crossover rate to the nearest percent: \% c. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. % a. Calculate each project's NPV. Round your answers to two decimal places. Do not round your intermediate calculations. Enter your answers in thilione. For example, an answer of $10,550,000 should be entered as 10.55 . Fian A: 5 milion Pian bis milition Calculate each project's IRR. Round your answer to two decimal ploces: Pien A: Plan bi D. By grophing the NPV proflies for Plan A and Plan B, approximate the crossover rate to the neerest percent. C. Calculate the crossoven rate where the two projects' NPys are equal, Round your answer to fwo dedimal pisces. d. Why is NPV better than IRR for making capital budgeting decisions that add to shareholder value? The input in the box below will not be greded, but may be reviewed and considered by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts