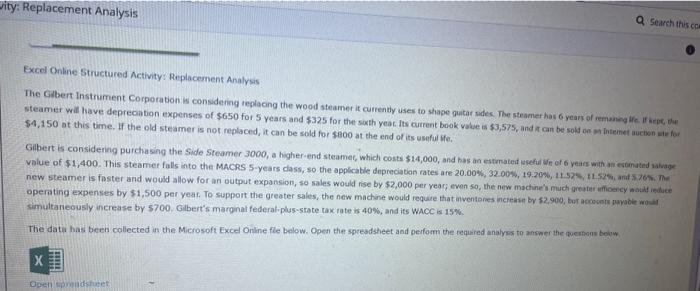

Question: Excel Online Structured Activity: Replacement Analysis $4,150 at this time. If the old steamer is not replaced, it can be sold for $800 at the

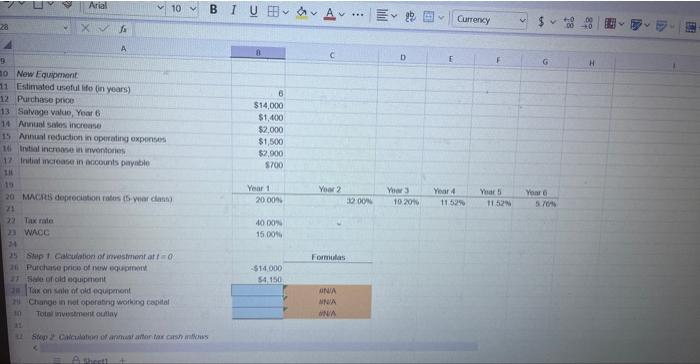

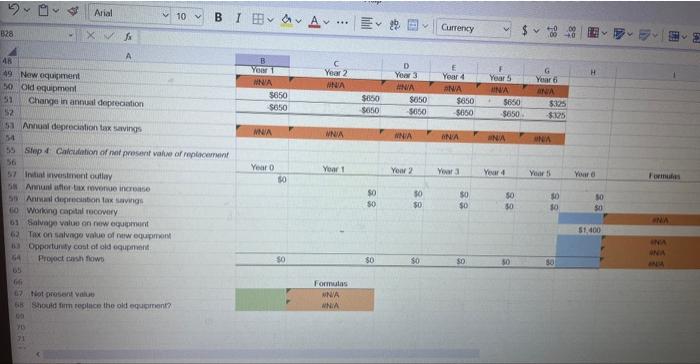

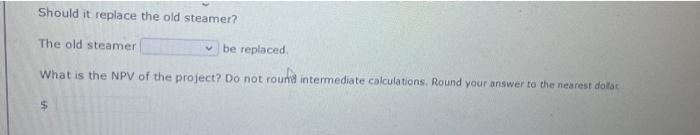

Excel Online Structured Activity: Replacement Analysis $4,150 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful ife. Gibert is considering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $14,000, and his an estrmated asefur Wre of 6 vears with an esanated aikage simultaneously increase by $700, Gibert's marginal federal. plus-state tax rate is 40%, and its Whoc is 15%. New equighrent Oid equipment Chanpe in anmut dopreciation Annual deprocistion tex savings Step 4. Calcudation of nat present valie of roplocement Instat investiment sulloy Amual atlor tex rovenue incroase Minat depresinton tax saving Wohing capital recowery Salvapio value en new equemeint Tox on salvage value of netwr equipmons Oppontunty cost at old equpment Progect cash hows thot prosent yalue Should firm replice the old equarnenr? \begin{tabular}{|c|c|c|} \hline Year 0 & Year 1 & \\ \hline \multirow[t]{5}{*}{80} & & \\ \hline & & $0 \\ \hline & & so \\ \hline & & \\ \hline & & \\ \hline \multirow[t]{4}{*}{80} & & $0 \\ \hline & Formulas & \\ \hline & MNA & \\ \hline & WNiA & \\ \hline \end{tabular} Should it replace the old steamer? The old steamer be replaced. What is the NPV of the project? Do not rountintermediate calculations. Round your answer to the nearest dolst $ Excel Online Structured Activity: Replacement Analysis $4,150 at this time. If the old steamer is not replaced, it can be sold for $800 at the end of its useful ife. Gibert is considering purchasing the Side Steamer 3000 , a higher-end steamer, which costs $14,000, and his an estrmated asefur Wre of 6 vears with an esanated aikage simultaneously increase by $700, Gibert's marginal federal. plus-state tax rate is 40%, and its Whoc is 15%. New equighrent Oid equipment Chanpe in anmut dopreciation Annual deprocistion tex savings Step 4. Calcudation of nat present valie of roplocement Instat investiment sulloy Amual atlor tex rovenue incroase Minat depresinton tax saving Wohing capital recowery Salvapio value en new equemeint Tox on salvage value of netwr equipmons Oppontunty cost at old equpment Progect cash hows thot prosent yalue Should firm replice the old equarnenr? \begin{tabular}{|c|c|c|} \hline Year 0 & Year 1 & \\ \hline \multirow[t]{5}{*}{80} & & \\ \hline & & $0 \\ \hline & & so \\ \hline & & \\ \hline & & \\ \hline \multirow[t]{4}{*}{80} & & $0 \\ \hline & Formulas & \\ \hline & MNA & \\ \hline & WNiA & \\ \hline \end{tabular} Should it replace the old steamer? The old steamer be replaced. What is the NPV of the project? Do not rountintermediate calculations. Round your answer to the nearest dolst $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts