Question: *EXCEL PLEASE* . Med iTransport is working to optimize their wheelchair product line. The expected demand is 13000 units with a standard deviation of 800

*EXCEL PLEASE*

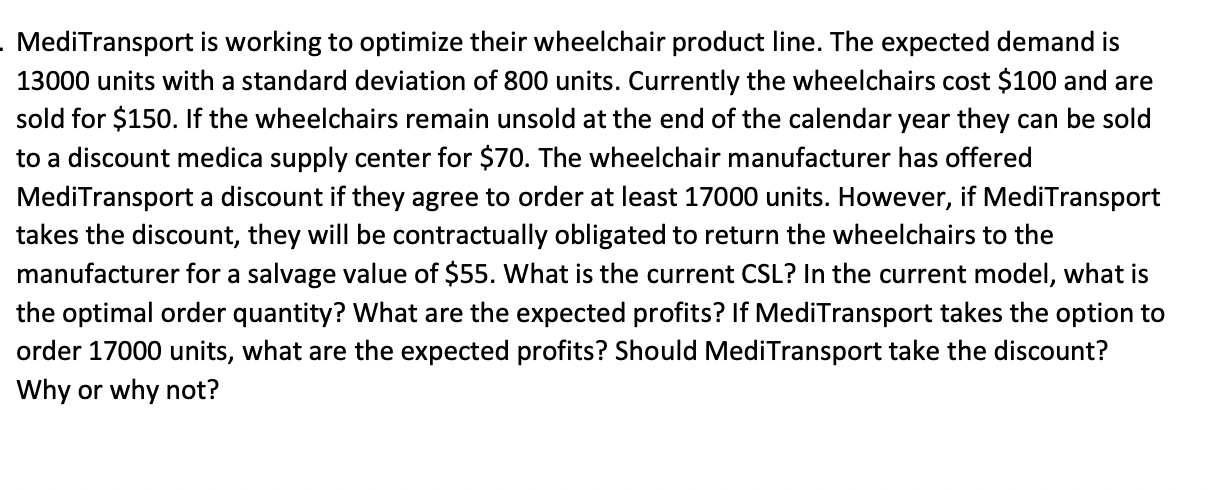

. Med iTransport is working to optimize their wheelchair product line. The expected demand is 13000 units with a standard deviation of 800 units. Currently the wheelchairs cost $100 and are sold for $150. If the wheelchairs remain unsold at the end of the calendar year they can be sold to a discount medica supply center for $70. The wheelchair manufacturer has offered Med iTransport a discount if they agree to order at least 17000 units. However, if MediTra nsport takes the discount, they will be contractually obligated to return the wheelchairs to the manufacturer for a salvage value of 555. What is the current CSL? In the current model, what is the optimal order quantity? What are the expected profits? If MediTranSport takes the Option to order 17000 units, what are the expected profits? Should MediTransport take the discount? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts