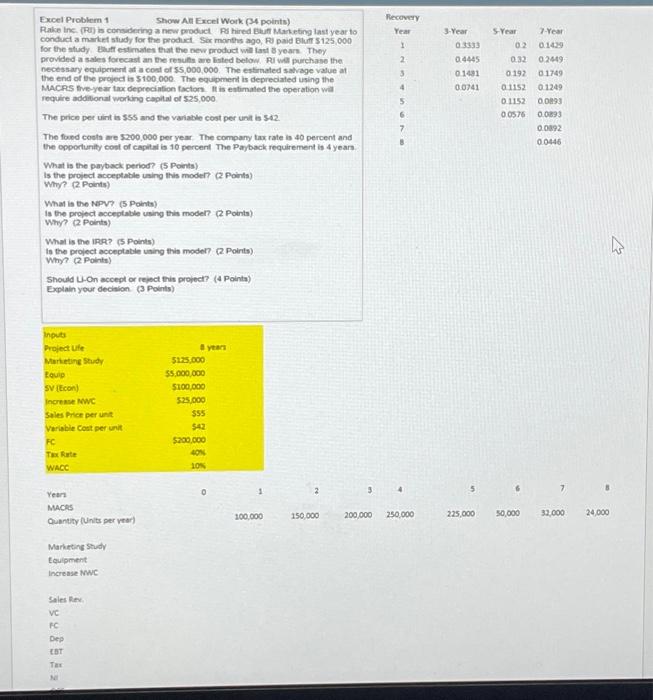

Question: Excel Problem 1 Show AE Excel Work (34 points) condict a market study for the produet. Sier months ago, PU paid Blutr $125,000 for the

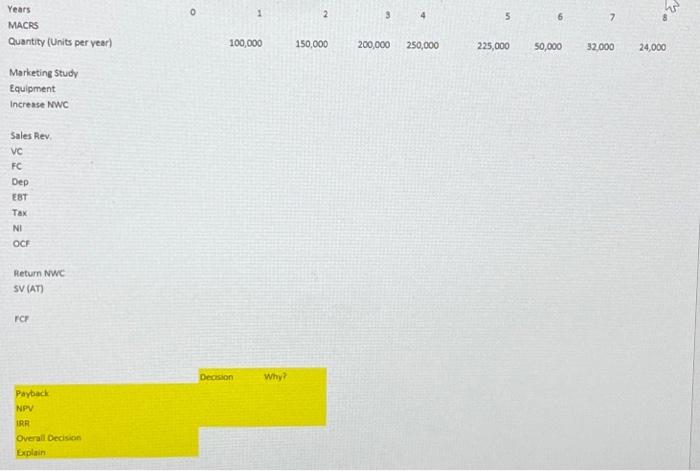

Excel Problem 1 Show AE Excel Work (34 points) condict a market study for the produet. Sier months ago, PU paid Blutr $125,000 for the study. Buff estirnales that the nevr groduct will last 8 years. They provided a sales forecast an tere resule are bsted below. Pd val purchase the. necessary equipenert at a coel of 55,000,000. The estimated satvage value at the end of the projoct is $100,000. The equipment is depreciated using the MACRS trve-year tax deprecintion facton. It is entimated the operation wa require additional working capital of $25,000 The price per uirt is $55 and the variable cest per unt is 542. The foued coets me $200,000 per year. The company tax rate is 40 percent and the opporturity cost of capitsi is 10 percent The Payback requirement is 4 years What is the payback period? (5 Poents) Is the proiect acceptable using this moder? (2 points)? Whr? (2. Points) What is the NPV? (5 Points) is the project acceptatble using this model? (2 Points) Why? (2 Points) What is the IPR? (s Points) is the project acceptatele uning this model? (2. Poirts). Why? (2. Points) Should U-On accept or reject fhis project? (4 Pointa) Explain your decinion. (3 Points) Years MACRS 0 1 5 6 7 8 225,000 50,000 32.000 24,000 Marketine Study Equipment Increase NWC Sales Rev. ve FC Dep 8T. Tax NI OCF Return NWE SV (AT) fCr Decsion Why? Poyback NirV: IRP Overall Decision Explain Excel Problem 1 Show AE Excel Work (34 points) condict a market study for the produet. Sier months ago, PU paid Blutr $125,000 for the study. Buff estirnales that the nevr groduct will last 8 years. They provided a sales forecast an tere resule are bsted below. Pd val purchase the. necessary equipenert at a coel of 55,000,000. The estimated satvage value at the end of the projoct is $100,000. The equipment is depreciated using the MACRS trve-year tax deprecintion facton. It is entimated the operation wa require additional working capital of $25,000 The price per uirt is $55 and the variable cest per unt is 542. The foued coets me $200,000 per year. The company tax rate is 40 percent and the opporturity cost of capitsi is 10 percent The Payback requirement is 4 years What is the payback period? (5 Poents) Is the proiect acceptable using this moder? (2 points)? Whr? (2. Points) What is the NPV? (5 Points) is the project acceptatble using this model? (2 Points) Why? (2 Points) What is the IPR? (s Points) is the project acceptatele uning this model? (2. Poirts). Why? (2. Points) Should U-On accept or reject fhis project? (4 Pointa) Explain your decinion. (3 Points) Years MACRS 0 1 5 6 7 8 225,000 50,000 32.000 24,000 Marketine Study Equipment Increase NWC Sales Rev. ve FC Dep 8T. Tax NI OCF Return NWE SV (AT) fCr Decsion Why? Poyback NirV: IRP Overall Decision Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts