Question: Excel Project #2 - Depreciation Practice Exerecise Peyton's Machine Shop purchased new equipment for a total amount of $315,000. The equipment is expected to last

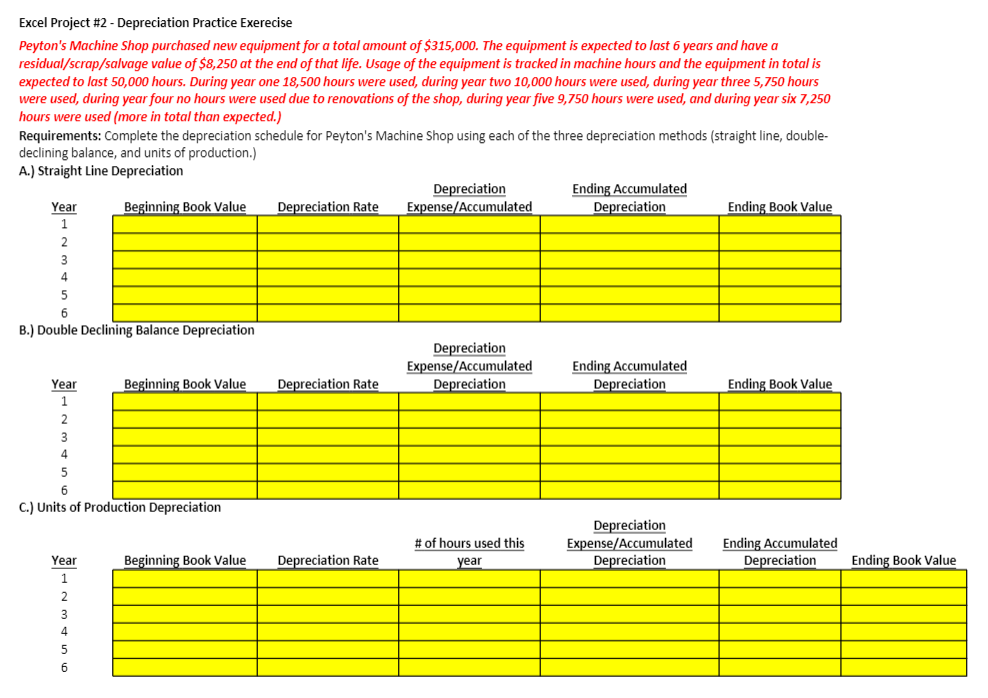

Excel Project #2 - Depreciation Practice Exerecise Peyton's Machine Shop purchased new equipment for a total amount of $315,000. The equipment is expected to last 6 years and have a residual/scrap/salvage value of $8,250 at the end of that life. Usage of the equipment is tracked in machine hours and the equipment in total is expected to last 50,000 hours. During year one 18,500 hours were used, during year two 10,000 hours were used during year three 5,750 hours were used, during year four no hours were used due to renovations of the shop, during year five 9,750 hours were used, and during year six 7,250 hours were used (more in total than expected.) Requirements: Complete the depreciation schedule for Peyton's Machine Shop using each of the three depreciation methods (straight line, double- declining balance, and units of production.) A.) Straight Line Depreciation Depreciation Ending Accumulated Year Beginning Book Value Depreciation Rate Expense/Accumulated Depreciation Ending Book Value 1 2 3 4 5 6 B.) Double Declining Balance Depreciation Depreciation Expense/Accumulated Ending Accumulated Year Beginning Book Value Depreciation Rate Depreciation Depreciation Ending Book Value 2 3 4 5 6 C.) Units of Production Depreciation # of hours used this year Depreciation Expense/Accumulated Depreciation Beginning Book Value Depreciation Rate Ending Accumulated Depreciation Ending Book Value Year 1 2. 3 4 5 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts