Question: excel question Problem 2: Risk-Adjusted Discount Rates (10 points) HPC is considering two mutually exclusive capital budgeting projects. HPC uses a CAPM-type risk-adjusted discount rate.

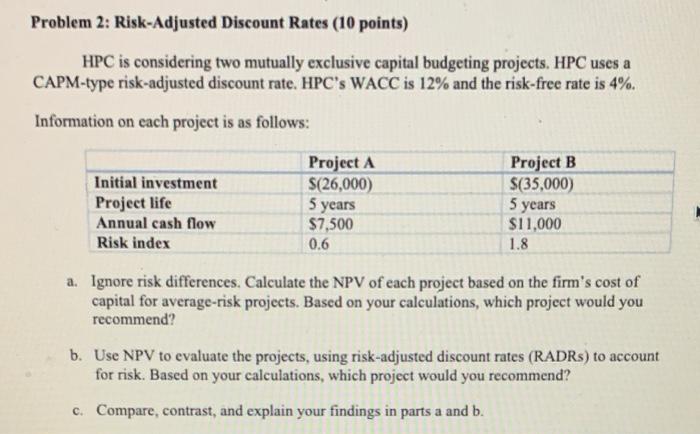

Problem 2: Risk-Adjusted Discount Rates (10 points) HPC is considering two mutually exclusive capital budgeting projects. HPC uses a CAPM-type risk-adjusted discount rate. HPC's WACC is 12% and the risk-free rate is 4%. Information on each project is as follows: Project A $(26,000) Initial investment Project life Annual cash flow Risk index 5 years Project B $(35,000) 5 years $11,000 1.8 $7,500 0.6 a. Ignore risk differences. Calculate the NPV of each project based on the firm's cost of capital for average-risk projects. Based on your calculations, which project would you recommend? b. Use NPV to evaluate the projects, using risk-adjusted discount rates (RADRs) to account for risk. Based on your calculations, which project would you recommend? C. Compare, contrast, and explain your findings in parts a and b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts