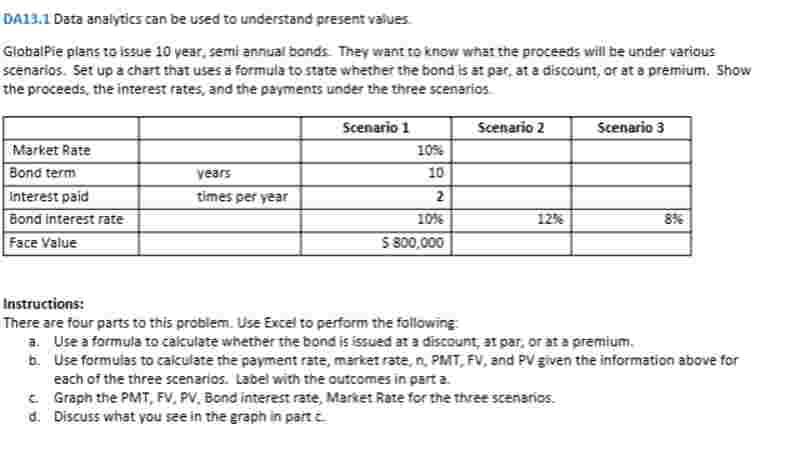

Question: Excel Spreadsheet Problem: GlobalPie plans to issue 1 0 year, semi annual bonds. They want to know what the proceeds will be under various scenarios.

Excel Spreadsheet Problem:

GlobalPie plans to issue year, semi annual bonds. They want to know what the proceeds will be under various scenarios. Set up a chart that uses a formula to state

whether the bond is at par, at a discount, or at a premium. Show the proceeds, the interest rates, and the payments under the three scenarios.

Instructions:

There are four parts to this problem. Use Excel to perform the following:

a Use a formula to calculate whether the bond is issued at a discount, at par, or at a premium.

b Use formulas to calculate the payment rate, market rate, n PMT FV and PV given the information above for each of the three scenarios. Label with the outcomes in

part a

c Graph the PMT FV PV Bond interest rate, Market Rate for the three scenarios.

d Discuss what you see in the graph in part c

I need help with formulas for both part a & b and explain how to graph the PMT FV PV Bond Interest Rate, Market rate for three scenarios!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock