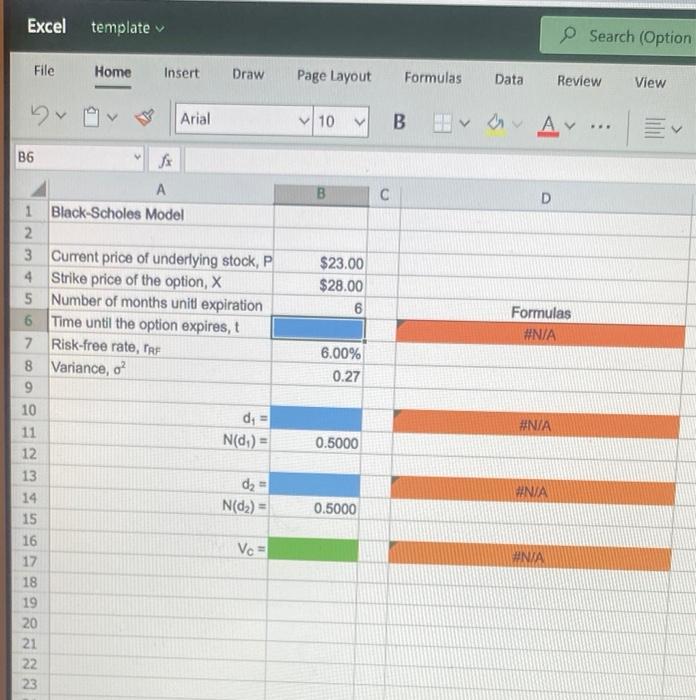

Question: Excel template Search (Option File Home Insert Draw Page Layout Formulas Data Review View by Arial 10 B 1 O. AY B6 B D $23.00

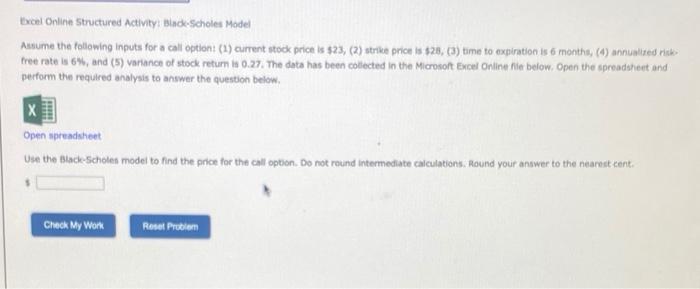

Excel template Search (Option File Home Insert Draw Page Layout Formulas Data Review View by Arial 10 B 1 O. AY B6 B D $23.00 $28.00 6 Formulas #N/A 6.00% 0.27 de = #N/A 1 Black-Scholes Model 2 3 Current price of underlying stock, P 4 Strike price of the option, X 5 Number of months unit expiration 6 Time until the option expires, t 7 Risk-free rate, TRF 8 Variance, o 9 10 11 N(d) = 12 13 d2 14 N(dz) = 15 16 Vc = 17 18 19 20 21 22 23 0.5000 #N/A 0.5000 #NIA Excel Online Structured Activity: Black-Scholes Model Asume the following inputs for a call option (1) current stock price is $23, (2) strike price is $28, (3) time to expiration is 6 months, (4) annualised Hicks free rate is 6%, and (5) vartance of stock return is 0.27. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below Open spreadsheet Use the Badeschole model to find the price for the call option. Do not round Intermediate calculations. Round your answer to the nearest tent. Check My Work Reset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts