Question: Excel with formulas would be great! will give positive rating!! 2. You have been asked to estimate the value of synergy in the merger of

Excel with formulas would be great! will give positive rating!!

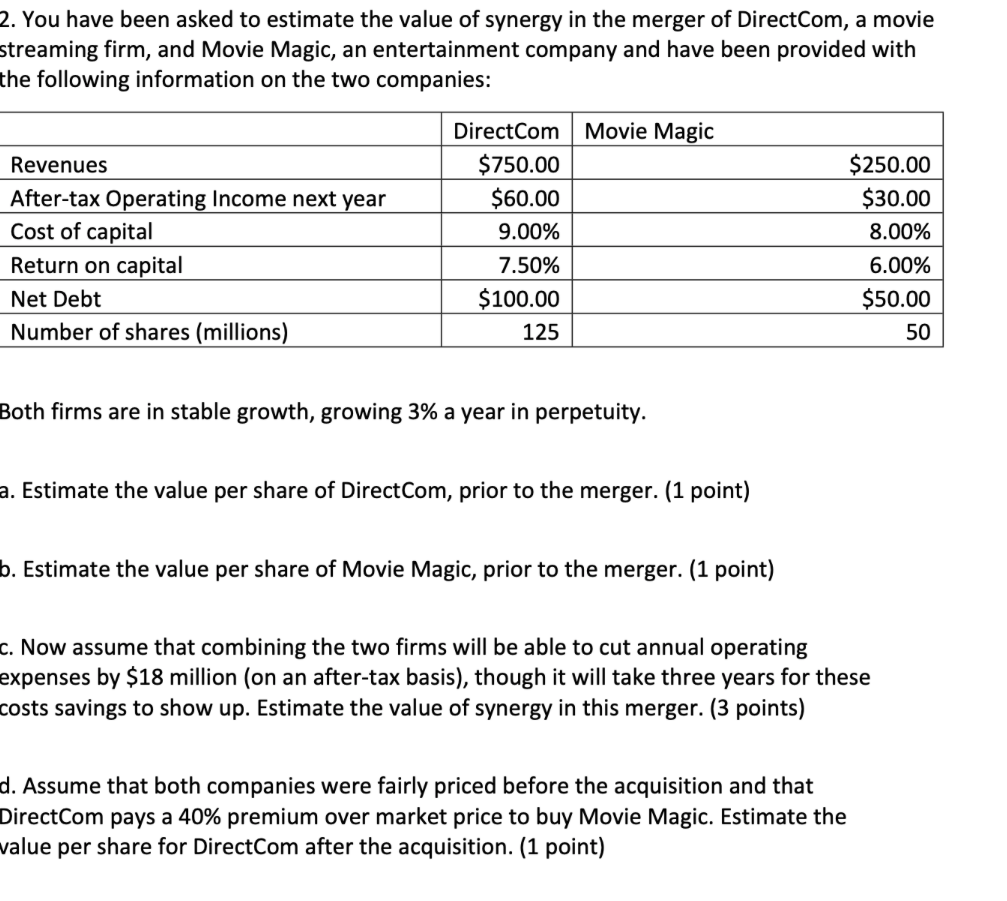

2. You have been asked to estimate the value of synergy in the merger of DirectCom, a movie streaming firm, and Movie Magic, an entertainment company and have been provided with the following information on the two companies: Movie Magic Revenues After-tax Operating Income next year Cost of capital Return on capital Net Debt Number of shares (millions) DirectCom $750.00 $60.00 9.00% 7.50% $100.00 125 $250.00 $30.00 8.00% 6.00% $50.00 50 Both firms are in stable growth, growing 3% a year in perpetuity. a. Estimate the value per share of DirectCom, prior to the merger. (1 point) b. Estimate the value per share of Movie Magic, prior to the merger. (1 point) c. Now assume that combining the two firms will be able to cut annual operating expenses by $18 million (on an after-tax basis), though it will take three years for these costs savings to show up. Estimate the value of synergy in this merger. (3 points) d. Assume that both companies were fairly priced before the acquisition and that DirectCom pays a 40% premium over market price to buy Movie Magic. Estimate the value per share for DirectCom after the acquisition. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts