Question: Excel work: A 15-year Treasury Bond with a face value of $1,000.00, paying 3% coupon rate, has a yield of 2.35%. The coupons are semiannual.

Excel work: A 15-year Treasury Bond with a face value of $1,000.00, paying 3% coupon rate, has a yield of 2.35%. The coupons are semiannual. What is the bond price/value? Use the Excel sheet below the chapter PPTs and develop a Bond Price Timeline for 15 years (with semiannual coupons, the timeline should show 30 columns). Upload the Excel sheet.

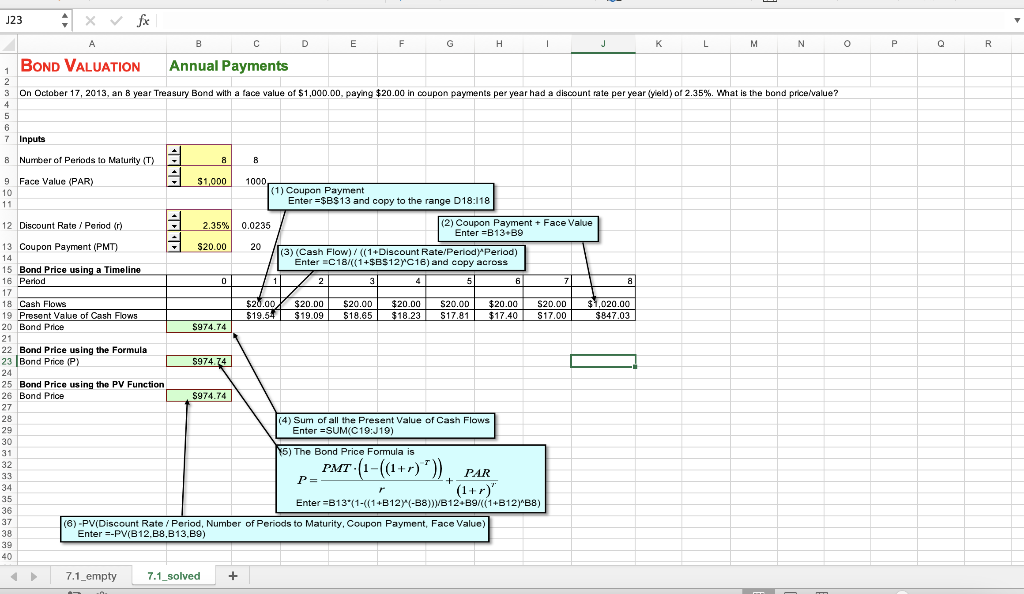

they had us using this as an example for how to do it... I'm getting tripped up because the example shown doesn't show coupon payments as percentages and is annual instead of semi-annual.

Bond Valuation Annual Payments Inputs 8 Number of Periods to Maturity (T) 9 Face Value PAR) (1) Coupon Payment Enter =$BS13 and copy to the range D18:I18 2 Discount Rate / Period (r) 3 Coupon Payment (PMT) \begin{tabular}{r|c} 2.35% & 0.0235 \\ \hline$20.00 & 20 \\ \hline \end{tabular} (2) Coupon Payment + Face Value Enter =B13+B9 (3) (Cash Flow) /((1+DiscountRate/Period) Period) 5 Bond Price using a Timeline 8 Cash Flows 1920P Present Val Bond Price \begin{tabular}{l|l} 21 & Bon \\ 23 & Bon \\ 24 & \end{tabular} 25 Bon Bond Price (4) Sum of all the Present Value of Cash Flows Enter = SUM(C 19:19) 55) The Bond Price Formula is (6) - PV(Discount Rate / Period, Number of Periods to Maturity, Coupon Payment, Face Value) Enter =PV(B12,B8,B13,B9) Bond Valuation Annual Payments Inputs 8 Number of Periods to Maturity (T) 9 Face Value PAR) (1) Coupon Payment Enter =$BS13 and copy to the range D18:I18 2 Discount Rate / Period (r) 3 Coupon Payment (PMT) \begin{tabular}{r|c} 2.35% & 0.0235 \\ \hline$20.00 & 20 \\ \hline \end{tabular} (2) Coupon Payment + Face Value Enter =B13+B9 (3) (Cash Flow) /((1+DiscountRate/Period) Period) 5 Bond Price using a Timeline 8 Cash Flows 1920P Present Val Bond Price \begin{tabular}{l|l} 21 & Bon \\ 23 & Bon \\ 24 & \end{tabular} 25 Bon Bond Price (4) Sum of all the Present Value of Cash Flows Enter = SUM(C 19:19) 55) The Bond Price Formula is (6) - PV(Discount Rate / Period, Number of Periods to Maturity, Coupon Payment, Face Value) Enter =PV(B12,B8,B13,B9)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts