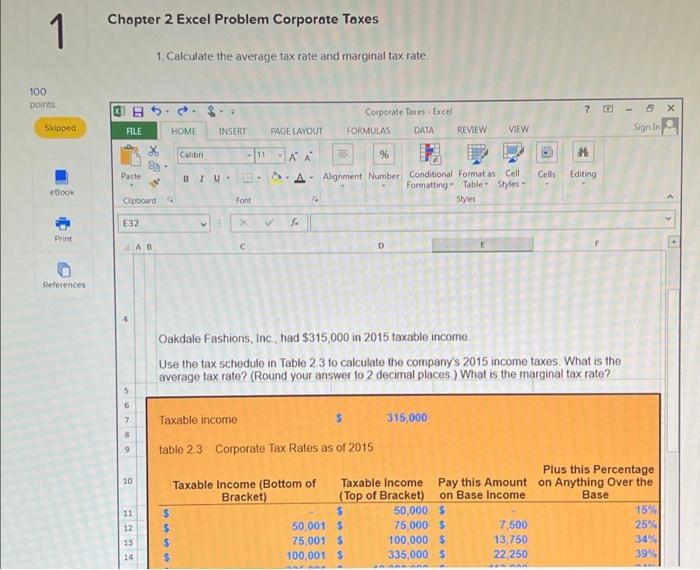

Question: excel worksheet principles of finance chapter 2. please help solve and explain steps! 1 100 points Skipped eBook Print References Chapter 2 Excel Problem Corporate

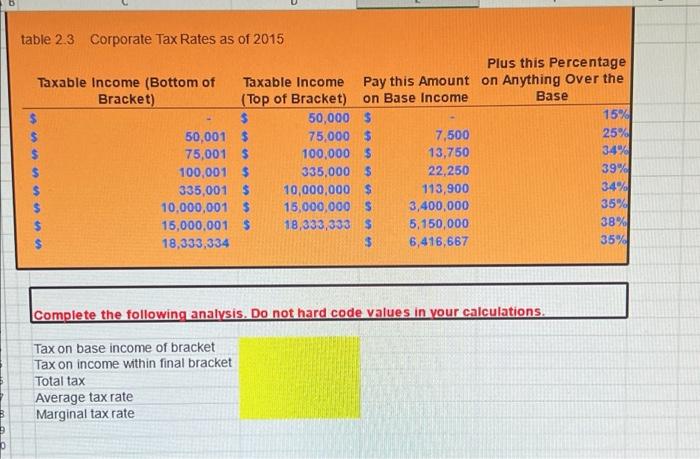

1 100 points Skipped eBook Print References Chapter 2 Excel Problem Corporate Taxes FILE ES calle Paste Clipboard E32 1676 10 11 12 19 14 1. Calculate the average tax rate and marginal tax rate. * BO W A.B HOME Calibri INSERT $ BIU- Font Taxable income PAGE LAYOUT E X fr C G Corporate Taxes-Excel % A Alignment Number Conditional Format as Cell Formatting Table Styles- Styles $ table 2.3 Corporate Tax Rates as of 2015 FORMULAS Taxable Income (Bottom of Bracket) 50,001 $ 75,001 $ 100,001 $ 395 An DATA REVIEW D Oakdale Fashions, Inc, had $315,000 in 2015 taxable income. Use the tax schedule in Table 2.3 to calculate the company's 2015 income taxes. What is the average tax rate? (Round your answer to 2 decimal places.) What is the marginal tax rate? 315,000 Taxable Income (Top of Bracket) $ VIEW Pay this Amount on Base Income 50,000 $ 75,000 $ 100,000 $ 335,000 $ Cells 7,500 13,750 22,250 ? M Editing A B Sign In Plus this Percentage on Anything Over the Base 15% 25% 34% 39% X. D B 9 table 2.3 Corporate Tax Rates as of 2015 Taxable Income (Bottom of Bracket) $ $ $ $ Taxable Income (Top of Bracket) Average tax rate Marginal tax rate $ 50,001 $ 75,001 $ 100,001 $ 335,001 $ 10,000,001 $ 15,000,001 $ 18,333,334 Pay this Amount on Base Income 50,000 $ 75,000 $ 100,000 $ 335,000 $ 10,000,000 $ 15,000,000 $ 18,333,333 $ $ 7,500 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667 Plus this Percentage on Anything Over the Base Complete the following analysis. Do not hard code values in your calculations. Tax on base income of bracket Tax on income within final bracket Total tax 15% 25% 34% 39% 34% 35% 38% 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts