Question: excel worksheet Problem #4 On Jan. 1, 2023 Philo Kvetch purchased 300 bonds @ $1,013.40 per bond. The new bond issue was priced such that

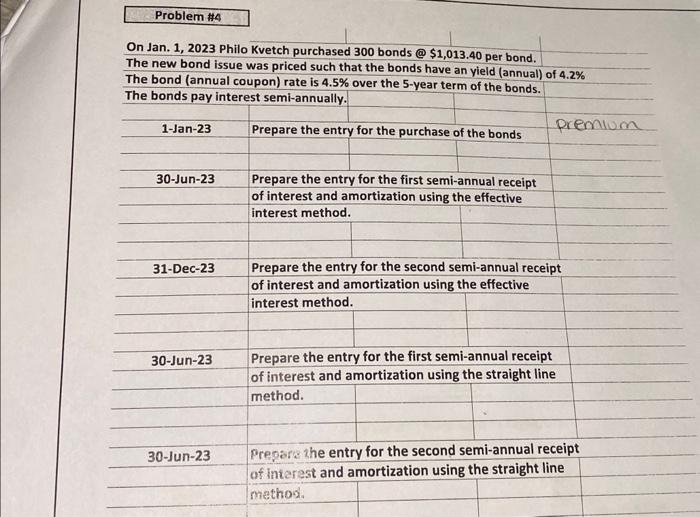

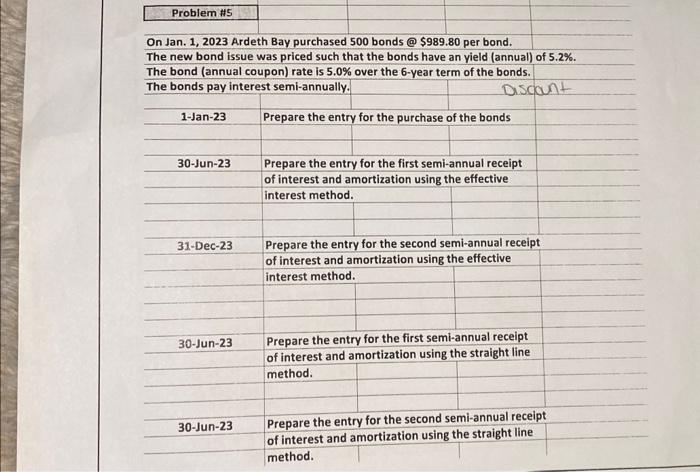

Problem \#4 On Jan. 1, 2023 Philo Kvetch purchased 300 bonds @ \$1,013.40 per bond. The new bond issue was priced such that the bonds have an yield (annual) of 4.2% The bond (annual coupon) rate is 4.5% over the 5 -year term of the bonds. The bonds pay interest semi-annually. 1-Jan-23 P Prepare the entry for the purchase of the bonds premium 30-Jun-23 Prepare the entry for the first semi-annual receipt of interest and amortization using the effective interest method. 31-Dec-23 Prepare the entry for the second semi-annual receipt of interest and amortization using the effective interest method. 30-Jun-23 Prepare the entry for the first semi-annual receipt of interest and amortization using the straight line method. 30-Jun-23 Prepsicthe entry for the second semi-annual receipt of interest and amortization using the straight line mathod. Problem H5 On Jan. 1, 2023 Ardeth Bay purchased 500 bonds @ $989.80 per bond. The new bond issue was priced such that the bonds have an yield (annual) of 5.2%. The bond (annual coupon) rate is 5.0\% over the 6 -year term of the bonds. The bonds pay interest semi-annually. Discount 1-Jan-23 Prepare the entry for the purchase of the bonds 30-Jun-23 Prepare the entry for the first semi-annual receipt of interest and amortization using the effective interest method. 31-Dec-23 Prepare the entry for the second semi-annual receipt of interest and amortization using the effective interest method. 30-Jun-23 Prepare the entry for the first semi-annual receipt of interest and amortization using the straight line method. 30-Jun-23 Prepare the entry for the second semi-annual receipt of interest and amortization using the straight line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts