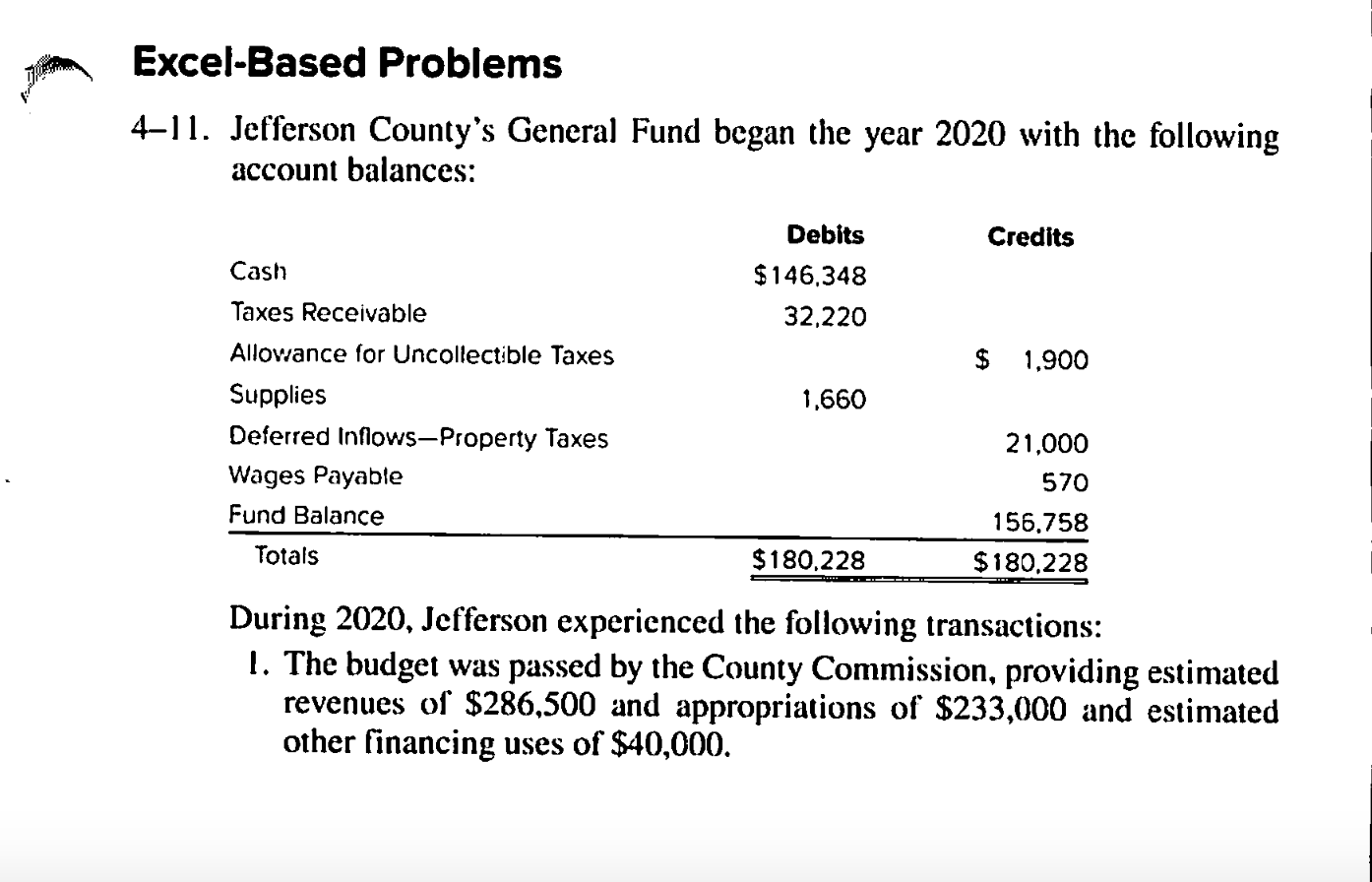

Question: Excel-Based Problems 4-l 1. Jefferson County's General Fund began the year 2020 with the following account balances: Debits Credits Cash $146,348 Taxes Receivable 32,220 Allowance

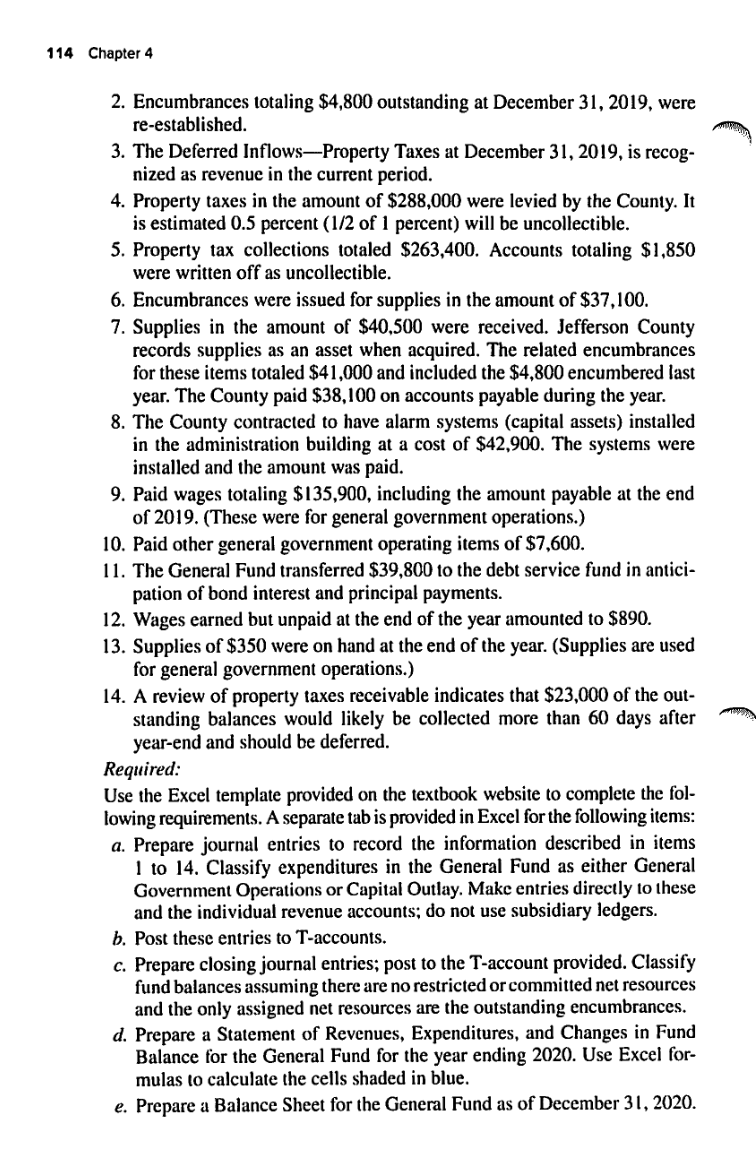

Excel-Based Problems 4-l 1. Jefferson County's General Fund began the year 2020 with the following account balances: Debits Credits Cash $146,348 Taxes Receivable 32,220 Allowance for Uncoectible Taxes 3 1.900 Supplies 1.660 Deferred InowsProperty Taxes 21,000 Wages Payable 570 Fund Balance 155.758 Totals $180,228 $180,228 During 2020. Jefferson experienced the following transactions: 1. The budget was passed by the County Commission. providing estimated revenues of $286,500 and appropriations of $233,000 and estimated other financing uses of $40,000. 114 Chapter 4 2. Encumhrances totaling $4.800 outstanding at December 31. 2019. were rel-established. 3. The Deferred InowsProperty Taxes at December 31. 2019. is recog- nized as revenue in the current period. 4. Property taxes in the amount of $288,000 were levied by the County. It is estimated 0.5 pereent(1!2 of 1 percent) will be uncollectible. 5. Ptoperty tax collections totaled 5263.400. Accounts totaling $1.850 were written off as uncollectible. 6. Encumbrances were issued for supplies in the amount of 337.100. 7. Supplies in the amount of 340.500 were received. Jefferson County records supplies as an asset when acquired. The related encumbrances for these items totaled $41,000 and included the $4.800 encumbered last year. The County paid $38,100 on accounts payable during the year. 8. The County contracted to have alarm systems (capital assets) installed in the administration building at a cost of 342.900. The systems were installed and the amount was paid. 9. Paid wages totaling $135,900. including the amount payable at the end of 2019. (These were for general government operations.) 10. Paid other general government operating items of $1.600. l l. The General Fund transferred 539.800 to the debt service fund in antici pation of bond interest and principal payments. 12. Wages earned but unpaid at the end of the year amounted to $890. 13. Supplies of $350 were on hand at the end of the year. [Supplies are used for general government operations.) 14. A review of property taxes receivable indicates that $23.000 of the out- standing balances would likely be collected more than 60 days after year-end and should be deferred. Required: Use the Excel template provided on the textbook website to complete the fol- lowing requirements. A separate tab is provided in Excel lot-the following items: a. Prepare journal entries to record the information described in items 1 to 14. Classify expenditures in the General Fund as either General Government Operations or Capital Outlay. Make entries directly to these and the individual revenue accounts: do not use subsidiary lodgers. b. Post these entries to Taecounts. c. Prepare closing journal entries: post to the T-aecount provided. Classify fund balances assuming there are no restricted or committed net resources and the only assigned net resources are the outstanding encumbrances. d. Prepare a Statement of Revenues. Expenditums. and Changes in Fund Balance for the General Fund for the year ending 2020. Use Excel for- mulas to calculate the cells shaded in blue. 2. Prepare a Balance Sheet for the General Fund as of December 31. 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts