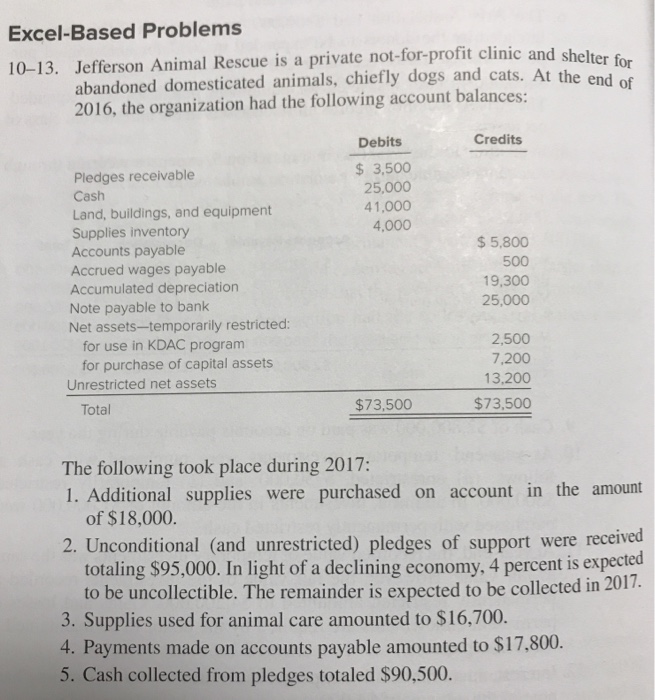

Question: Excel-Based Problems elter for 10-13. Jefferson Animal Rescue is a private not-for-profit clinic and sh abandoned domesticated animals, chiefly dogs and cats. At the 2016,

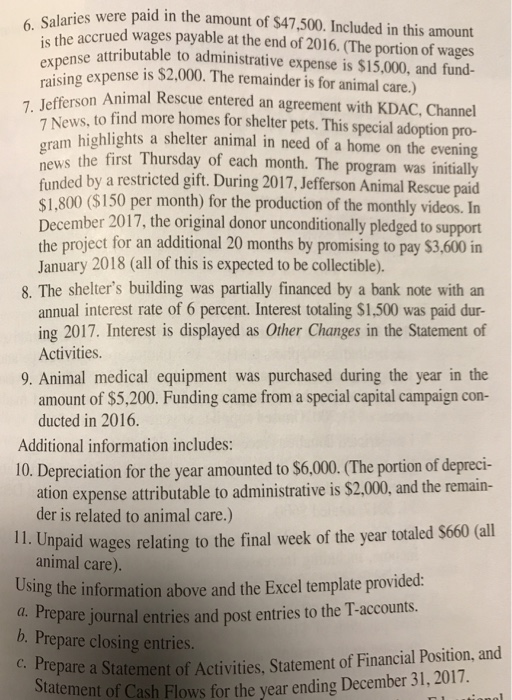

Excel-Based Problems elter for 10-13. Jefferson Animal Rescue is a private not-for-profit clinic and sh abandoned domesticated animals, chiefly dogs and cats. At the 2016, the organization had the following account balances: Debits Credits 3,500 25,000 41,000 Pledges receivable Cash Land, buildings, and equipment Supplies inventory Accounts payable Accrued wages payable Accumulated depreciation Note payable to bank Net assets-temporarily restricted: 4,000 $ 5,800 500 19,300 25,000 2,500 7,200 13,200 $73,500 for use in KDAC program for purchase of capital assets Unrestricted net assets Total $73,500 The following took place during 2017: 1. Additional supplies were purchased on account in the amount of $18,000. 2. Unconditional (and unrestricted) pledges of support were received totaling $95,000. In light of a declining economy, 4 percent is expected to be uncollectible. The remainder is expected to be collected in 2017 3. Supplies used for animal care amounted to $16,700. 4. Payments made on accounts payable amounted to $17,800. 5. Cash collected from pledges totaled $90,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts