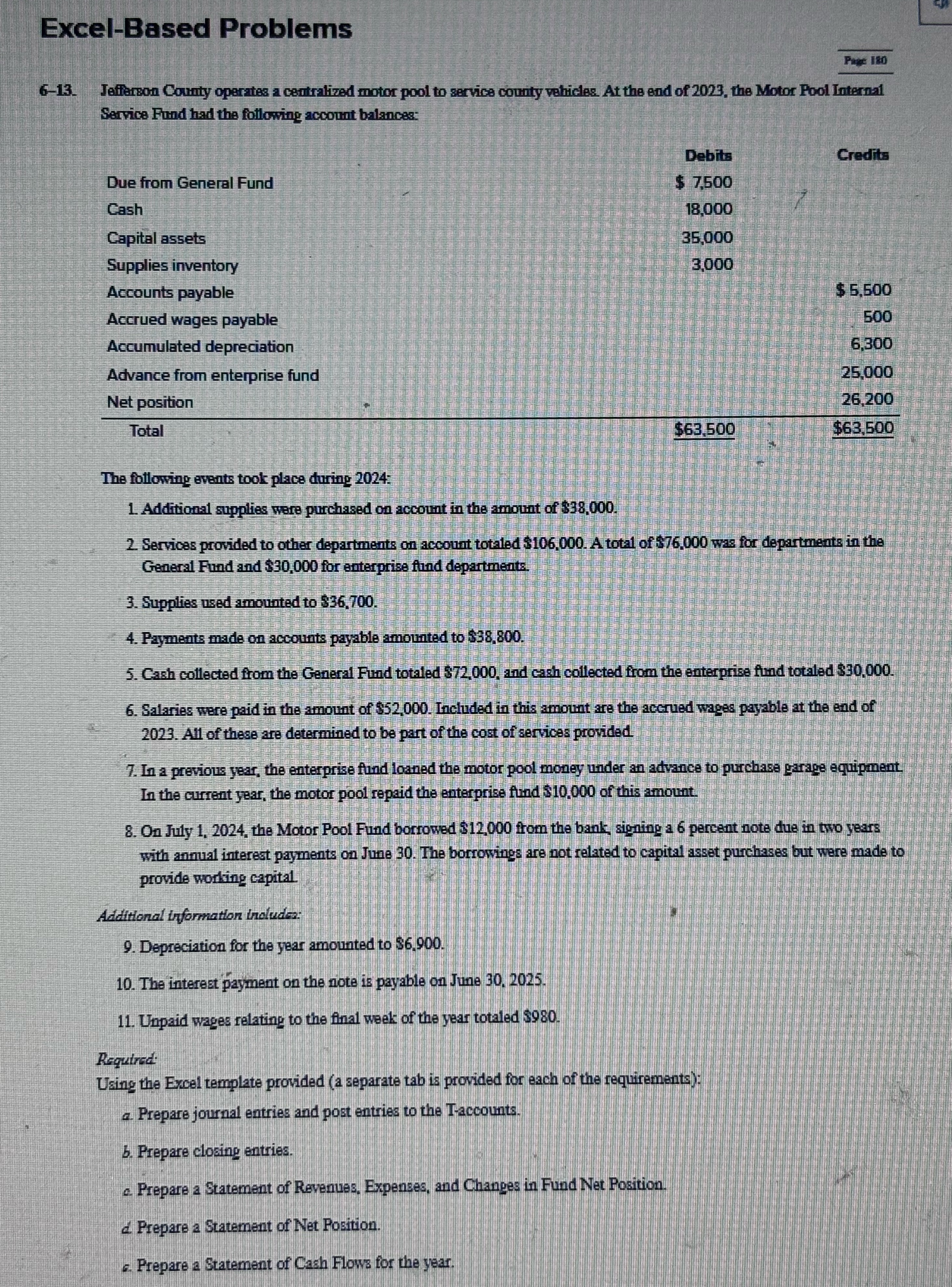

Question: Excel-Based Problems Page 180 6-13. Jefferson County operates a centralized motor pool to service county vehicles. At the end of 2023, the Motor Pool Internal

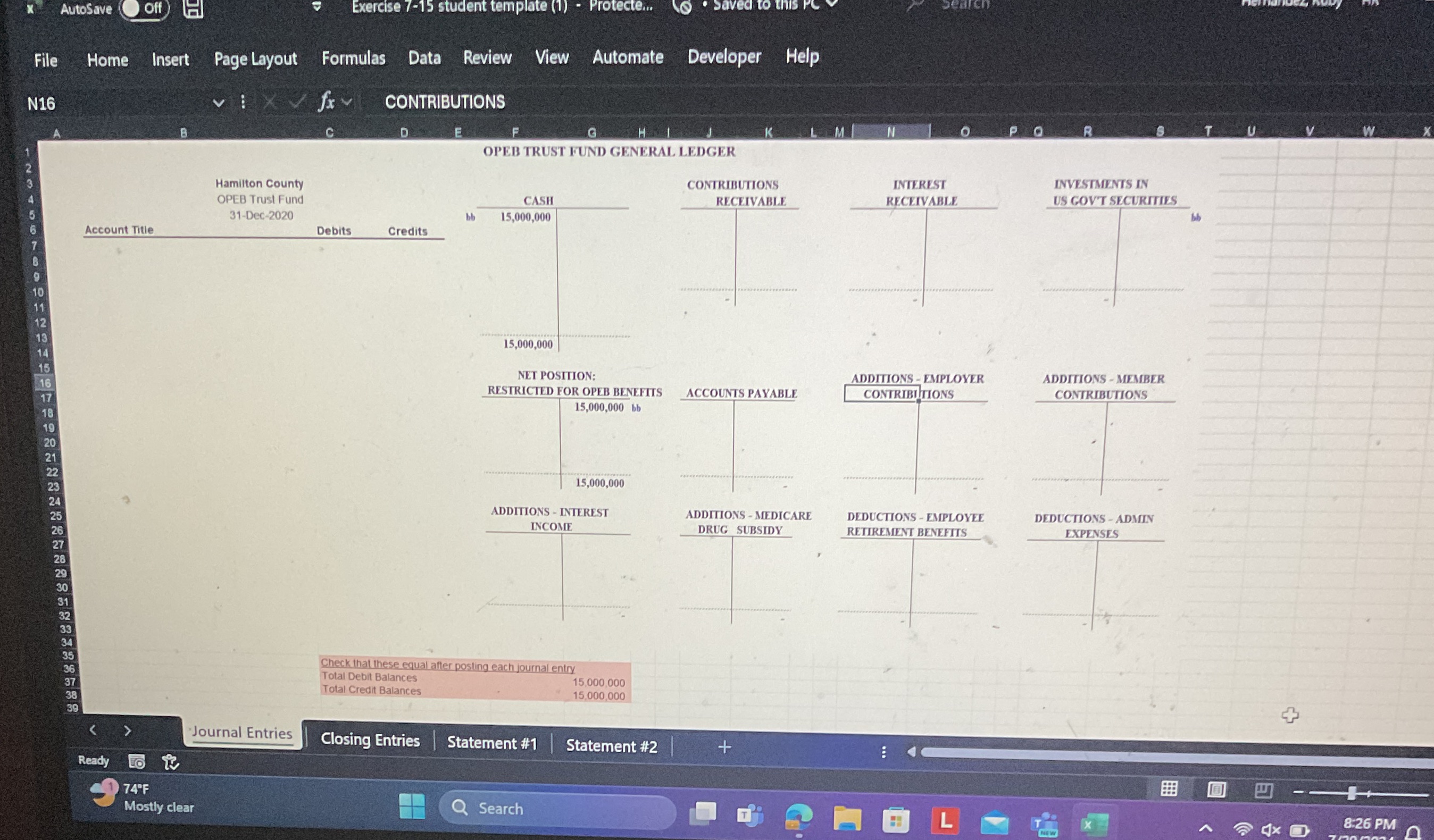

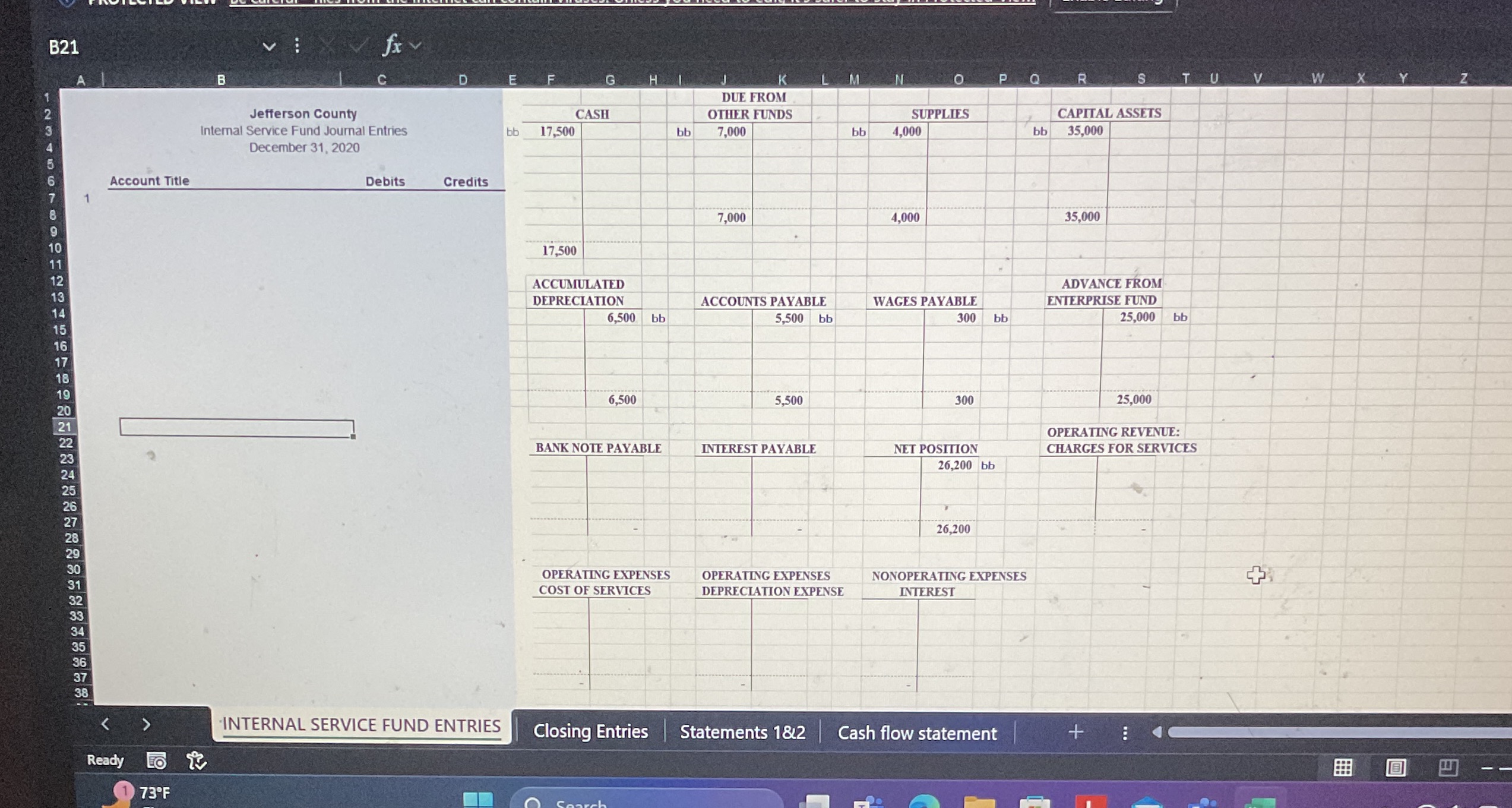

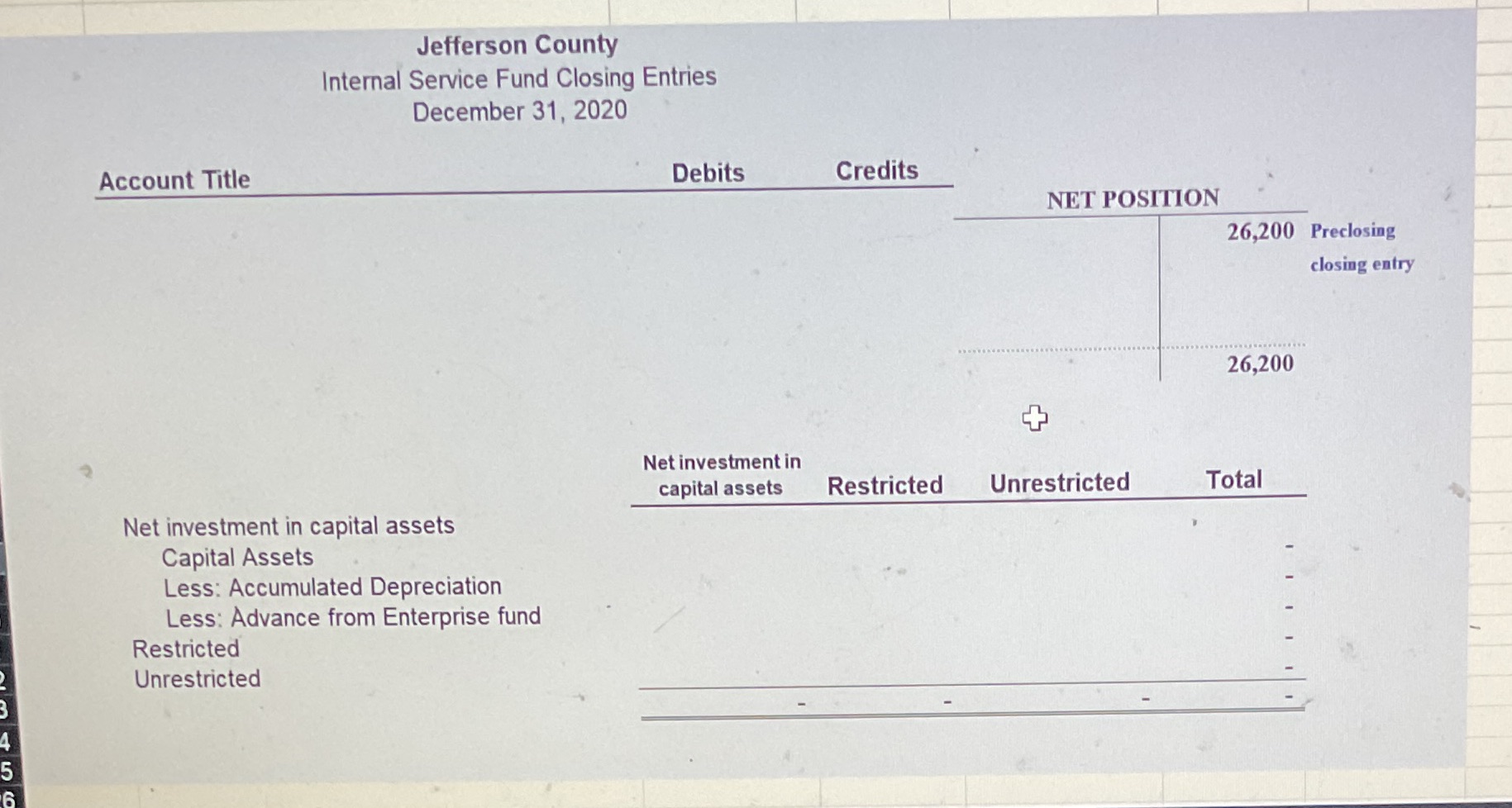

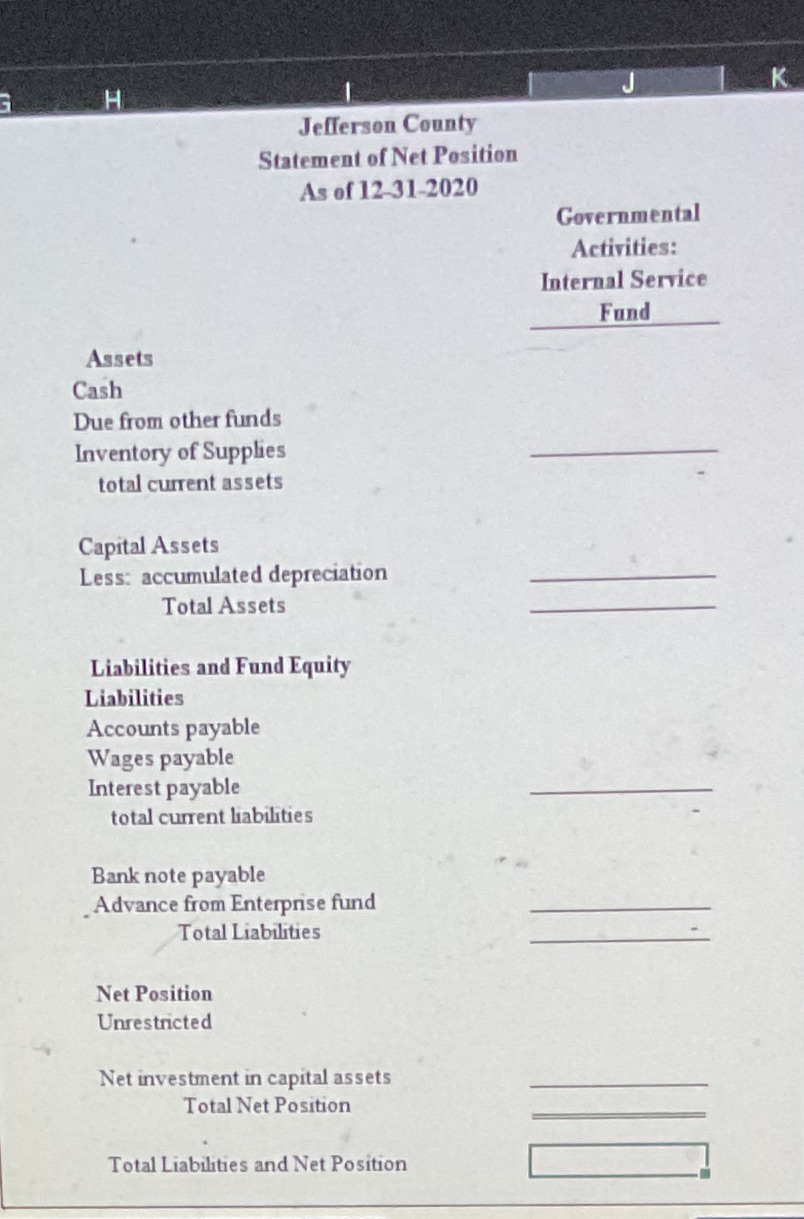

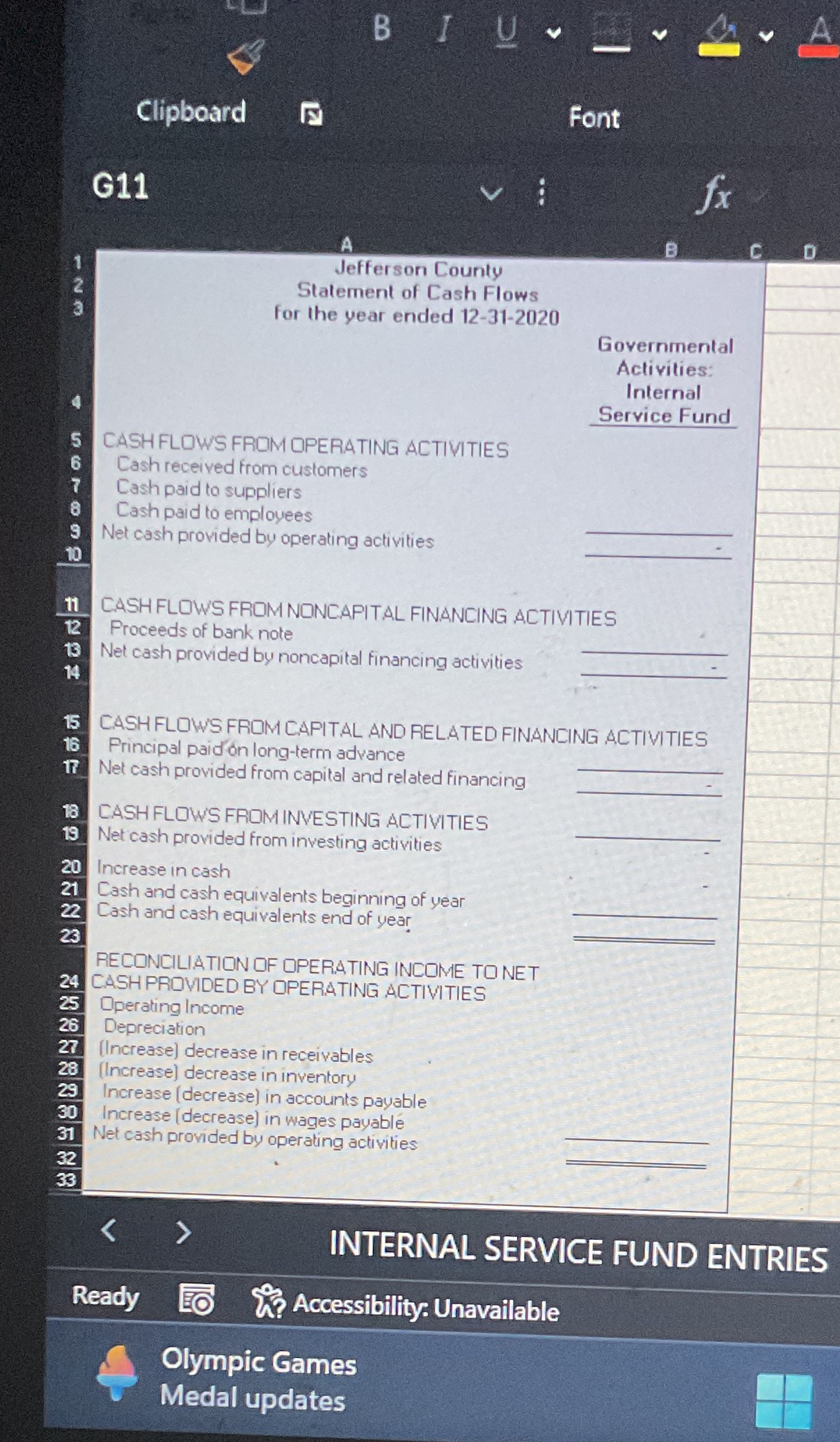

Excel-Based Problems Page 180 6-13. Jefferson County operates a centralized motor pool to service county vehicles. At the end of 2023, the Motor Pool Internal Service Fund had the following account balances: Debits Credits Due from General Fund $ 7.500 Cash 18,000 Capital assets 35,000 Supplies inventory 3,000 Accounts payable $5.500 Accrued wages payable 500 Accumulated depreciation 6.300 Advance from enterprise fund 25,000 Net position 26,200 Total $63,500 $63.500 The following events took place during 2024: 1. Additional supplies were purchased on account in the amount of $38,000. 2. Services provided to other departments on account totaled $106,000. A total of $76.000 was for departments in the General Fund and $30,000 for enterprise fund departments 3. Supplies used amounted to $36,700. 4. Payments made on accounts payable amounted to $38,800. 5. Cash collected from the General Fund totaled $72.000, and cash collected from the enterprise fund totaled $30,000. 6. Salaries were paid in the amount of $52,000. Included in this amount are the accrued w payable at the end of 2023. All of these are determined to be part of the cost of services provided. 7. In a previous year, the enterprise fund loaned the motor pool money under an advance to purchase garage equipment In the current year, the motor pool repaid the enterprise fund $10.000 of this amount 8. On July 1. 2024, the Motor Pool Fund borrowed $12.000 from the ba igning a 6 percent note due in two years with annual interest payments on June 30. The borrowing not related to capital asset purchases but were made to provide working capital Additional information includes: 9. Depreciation for the year amounted to $6,900. 10. The interest payment on the note is payable on June 30, 2025. 11. Unpaid wages relating to the final week of the year totaled $980. Required Using the Excel template provided (a separate tab is provided for each of the requirements); a. Prepare journal entries and post entries to the I-accounts. 6. Prepare closing entries. Prepare a Statement of Revenues. Expenses, and Changes in Fund Net Position 2 Prepare a Statement of Net Position. Prepare a Statement of Cash Flows for the yearAutoSave Off Exercise 7-15 student template (1) - Protecte... Saved to this PC File Home Insert Page Layout Formulas Data Review View Automate Developer Help N16 VIX fx CONTRIBUTIONS D N O P Q R OPEB TRUST FUND GENERAL LEDGER Hamilton County CONTRIBUTIONS INTEREST INVESTMENTS IN OPEB Trust Fund CASH RECEIVABLE RECEIVABLE US GOV'T SECURITIES 31-Dec-2020 bb 15,000,000 Account Title Debits Credits 15,000,000 NET POSITION: ADDITIONS - EMPLOYER ADDITIONS - MEMBER RESTRICTED FOR OPEB BENEFITS ACCOUNTS PAYABLE CONTRIBUTIONS CONTRIBUTIONS 15,000,000 bb 15,000,000 ADDITIONS - INTEREST ADDITIONS - MEDICARE DEDUCTIONS - EMPLOYEE DEDUCTIONS - ADMIN INCOME DRUG SUBSIDY RETIREMENT BENEFITS EXPENSES 8898828698 88NEENEENBC Check that these equal after posting each journal entry Total Debit Balances 15,000,000 Total Credit Balances 15,000,000 + Journal Entries Closing Entries Statement #1 Statement #2 + Ready LO R P 74.F Mostly clear Q Search T 8:26 PMB21 fx B D E F G H M N O P Q S T U V W DUE FROM Jefferson County CASH OTHER FUNDS SUPPLIES CAPITAL ASSETS Internal Service Fund Journal Entries bb 17,500 bb 7,000 bb 4,000 bb 35,000 December 31, 2020 Account Title Debits Credits 7,00 4.000 35,000 17,500 ACCUMULATED ADVANCE FROM DEPRECIATION ACCOUNTS PAYABLE WAGES PAYABLE ENTERPRISE FUND 6,500 bb 5,500 bb 300 bb 25,000 bb 6,500 5,500 300 25,000 OPERATING REVENUE: BANK NOTE PAYABLE INTEREST PAYABLE NET POSITION CHARGES FOR SERVICES 26,200 bb 26,200 OPERATING EXPENSES OPERATING EXPENSES NONOPERATING EXPENSES COST OF SERVICES DEPRECIATION EXPENSE INTEREST INTERNAL SERVICE FUND ENTRIES Closing Entries | Statements 1812 Cash flow statement + Ready (1 73'FJefferson County Internal Service Fund Closing Entries December 31, 2020 Account Title Debits Credits NET POSITION 26,200 Preclosing closing entry 26,200 + Net investment in capital assets Restricted Unrestricted Total Net investment in capital assets Capital Assets Less: Accumulated Depreciation Less: Advance from Enterprise fund Restricted UnrestrictedH Jefferson County Statement of Net Position As of 12-31-2020 Governmental Activities: Internal Service Fund Assets Cash Due from other funds Inventory of Supplies total current assets Capital Assets Less: accumulated depreciation Total Assets Liabilities and Fund Equity Liabilities Accounts payable Wages payable Interest payable total current liabilities Bank note payable Advance from Enterprise fund Total Liabilities Net Position Unrestricted Net investment in capital assets Total Net Position Total Liabilities and Net PositionBIUV A Clipboard Font G11 fx A B C D Jefferson County IN Statement of Cash Flows For the year ended 12-31-2020 Governmental Activities: Internal Service Fund CASH FLOWS FROM OPERATING ACTIVITIES Cash received from customers Cash paid to suppliers Cash paid to employees Net cash provided by operating activities 10 11 CASH FLOWS FROM NONCAPITAL FINANCING ACTIVITIES 12 Proceeds of bank note 13 Net cash provided by noncapital financing activities 14 15 CASH FLOWS FROM CAPITAL AND RELATED FINANCING ACTIVITIES 16 Principal paid on long-term advance 17 Net cash provided from capital and related financing 18 CASH FLOWS FROM INVESTING ACTIVITIES 19 Net cash provided from investing activities Increase in cash Cash and cash equivalents beginning of year Cash and cash equivalents end of year RECONCILIATION OF OPERATING INCOME TO NET CASH PROVIDED BY OPERATING ACTIVITIES Operating Income Depreciation [Increase] decrease in receivables [Increase] decrease in inventory Increase (decrease] in accounts payable Increase [ decrease) in wages payable Net cash provided by operating activities INTERNAL SERVICE FUND ENTRIES Ready LO *?Accessibility. Unavailable Olympic Games Medal updates