Question: excell formulas what are the key strokes or formula solutions in excell for the data I am not familiar with excell ...what I am looking

excell formulas

what are the key strokes or formula solutions in excell for the data

I am not familiar with excell ...what I am looking for is the excell formula function that goes long with the calculstions.

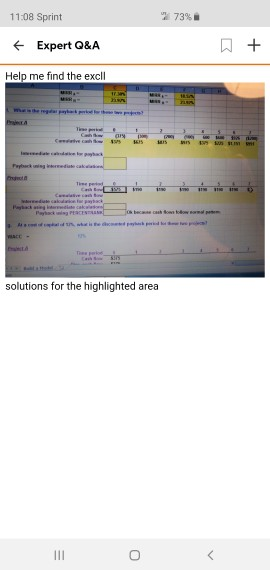

11:08 Sprint 73% Expert Q&A Help me find the excll MIR" MR- Whe de regar payh thw PrctA Te pl Cah th 1 p edcde or pobak Faybck uning inrediase caka Tiee period Cah Canaave adh e ed cakoaaion f payback Payhack asing it diecakao Paykack ing PtaCENAS n os bece cash Sown too ead pem rssh d atd a s wht is te ceed ah pid ACC bastA solutions for the highlighted area III 11:08 Sprint 73% Expert Q&A Help me find the excll MIR" MR- Whe de regar payh thw PrctA Te pl Cah th 1 p edcde or pobak Faybck uning inrediase caka Tiee period Cah Canaave adh e ed cakoaaion f payback Payhack asing it diecakao Paykack ing PtaCENAS n os bece cash Sown too ead pem rssh d atd a s wht is te ceed ah pid ACC bastA solutions for the highlighted area III C G 18.57 % H MIRR 17.30 % MIRR MIRR 23.92% MIRR 23.92% What is the regular payback period for these two projects? Project A Time period Cash flow Cumulative cash flow 3 5 (375) $375 (300) $675 (200) $875 (100) $975 $926 $600 $225 $1,151 600 (5200) $951 $375 Intermediate calculation for payback Payback using intermediate calculations Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations Payback using PERCENTRANK 2 3 4 6 7 $575 $190 $190 $190 $190 $190 $190 Ok because cash flows follow normal pattern. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC 12% Project A 2 Time period Cash flow $375 Build a Model solutions for the highlighted area 11:08 Sprint 73% Expert Q&A Help me find the excll MIR" MR- Whe de regar payh thw PrctA Te pl Cah th 1 p edcde or pobak Faybck uning inrediase caka Tiee period Cah Canaave adh e ed cakoaaion f payback Payhack asing it diecakao Paykack ing PtaCENAS n os bece cash Sown too ead pem rssh d atd a s wht is te ceed ah pid ACC bastA solutions for the highlighted area III 11:08 Sprint 73% Expert Q&A Help me find the excll MIR" MR- Whe de regar payh thw PrctA Te pl Cah th 1 p edcde or pobak Faybck uning inrediase caka Tiee period Cah Canaave adh e ed cakoaaion f payback Payhack asing it diecakao Paykack ing PtaCENAS n os bece cash Sown too ead pem rssh d atd a s wht is te ceed ah pid ACC bastA solutions for the highlighted area III C G 18.57 % H MIRR 17.30 % MIRR MIRR 23.92% MIRR 23.92% What is the regular payback period for these two projects? Project A Time period Cash flow Cumulative cash flow 3 5 (375) $375 (300) $675 (200) $875 (100) $975 $926 $600 $225 $1,151 600 (5200) $951 $375 Intermediate calculation for payback Payback using intermediate calculations Project B Time period Cash flow Cumulative cash flow Intermediate calculation for payback Payback using intermediate calculations Payback using PERCENTRANK 2 3 4 6 7 $575 $190 $190 $190 $190 $190 $190 Ok because cash flows follow normal pattern. At a cost of capital of 12%, what is the discounted payback period for these two projects? WACC 12% Project A 2 Time period Cash flow $375 Build a Model solutions for the highlighted area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts