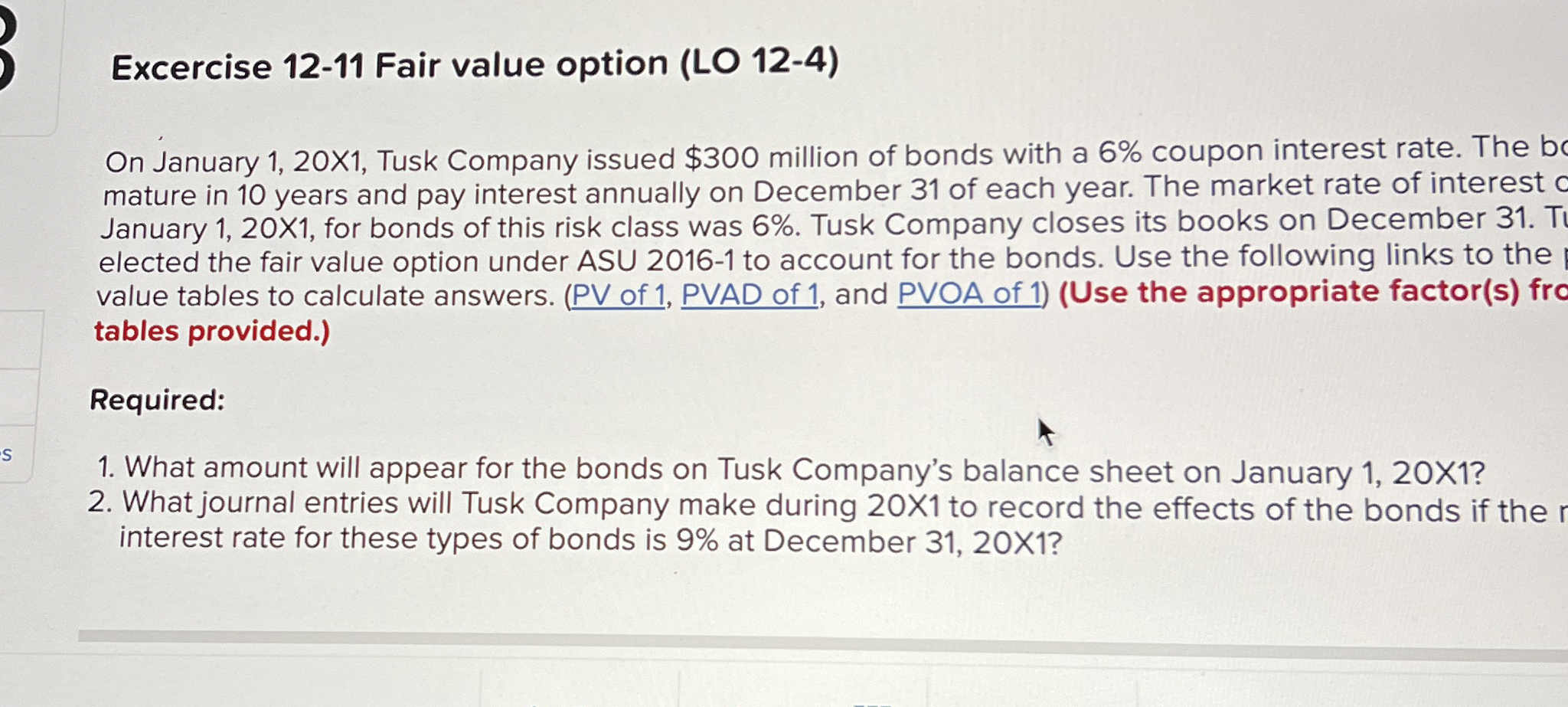

Question: Excercise 1 2 - 1 1 Fair value option ( LO 1 2 - 4 ) On January 1 , 2 0 X 1 ,

Excercise Fair value option LO

On January X Tusk Company issued $ million of bonds with a coupon interest rate. The be

mature in years and pay interest annually on December of each year. The market rate of interest c

January times for bonds of this risk class was Tusk Company closes its books on December T

elected the fair value option under ASU to account for the bonds. Use the following links to the

value tables to calculate answers. PV of PVAD of and PVOA of Use the appropriate factors fro

tables provided.

Required:

What amount will appear for the bonds on Tusk Company's balance sheet on January X

What journal entries will Tusk Company make during X to record the effects of the bonds if the r

interest rate for these types of bonds is at December X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock