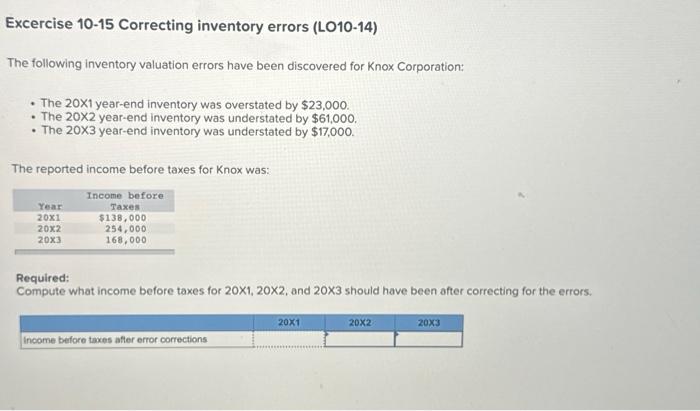

Question: Excercise 10-15 Correcting inventory errors (LO10-14) The following inventory valuation errors have been discovered for Knox Corporation: - The 201 year-end inventory was overstated by

Excercise 10-15 Correcting inventory errors (LO10-14) The following inventory valuation errors have been discovered for Knox Corporation: - The 201 year-end inventory was overstated by $23,000. - The 202 year-end inventory was understated by $61,000. - The 203 year-end inventory was understated by $17,000. The reported income before taxes for Knox was: Required: Compute what income before taxes for 201,202, and 203 should have been after correcting for the errors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts