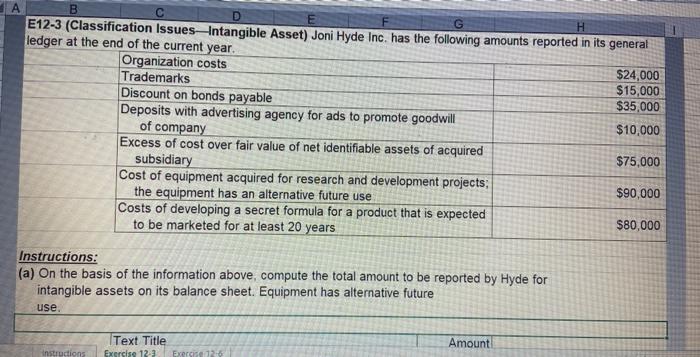

Question: excercise 12-3 excercise 12-6 A D H B E12-3 (Classification Issues-Intangible Asset) Joni Hyde Inc. has the following amounts reported in its general ledger at

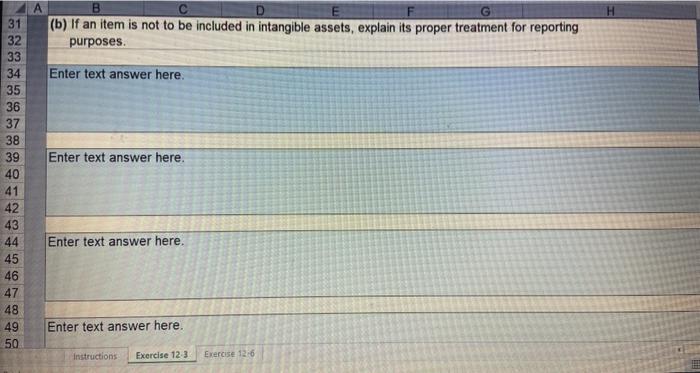

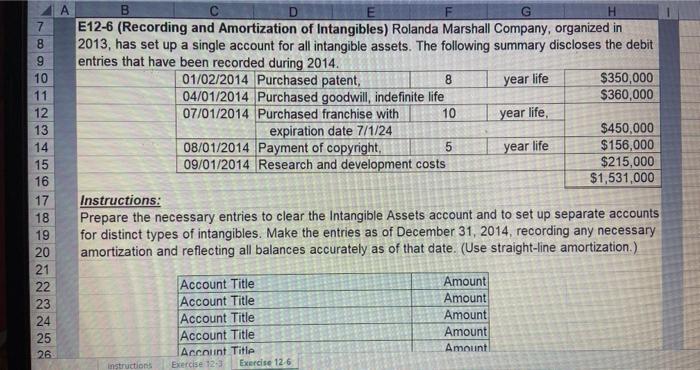

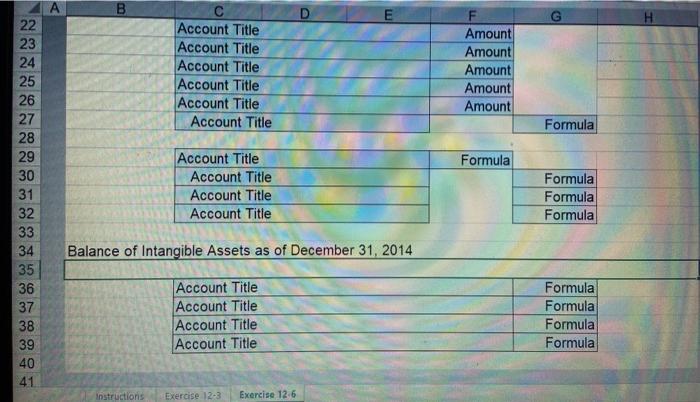

A D H B E12-3 (Classification Issues-Intangible Asset) Joni Hyde Inc. has the following amounts reported in its general ledger at the end of the current year. Organization costs $24,000 Trademarks $15,000 Discount on bonds payable $35,000 Deposits with advertising agency for ads to promote goodwill $10,000 of company Excess of cost over fair value of net identifiable assets of acquired $75,000 subsidiary Cost of equipment acquired for research and development projects: $90,000 the equipment has an alternative future use Costs of developing a secret formula for a product that is expected $80,000 to be marketed for at least 20 years Instructions: (a) On the basis of the information above, compute the total amount to be reported by Hyde for intangible assets on its balance sheet. Equipment has alternative future use. Text Title Exercise 123 Exers 125 Amount Instructions H (b) If an item is not to be included in intangible assets, explain its proper treatment for reporting purposes. Enter text answer here. Enter text answer here. 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Enter text answer here. Enter text answer here. Instructions Exercise 123 Exercise 12-6 year life year life, H E12-6 (Recording and Amortization of Intangibles) Rolanda Marshall Company, organized in 2013, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2014, 01/02/2014 Purchased patent, 8 $350,000 04/01/2014 Purchased goodwill, indefinite life $360,000 07/01/2014 Purchased franchise with 10 expiration date 7/1/24 $450,000 08/01/2014 Payment of copyright, 5 $156,000 09/01/2014 Research and development costs $215,000 $1,531,000 Instructions: Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2014, recording any necessary amortization and reflecting all balances accurately as of that date. (Use straight-line amortization.) 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 year life Account Title Account Title Account Title Account Title Account Title Exercise 12-3 Exercise 126 Amount Amount Amount Amount Amount instructions Account Title Account Title Account Title Account Title Account Title Account Title F Amount Amount Amount Amount Amount Formula Formula 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 Account Title Account Title Account Title Account Title Formula Formula Formula Balance of Intangible Assets as of December 31, 2014 Account Title Account Title Account Title Account Title Formula Formula Formula Formula Instructions Exercise 12-3 Exercise 12.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts