Question: EXCERCISE EXAMPLE MASTER BUDGET AND PERFORMANCE EVALUATION Specifics Instructions: Study the required resources of the module and particularly the recording of the class to carry

EXCERCISE

EXAMPLE

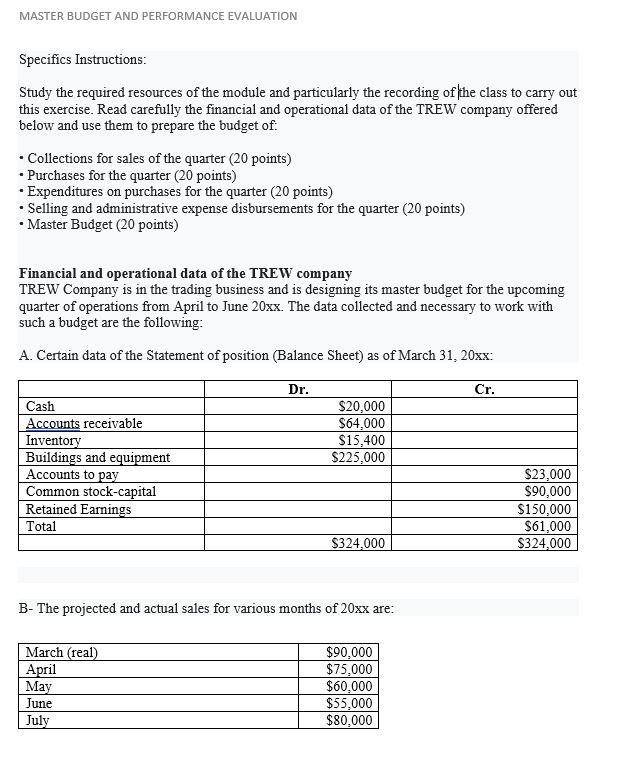

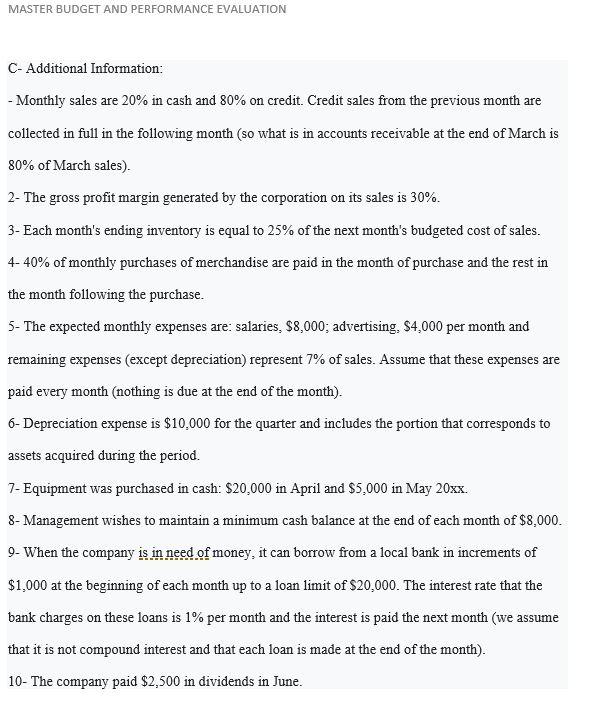

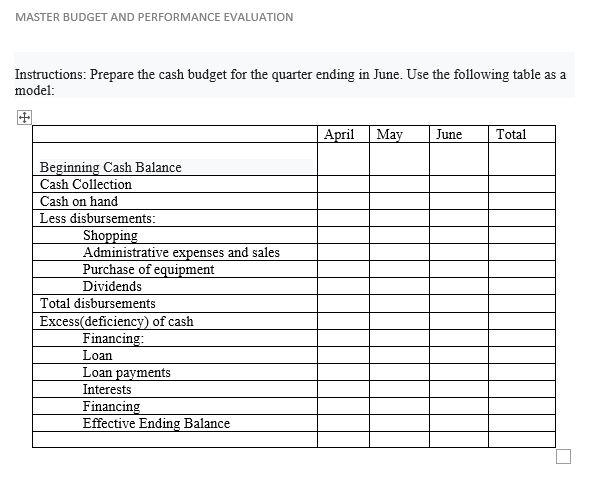

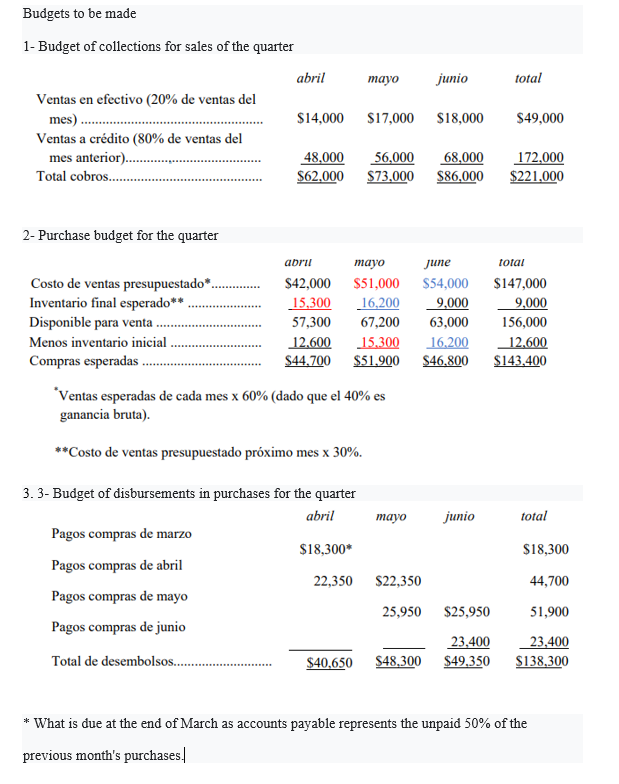

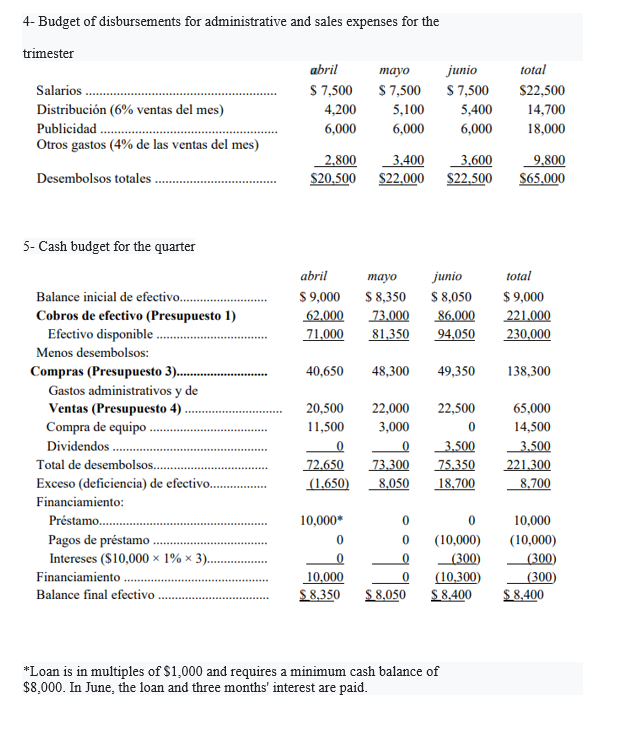

MASTER BUDGET AND PERFORMANCE EVALUATION Specifics Instructions: Study the required resources of the module and particularly the recording of the class to carry out this exercise. Read carefully the financial and operational data of the TREW company offered below and use them to prepare the budget of: Collections for sales of the quarter (20 points) Purchases for the quarter (20 points) Expenditures on purchases for the quarter (20 points) Selling and administrative expense disbursements for the quarter (20 points) Master Budget (20 points) Financial and operational data of the TREW company TREW Company is in the trading business and is designing its master budget for the upcoming quarter of operations from April to June 20xx. The data collected and necessary to work with such a budget are the following: A. Certain data of the Statement of position (Balance Sheet) as of March 31, 20xx: Dr. Cr. Cash $20,000 Accounts receivable $64,000 Inventory $15,400 Buildings and equipment. $225,000 Accounts to pay Common stock-capital Retained Earnings Total $324,000 B- The projected and actual sales for various months of 20xx are: March (real) $90,000 April $75,000 May $60,000 June $55,000 July $80,000 $23,000 $90,000 $150,000 $61,000 $324,000 MASTER BUDGET AND PERFORMANCE EVALUATION C- Additional Information: - Monthly sales are 20% in cash and 80% on credit. Credit sales from the previous month are collected in full in the following month (so what is in accounts receivable at the end of March is 80% of March sales). 2- The gross profit margin generated by the corporation on its sales is 30%. 3- Each month's ending inventory is equal to 25% of the next month's budgeted cost of sales. 4-40% of monthly purchases of merchandise are paid in the month of purchase and the rest in the month following the purchase. 5- The expected monthly expenses are: salaries, $8,000; advertising, $4,000 per month and remaining expenses (except depreciation) represent 7% of sales. Assume that these expenses are paid every month (nothing is due at the end of the month). 6- Depreciation expense is $10,000 for the quarter and includes the portion that corresponds to assets acquired during the period. 7- Equipment was purchased in cash: $20,000 in April and $5,000 in May 20xx. 8- Management wishes to maintain a minimum cash balance at the end of each month of $8,000. 9- When the company is in need of money, it can borrow from a local bank in increments of $1,000 at the beginning of each month up to a loan limit of $20,000. The interest rate that the bank charges on these loans is 1% per month and the interest is paid the next month (we assume that it is not compound interest and that each loan is made at the end of the month). 10- The company paid $2,500 in dividends in June. MASTER BUDGET AND PERFORMANCE EVALUATION Instructions: Prepare the cash budget for the quarter ending in June. Use the following table as a model: April May June Total Beginning Cash Balance Cash Collection Cash on hand Less disbursements: Shopping Administrative expenses and sales Purchase of equipment Dividends Total disbursements Excess(deficiency) of cash Financing: Loan. Loan payments Interests Financing Effective Ending Balance Budgets to be made 1-Budget of collections for sales of the quarter abril mayo junio total Ventas en efectivo (20% de ventas del mes). $14,000 $17,000 $18,000 $49,000 Ventas a crdito (80% de ventas del mes anterior)... 48,000 56,000 68,000 172,000 Total cobros.... $62,000 $73,000 $86,000 $221,000 2- Purchase budget for the quarter abril mayo June total $42,000 $51,000 $54,000 $147,000 Costo de ventas presupuestado.. Inventario final esperado** Disponible para venta 15,300 9,000 9,000 16,200 67,200 63,000 57,300 156,000 Menos inventario inicial. 12,600 15,300 16,200 12,600 Compras esperadas. $44,700 $51.900 $46,800 $143,400 *Ventas esperadas de cada mes x 60% (dado que el 40% es ganancia bruta). **Costo de ventas presupuestado prximo mes x 30%. 3.3- Budget of disbursements in purchases for the quarter abril mayo junio total Pagos compras de marzo $18,300* $18,300 Pagos compras de abril 22,350 $22,350 44,700 Pagos compras de mayo 25,950 $25,950 51,900 Pagos compras de junio 23,400 23,400 Total de desembolso........... $40,650 $48,300 $49,350 $138,300 * What is due at the end of March as accounts payable represents the unpaid 50% of the previous month's purchases. 4- Budget of disbursements for administrative and sales expenses for the trimester abril mayo junio total Salarios. $ 7,500 $ 7,500 $ 7,500 $22,500 Distribucin (6% ventas del mes) 4,200 5,100 5,400 14,700 Publicidad. 6,000 6,000 6,000 18,000 Otros gastos (4% de las ventas del mes) 2,800 3,400 3,600 9,800 Desembolsos totales $20,500 $22,000 $22,500 $65,000 5- Cash budget for the quarter abril mayo junio total Balance inicial de efectivo........... $ 9,000 $ 8,350 $ 8,050 $ 9,000 Cobros de efectivo (Presupuesto 1) 62,000 73.000 86,000 221.000 Efectivo disponible.. 71,000 81,350 94,050 230,000 Menos desembolsos: Compras (Presupuesto 3)..... 40,650 48,300 49,350 138,300 Gastos administrativos y de 20,500 22,000 22,500 65,000 Ventas (Presupuesto 4). Compra de equipo. 11,500 3,000 0 14,500 Dividendos. 3.500 3.500 Total de desembolsos.... 72.650 73,300 75.350 221.300 Exceso (deficiencia) de efectivo.. (1,650) 8,050 18,700 8,700 Financiamiento: Prstamo........ 10,000* 10,000 Pagos de prstamo. 0 (10,000) (10,000) Intereses ($10,000 1% 3)... 0 (300) (300) Financiamiento. 10,000 (10,300) (300) Balance final efectivo $8,350 $ 8,050 $ 8,400 *Loan is in multiples of $1,000 and requires a minimum cash balance of $8,000. In June, the loan and three months' interest are paid. $8,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts