Question: excerise 1 please Sheet1 Sheet2 Sheet3 Exercise One Presented below are selected transactions of Leger Company for 2022: Jan. 1 Retired a piece of machinery

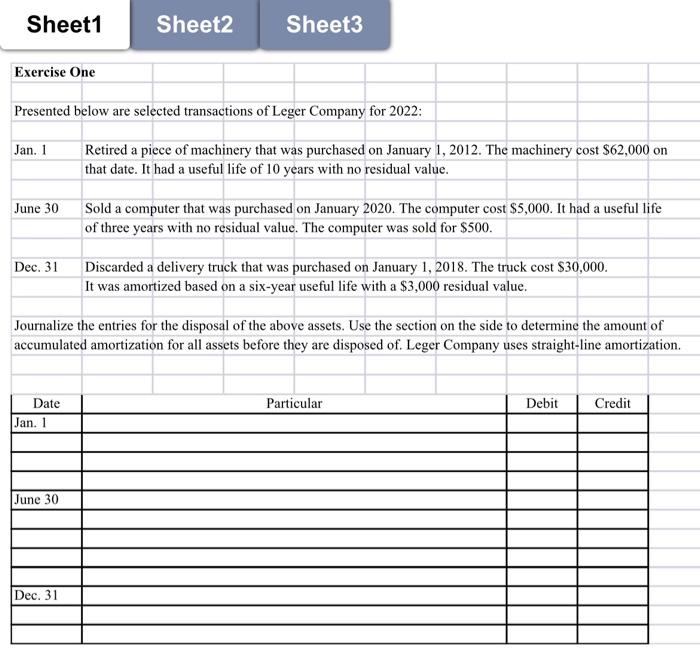

Sheet1 Sheet2 Sheet3 Exercise One Presented below are selected transactions of Leger Company for 2022: Jan. 1 Retired a piece of machinery that was purchased on January 1, 2012. The machinery cost $62,000 on that date. It had a useful life of 10 years with no residual value. June 30 Sold a computer that was purchased on January 2020. The computer cost $5,000. It had a useful life of three years with no residual value. The computer was sold for $500. Dec. 31 Discarded a delivery truck that was purchased on January 1, 2018. The truck cost $30,000. It was amortized based on a six-year useful life with a $3,000 residual value. Journalize the entries for the disposal of the above assets. Use the section on the side to determine the amount of accumulated amortization for all assets before they are disposed of. Leger Company uses straight-line amortization. Particular Debit Credit Date Jan. 1 June 30 Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts