Question: Exchange of Assets Use the same information as in E10-9, except that the warehouse owned by Denver has a fair value of $33,000, and therefore,

Exchange of Assets Use the same information as in E10-9, except that the warehouse owned by Denver has a fair value of $33,000, and therefore, Bristol agrees to pay Denver $3,000 to complete the exchange.

Required:

Assuming the transaction has commercial substance, prepare journal entries for Denver and Bristol to record the exchange.

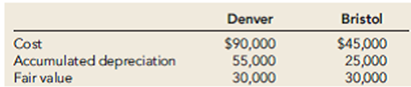

Reference: E10-9: Exchange of Assets Two independent companies, Denver and Bristol, each own a warehouse, and they agree to an exchange in which no cash changes hands. The following information for the two warehouses is available:

Required:

1. Assuming the exchange has commercial substance, prepare journal entries for Denver and Bristol to record the exchange.

2. Assuming the exchange does not have commercial substance, prepare journal entries for Denver and Bristol to record the exchange.

3. Next Level What is the justification of accounting for the exchange differently when the exchange has commercial substance versus when it does not?

Cost Accumulated depreciation Fair value Denver $90,000 55,000 30,000 Bristol $45,000 25,000 30,000

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

To address the problem well first determine the journal entries for each company considering the com... View full answer

Get step-by-step solutions from verified subject matter experts