Question: Exercis 8-0 Specific identification P1 purchase, 12 specific identification method, calculate (a heto Ripken Company's ending inventory includes the following items. Compute the lower of

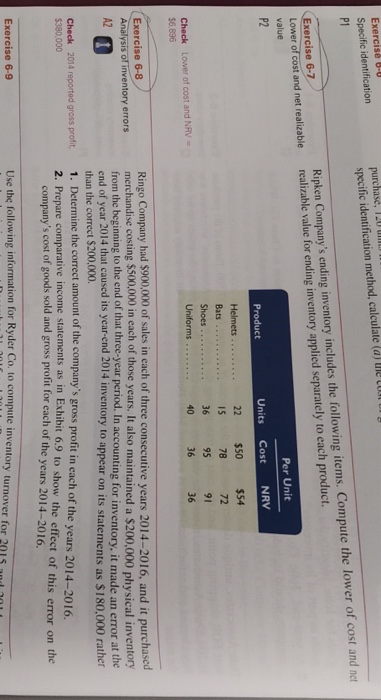

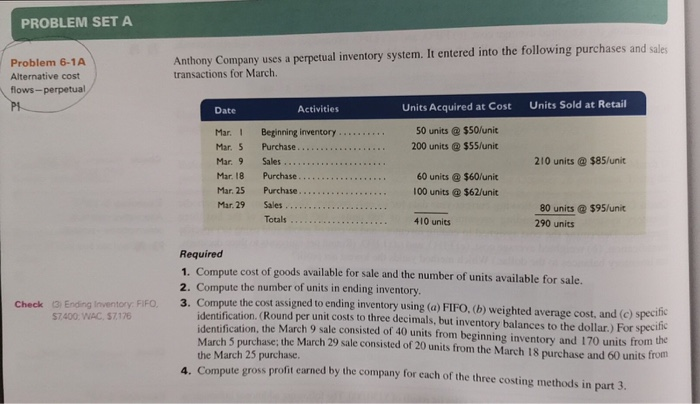

Exercis 8-0 Specific identification P1 purchase, 12 specific identification method, calculate (a heto Ripken Company's ending inventory includes the following items. Compute the lower of cost and net realizable value for ending inventory applied separately to each product. Exercise 6-7 Lower of cost and net realizable value Per Unit Units Cost NRV Bats Shoes Uniforms 22 $50 $54 15 36 95 Lower of cost and NAV- Check $6,896 Ringo Company had $900,000 of sales in each of three consecutive years 2014-2016, and it purchased Exercise 6-8 Analysis of inventory errors A2 merchandise costing $500,000 in each of those years. It also maintained a $200,000 physical inventory from the beginning to the end of that three-year period. In accounting for inventory, it made an error at the end of year 2014 that caused its year-end 2014 inventory to appear on its statements as $180,000 rather than the correct $200,000. 1. Determine the correct amount of the company's gross profit in each of the years 2014-06 2. Prepare comparative income statements as in Exhibit 6.9 to show the eff Check 2014 reported gross profit $380,000 company's cost of goods sold and gross profit for each of the years 2014-2016. following information for Ryder Co. to compute inventory turnover for 20L5 and 20 PROBLEM SET A Problem 6-1A Alternative cost flows-perpetual/ Anthony Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Activities Units Acquired at Cost Units Sold at Retail Date 50 units @$50/unit 200 units@ $55/unit Mar. I Beginning inventory Mar. 5 Purchase. Mar. 9 Sales Mar. 18 Purchase. 210 units @ $85/unit 60 units @$60/unit 100 units@$62/unit Mar. 29Sales 80 units@ $95/unit 290 units Totals 410 units Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute the number of units in ending inventory Check (3) Ending Inventory F e the cost assigned to ending inventory using (a) FIFO. (b) weighted average cost, and (c) specific identification. (Round per unit costs to three decimals, but inventory balances to the dollar.) For specific identification, the March 9 sale consisted of 40 units from beginning inventory and 170 units from the March 5 purchase; the March 29 sale consisted of 20 units from the March 18 purchase and 60 units from the March 25 purchase. $7400. WAC $7.176 4. Compute gross profit earned by the company for each of the three costing methods in part3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts