Question: Exercise 1 0 - 1 9 ( Algorithmic ) ( LO . 5 ) Miller owns a personal residence with a fair market value of

Exercise AlgorithmicLO

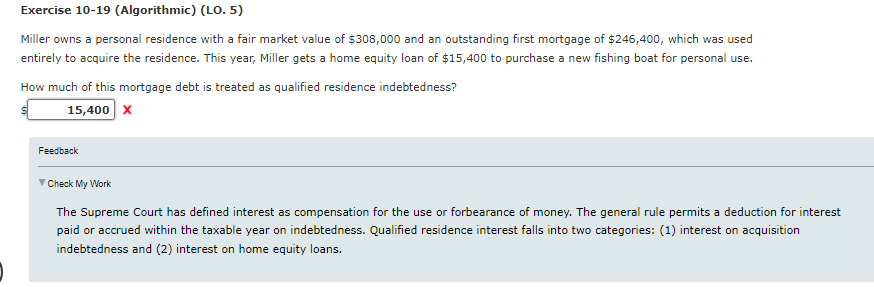

Miller owns a personal residence with a fair market value of $ and an outstanding first mortgage of $ which was used

entirely to acquire the residence. This year, Miller gets a home equity loan of $ to purchase a new fishing boat for personal use.

How much of this mortgage debt is treated as qualified residence indebtedness?

Feedback

Check My Work

The Supreme Court has defined interest as compensation for the use or forbearance of money. The general rule permits a deduction for interest

paid or accrued within the taxable year on indebtedness. Qualified residence interest falls into two categories: interest on acquisition

indebtedness and interest on home equity loans.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock