Question: Exercise 1 0 - 2 0 ( Algo ) Complete the accounting cycle using stockholders' equity transactions ( LO 1 0 - 2 , 1

Exercise Algo Complete the accounting cycle using stockholders' equity transactions LOGL

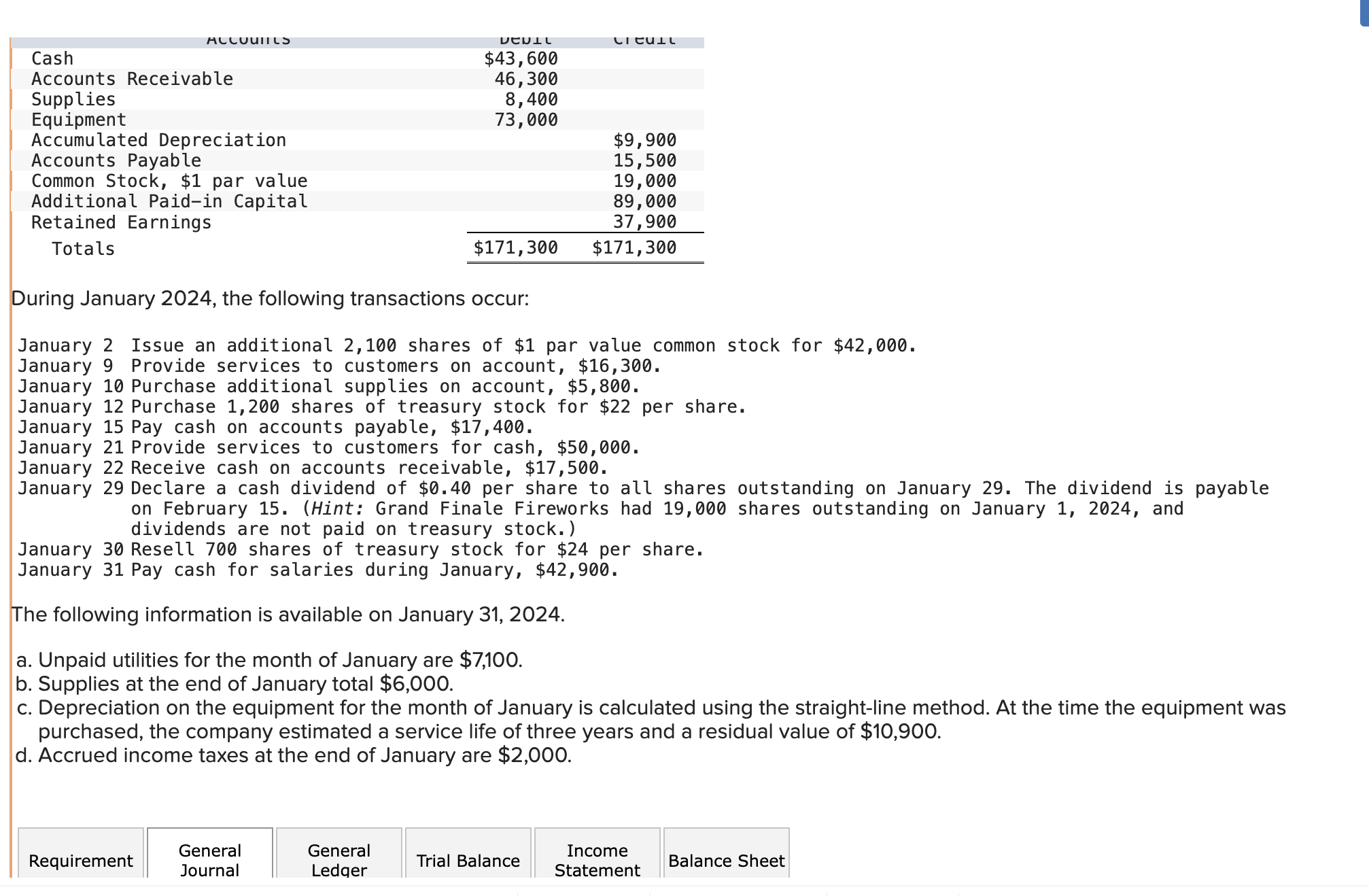

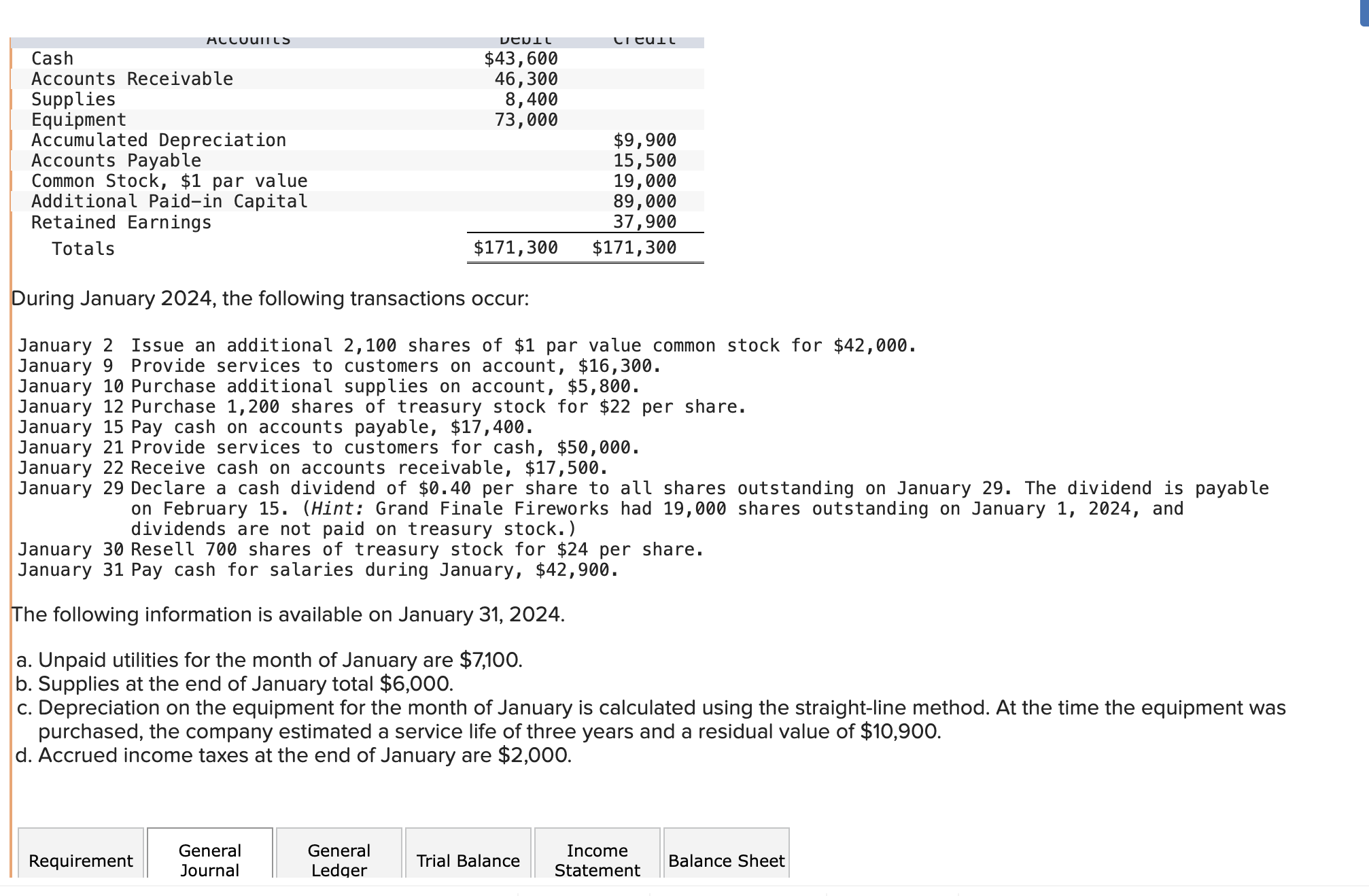

On January the general ledger of Grand Finale Fireworks includes the following account balances:

Accounts Debit Credit

Cash $

Accounts Receivable

Supplies

Equipment

Accumulated Depreciation $

Accounts Payable

Common Stock, $ par value

Additional Paidin Capital

Retained Earnings

Totals $ $

During January the following transactions occur:

January Issue an additional shares of $ par value common stock for $

January Provide services to customers on account, $

January Purchase additional supplies on account, $

January Purchase shares of treasury stock for $ per share.

January Pay cash on accounts payable, $

January Provide services to customers for cash, $

January Receive cash on accounts receivable, $

January Declare a cash dividend of $ per share to all shares outstanding on January The dividend is payable on February Hint: Grand Finale Fireworks had shares outstanding on January and dividends are not paid on treasury stock.

January Resell shares of treasury stock for $ per share.

January Pay cash for salaries during January, $

The following information is available on January

Unpaid utilities for the month of January are $

Supplies at the end of January total $

Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $

Accrued income taxes at the end of January are $

Do the general journal for:

January : Record the declaration of a cash dividend of $ per share to all shares outstanding on January The dividend is payable on February Hint: Grand Finale Fireworks had shares outstanding on January and dividends are not paid on treasury stock.

Janurary : Record the resale of shares of treasury stock for $ per share.

January : Supplies at the end of January total $ Prepare the adjusting entry for supplies.

January : Depreciation on the equipment for the month of January is calculated using the straightline method. At the time the equipment was purchased, the company estimated a service life of three years and a residual value of $ Prepare the adjusting entry for depreciation.

January : Accrued income taxes at the end of January are $ Prepare the adjusting entry for income taxes.

January : Record the entry to close the revenue accounts.

January : Record the entry to close the expense accounts.

January : Record the entry to close the dividends account.

Do the income statement for the Month Ended January

Do the balance sheet Jan

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock