Question: Exercise 1 ( 1 0 points ) Three bonds are traded on the market: A: risk - free bond, zero coupon, maturity 4 months, market

Exercise points

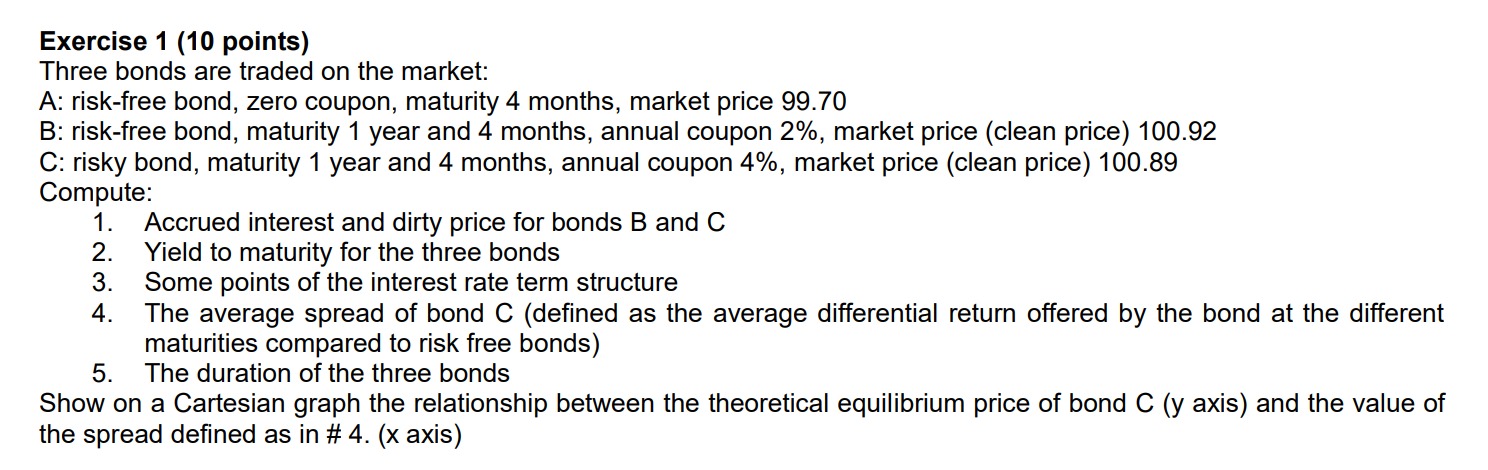

Three bonds are traded on the market:

A: riskfree bond, zero coupon, maturity months, market price

B: riskfree bond, maturity year and months, annual coupon market price clean price

C: risky bond, maturity year and months, annual coupon market price clean price

Compute:

Accrued interest and dirty price for bonds B and

Yield to maturity for the three bonds

Some points of the interest rate term structure

The average spread of bond defined as the average differential return offered by the bond at the different

maturities compared to risk free bonds

The duration of the three bonds

Show on a Cartesian graph the relationship between the theoretical equilibrium price of bond axis and the value of

the spread defined as in # x axis

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock