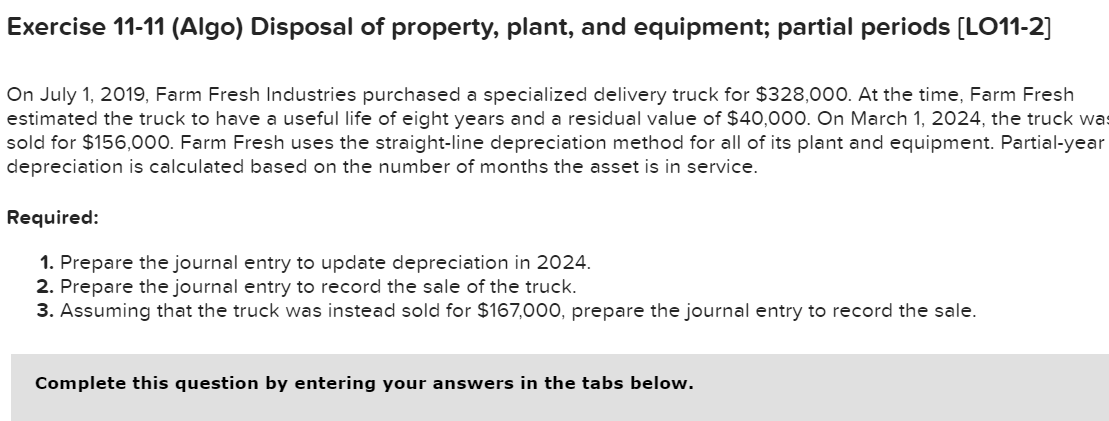

Question: Exercise 1 1 - 1 1 ( Algo ) Disposal of property, plant, and equipment; partial periods [ LO 1 1 - 2 ] On

![Exercise 11-11(Algo) Disposal of property, plant, and equipment; partial periods [LO11-2]](https://s3.amazonaws.com/si.experts.images/answers/2024/06/666389a107b4f_328666389a07ec08.jpg)

Exercise Algo Disposal of property, plant, and equipment; partial periods LO

On July Farm Fresh Industries purchased a specialized delivery truck for $ At the time, Farm Fresh

estimated the truck to have a useful life of eight years and a residual value of $ On March the truck was

sold for $ Farm Fresh uses the straightline depreciation method for all of its plant and equipment. Partialyear

depreciation is calculated based on the number of months the asset is in service.

Required:

Prepare the journal entry to update depreciation in

Prepare the journal entry to record the sale of the truck.

Assuming that the truck was instead sold for $ prepare the journal entry to record the sale.

Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock