Question: Exercise 1 1 - 3 5 ( Algo ) Cost Allocation: Reciprocal Method ( LO 1 1 - 1 ) Memorial Services, Incorporated ( MSI

Exercise Algo Cost Allocation: Reciprocal Method LO

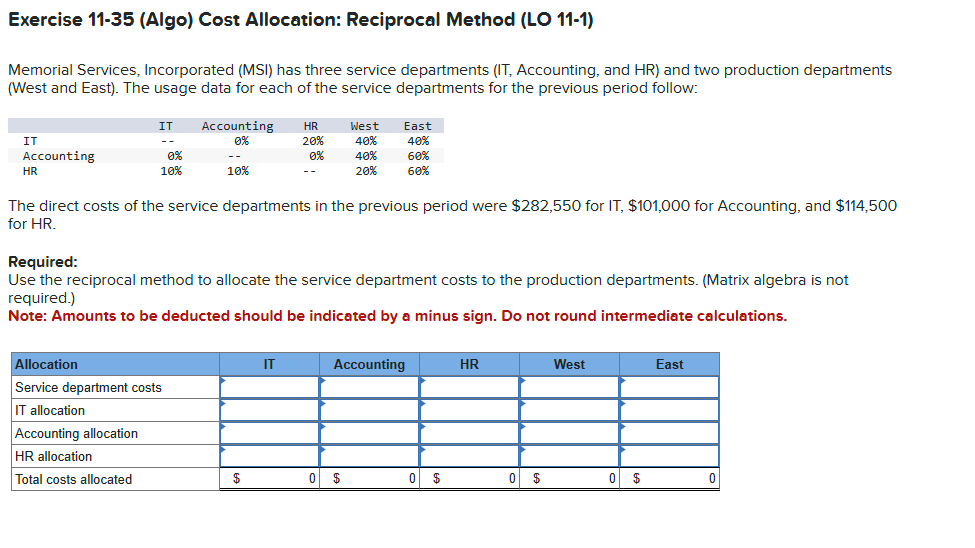

Memorial Services, Incorporated MSI has three service departments IT Accounting, and HR and two production departments West and East The usage data for each of the service departments for the previous period follow:

ITAccountingHRWestEastITAccountingHR

The direct costs of the service departments in the previous period were $ for IT $ for Accounting, and $ for HR

Required:

Use the reciprocal method to allocate the service department costs to the production departments. Matrix algebra is not required.

Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. Exercise Algo Cost Allocation: Reciprocal Method LO

Memorial Services, Incorporated MSI has three service departments IT Accounting, and HR and two production departments West and East The usage data for each of the service departments for the previous period follow:

The direct costs of the service departments in the previous period were $ for IT$ for Accounting, and $ for HR

Required:

Use the reciprocal method to allocate the service department costs to the production departments. Matrix algebra is not required.

Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock