Question: Exercise 1 - 1 4 Preparing an income statement P 2 On October 1 , Ebony Ernst organized Ernst Consulting; on October 3 , the

Exercise

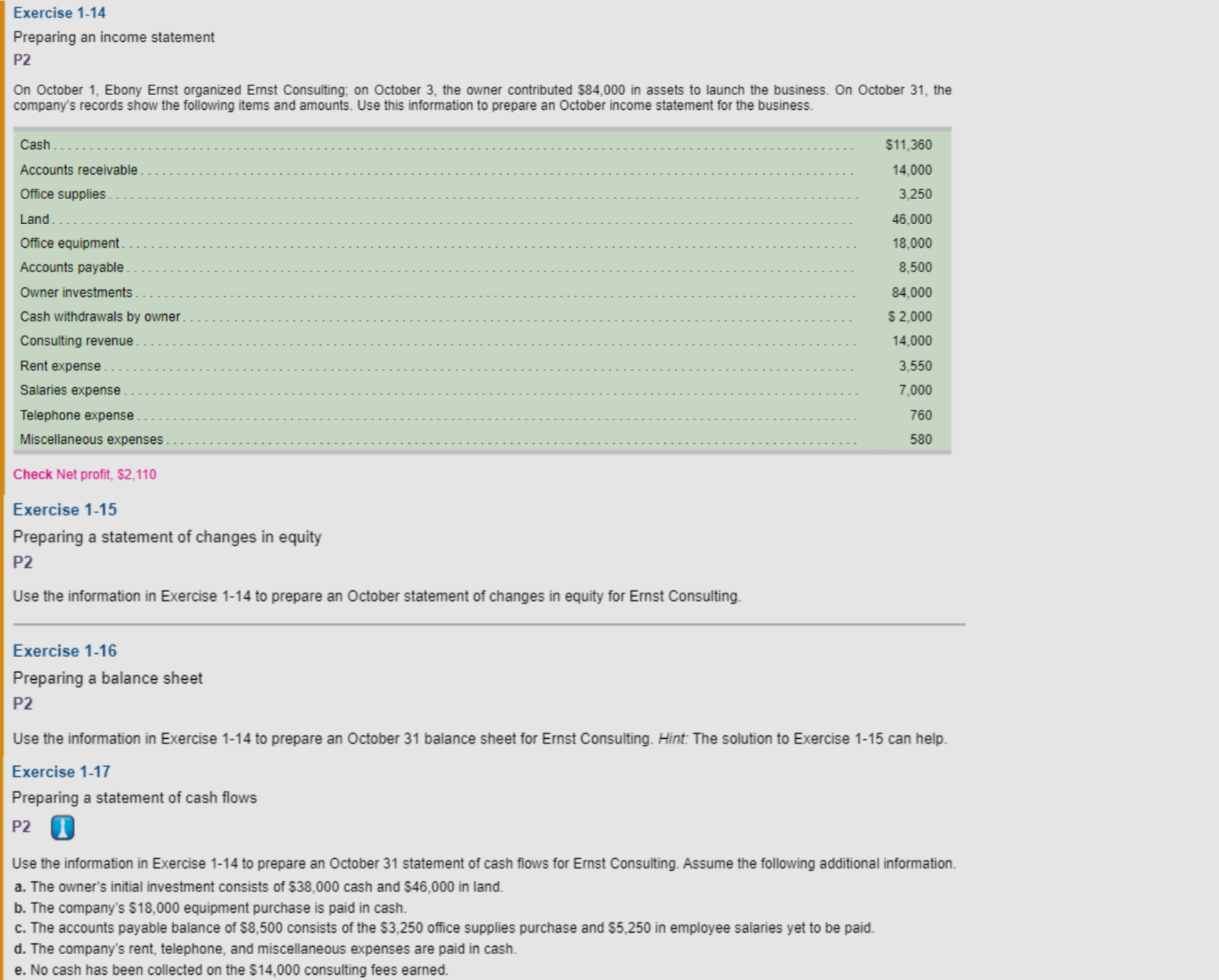

Preparing an income statement

P

On October Ebony Ernst organized Ernst Consulting; on October the owner contributed $ in assets to launch the business. On October the

company's records show the following items and amounts. Use this information to prepare an October income statement for the business.

Check Net profit, $

Exercise

Preparing a statement of changes in equity

P

Use the information in Exercise to prepare an October statement of changes in equity for Ernst Consulting.

Exercise

Preparing a balance sheet

P

Use the information in Exercise to prepare an October balance sheet for Ernst Consulting. Hint: The solution to Exercise can help.

Exercise

Preparing a statement of cash flows

P

Use the information in Exercise to prepare an October statement of cash flows for Ernst Consulting. Assume the following additional information.

a The owner's initial investment consists of $ cash and $ in land.

b The company's $ equipment purchase is paid in cash.

c The accounts payable balance of $ consists of the $ office supplies purchase and $ in employee salaries yet to be paid.

d The company's rent, telephone, and miscellaneous expenses are paid in cash.

e No cash has been collected on the $ consulting fees earned.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock